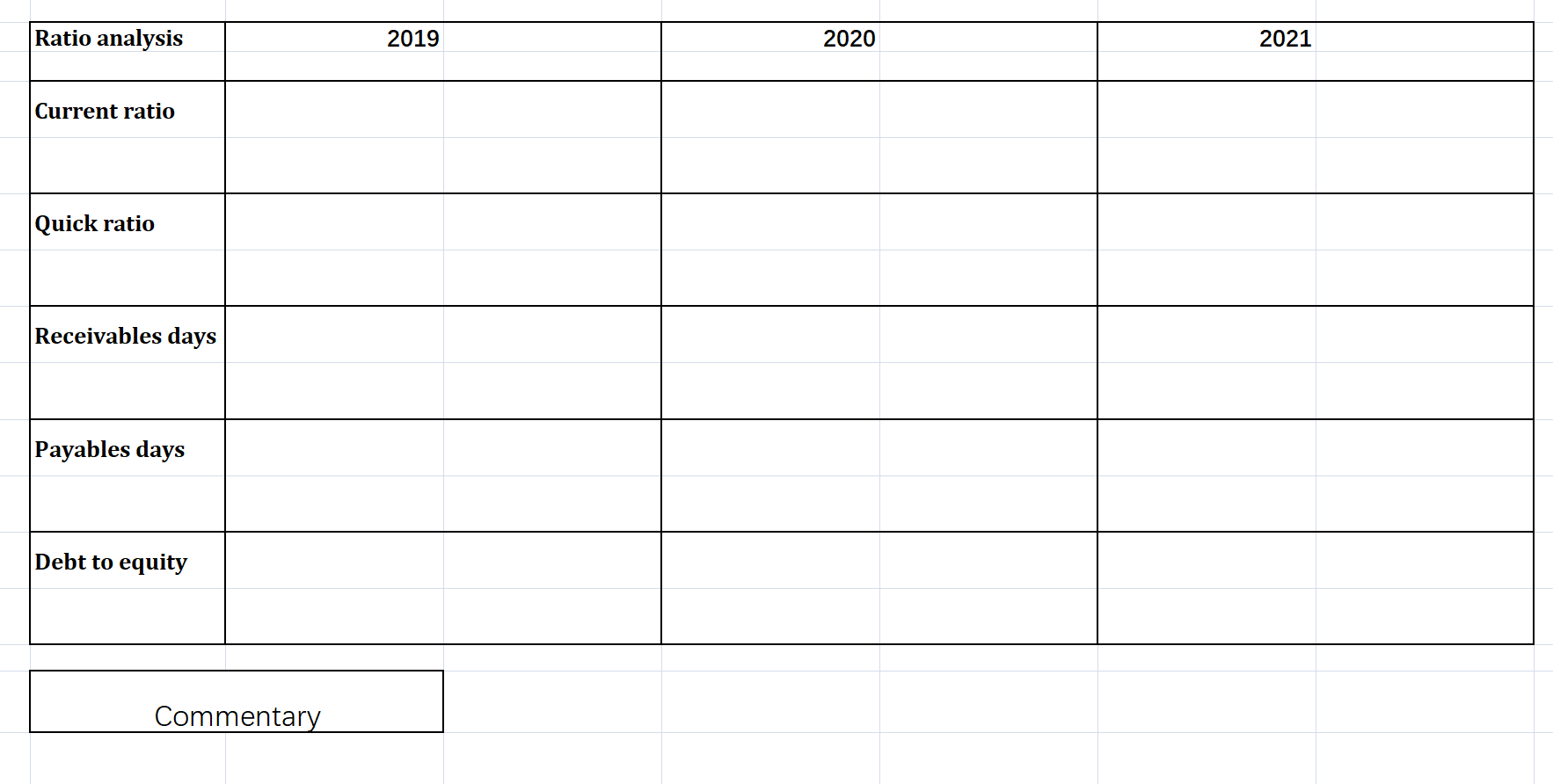

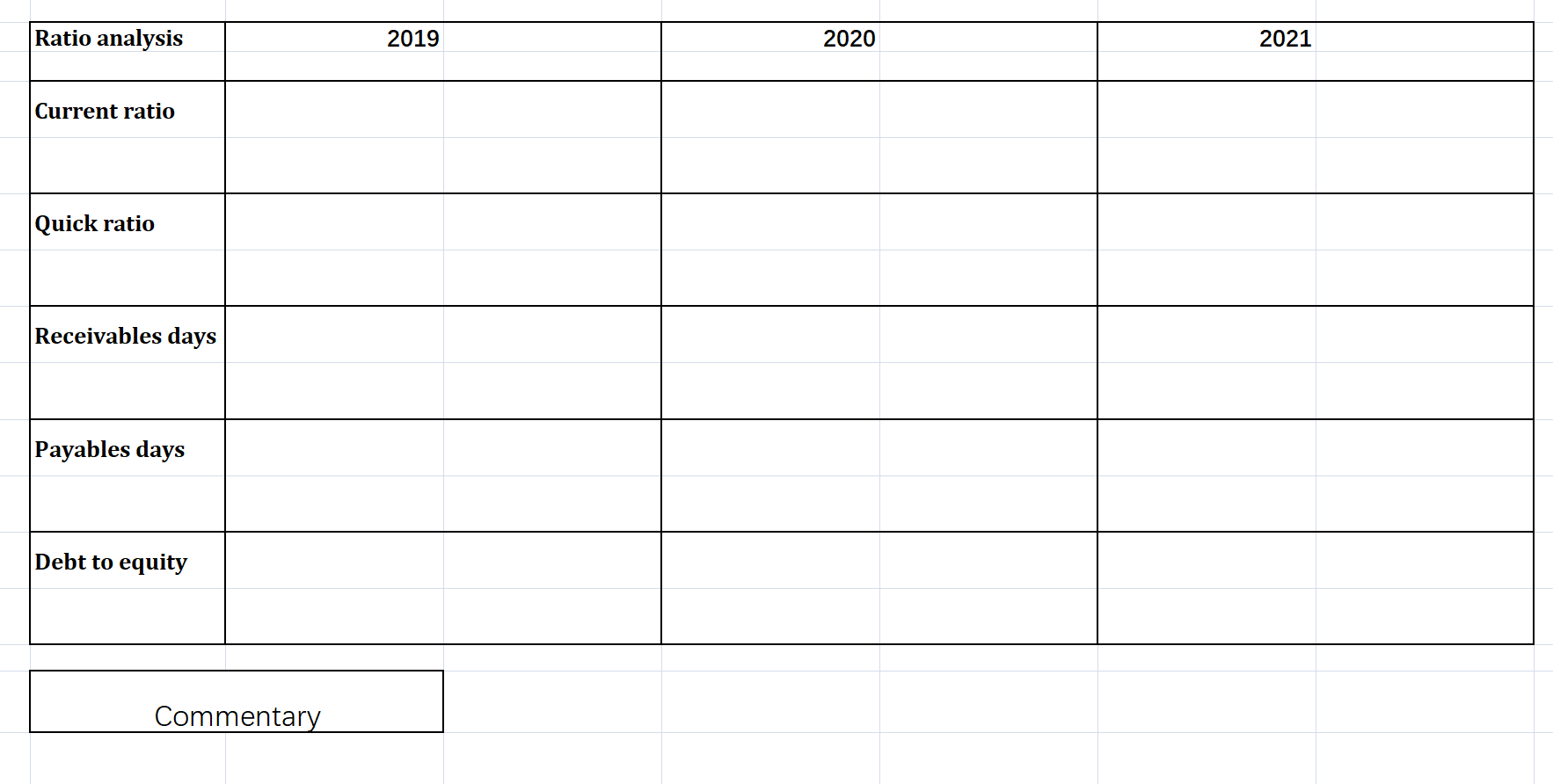

Please finish the Ratio analysis.Thank you

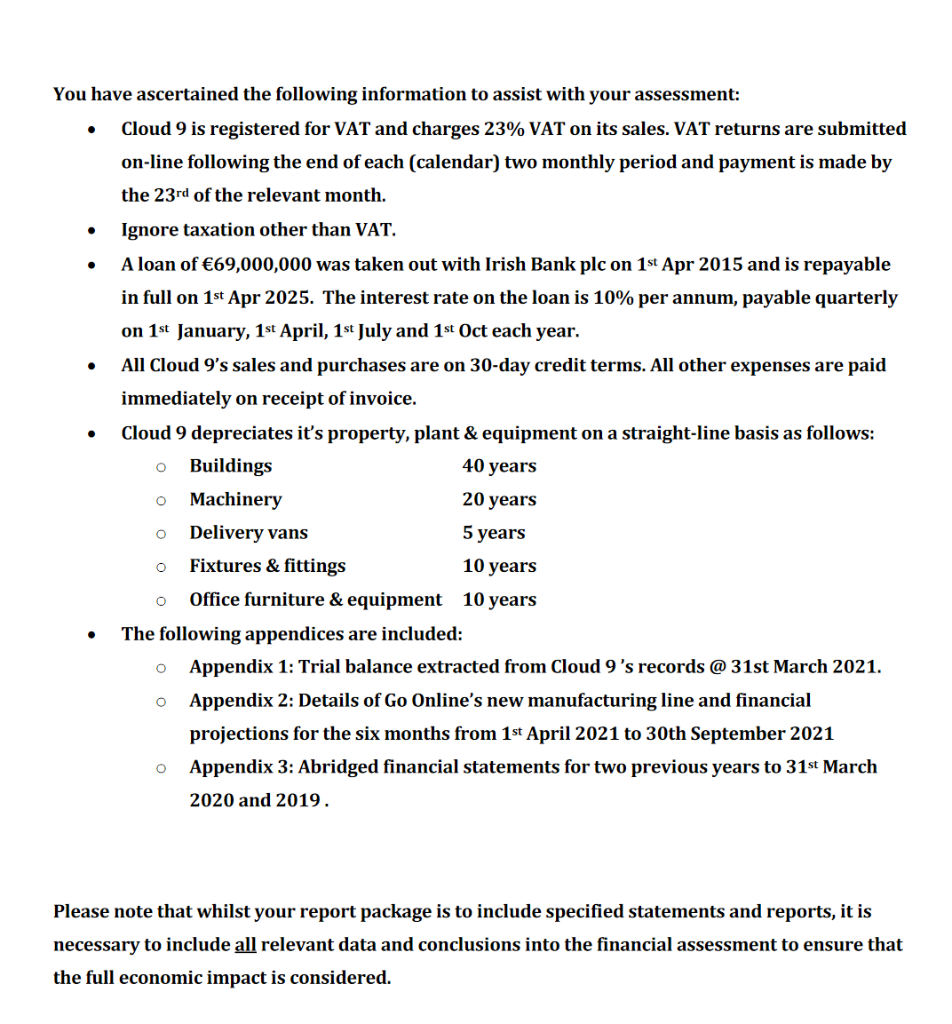

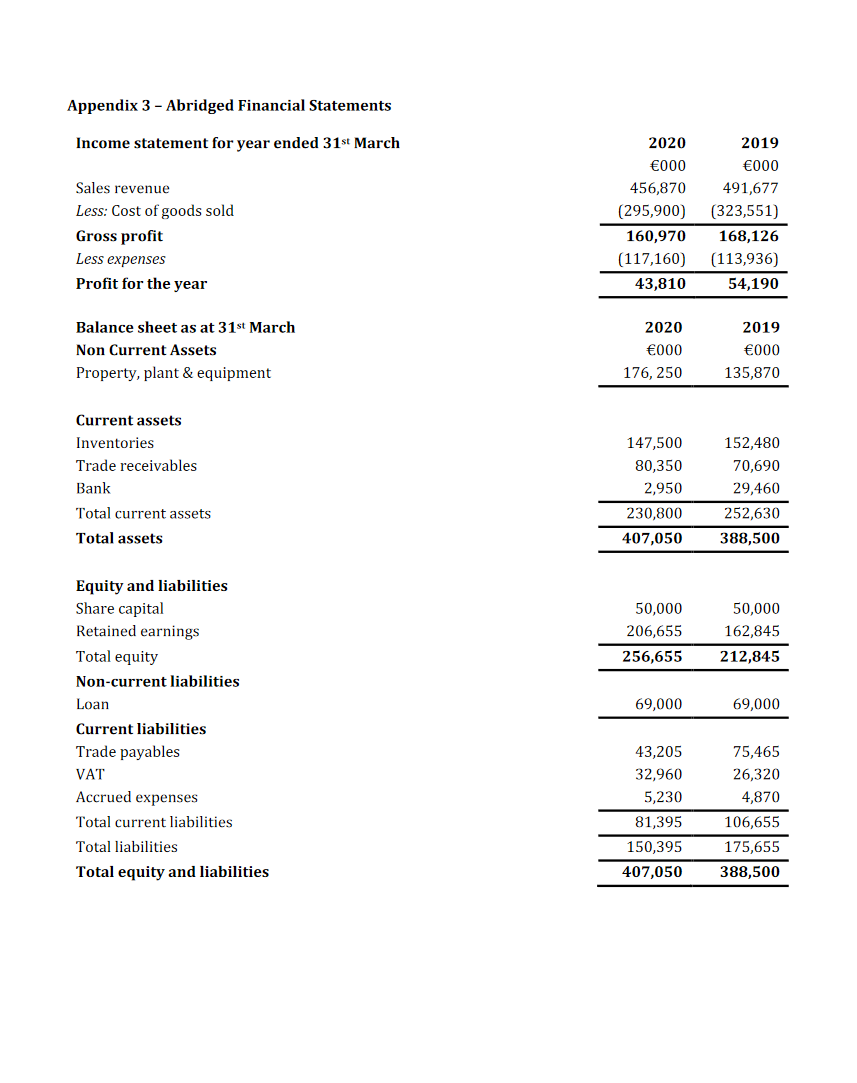

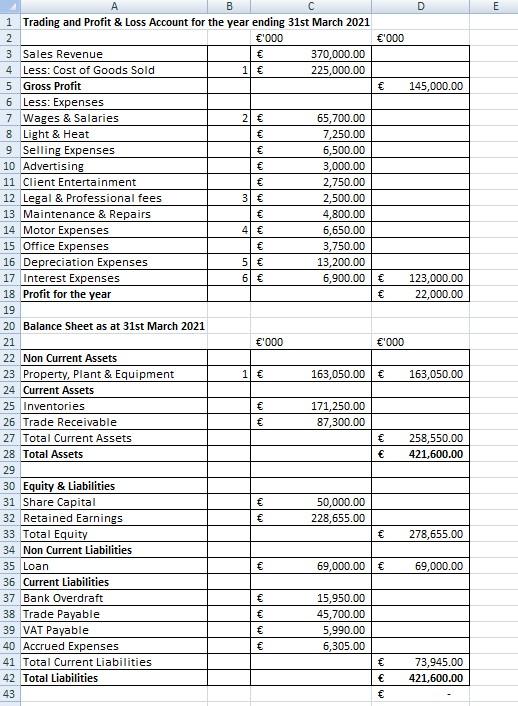

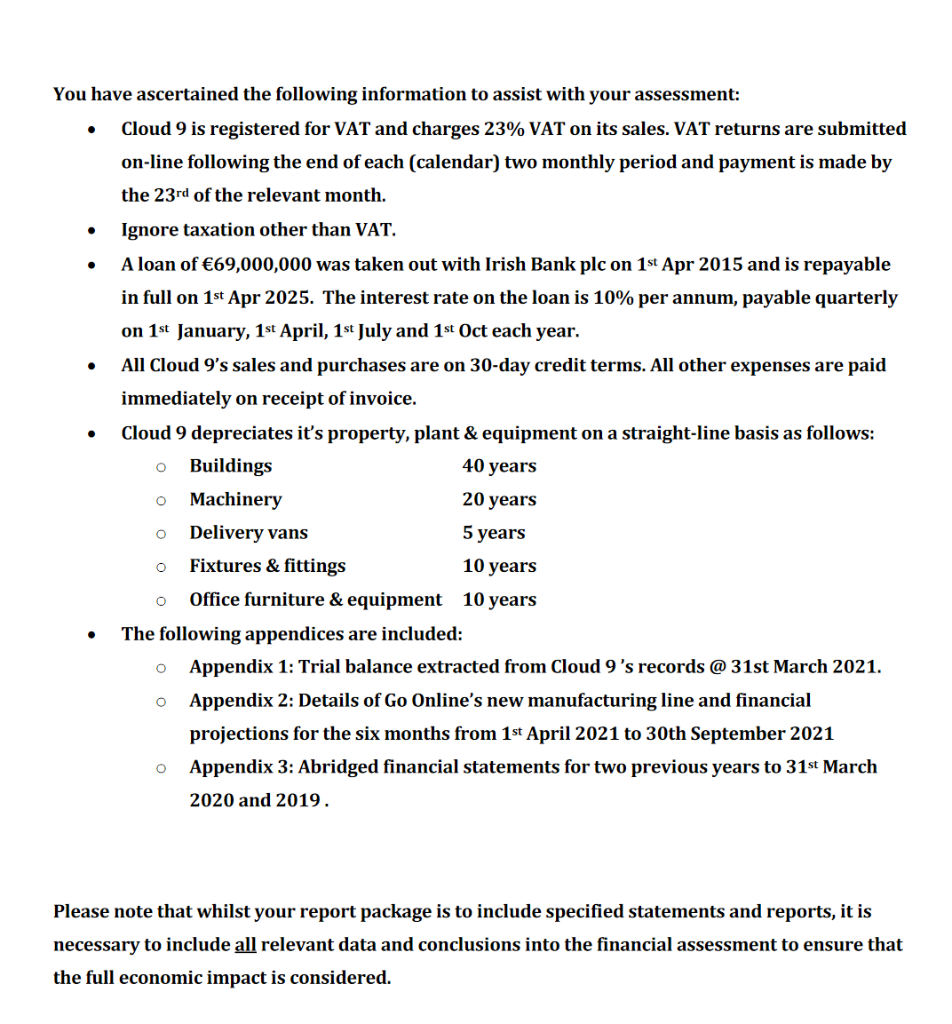

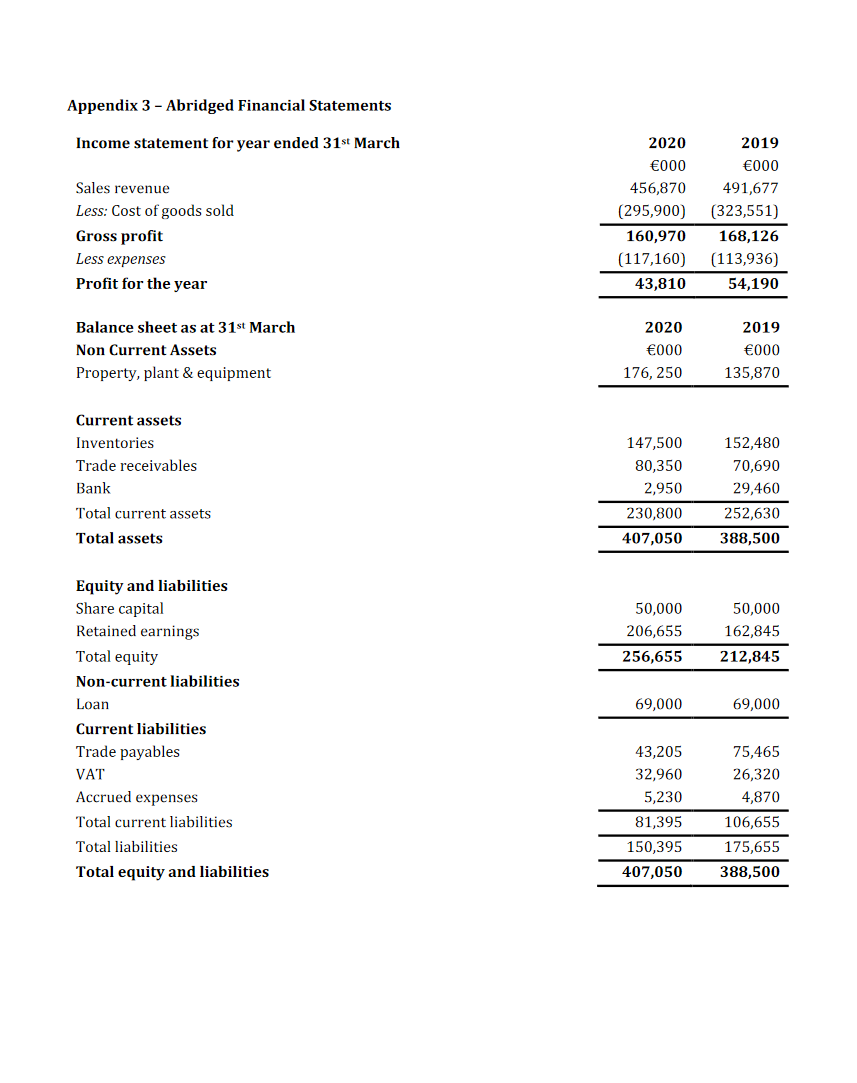

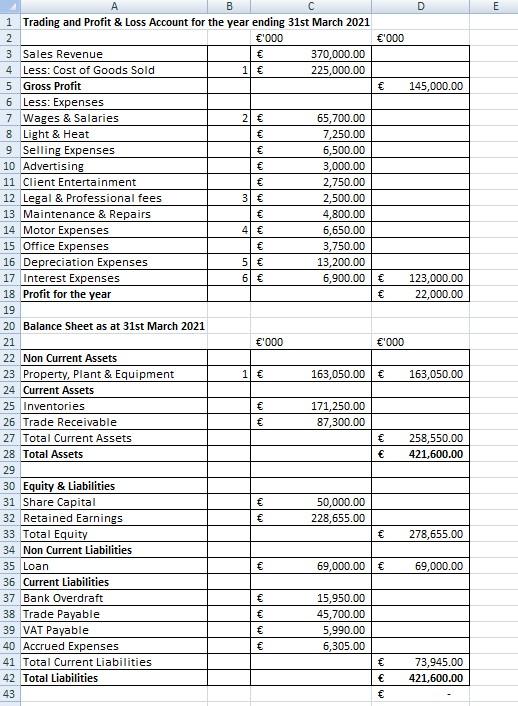

. . You have ascertained the following information to assist with your assessment: Cloud 9 is registered for VAT and charges 23% VAT on its sales. VAT returns are submitted on-line following the end of each (calendar) two monthly period and payment is made by the 23rd of the relevant month. Ignore taxation other than VAT. A loan of 69,000,000 was taken out with Irish Bank plc on 1st Apr 2015 and is repayable in full on 1st Apr 2025. The interest rate on the loan is 10% per annum, payable quarterly on 1st January, 1st April, 1st July and 1st Oct each year. All Cloud 9's sales and purchases are on 30-day credit terms. All other expenses are paid immediately on receipt of invoice. Cloud 9 depreciates it's property, plant & equipment on a straight-line basis as follows: Buildings 40 years Machinery 20 years Delivery vans Fixtures & fittings Office furniture & equipment 10 years The following appendices are included: Appendix 1: Trial balance extracted from Cloud 9's records @ 31st March 2021. Appendix 2: Details of Go Online's new manufacturing line and financial projections for the six months from 1st April 2021 to 30th September 2021 Appendix 3: Abridged financial statements for two previous years to 31st March 2020 and 2019. O o 0 5 years 10 years o . O o O Please note that whilst your report package is to include specified statements and reports, it is necessary to include all relevant data and conclusions into the financial assessment to ensure that the full economic impact is considered. Appendix 3 - Abridged Financial Statements Income statement for year ended 31st March Sales revenue Less: Cost of goods sold Gross profit Less expenses Profit for the year 2020 000 456,870 (295,900) 160,970 (117,160) 43,810 2019 000 491,677 (323,551) 168,126 (113,936) 54,190 2020 Balance sheet as at 31st March Non Current Assets Property, plant & equipment 2019 000 000 176, 250 135,870 Current assets Inventories Trade receivables Bank 147,500 80,350 2,950 230,800 407,050 152,480 70,690 29,460 252,630 388,500 Total current assets Total assets Equity and liabilities Share capital Retained earnings 50,000 206,655 256,655 50,000 162,845 212,845 Total equity Non-current liabilities Loan 69,000 69,000 Current liabilities Trade payables VAT Accrued expenses Total current liabilities Total liabilities Total equity and liabilities 43,205 32,960 5,230 81,395 150,395 407,050 75,465 26,320 4,870 106,655 175,655 388,500 E A B D 1 Trading and Profit & Loss Account for the year ending 31st March 2021 2 '000 '000 3 Sales Revenue 370,000.00 4 Less: Cost of Goods Sold 10 225,000.00 5 Gross Profit 145,000.00 6 Less: Expenses 7 Wages & Salaries 21 65,700.00 8 Light & Heat 7,250.00 9 Selling Expenses 6,500.00 10 Advertising 3,000.00 11 Client Entertainment 2,750.00 12 Legal & Professional fees 31 2,500.00 13 Maintenance & Repairs 4,800.00 14 Motor Expenses 4 6,650.00 15 Office Expenses 3,750.00 16 Depreciation Expenses 51 13,200.00 17 Interest Expenses 61 6,900.00 123,000.00 18 Profit for the year 22,000.00 19 20 Balance Sheet as at 31st March 2021 21 E'000 '000 22 Non Current Assets 23 Property, Plant & Equipment 1 163,050.00 163,050.00 24 Current Assets 25 Inventories 171,250.00 26 Trade Receivable 87,300.00 27 Total Current Assets 258,550.00 28 Total Assets 421,600.00 29 30 Equity & Liabilities 31 Share Capital E 50,000.00 32 Retained Earnings 228,655.00 33 Total Equity 278,655.00 34 Non Current Liabilities 35 Loan 69,000.00 69,000.00 36 Current Liabilities 37 Bank Overdraft 15,950.00 38 Trade Payable 45,700.00 39 VAT Payable 5,990.00 40 Accrued Expenses 6,305.00 41 Total Current Liabilities 73,945.00 42 Total Liabilities 421,600.00 43 Ratio analysis 2019 2020 2021 Current ratio Quick ratio Receivables days Payables days Debt to equity Commentary