Question

Please first solve the assigned problem 8-28A located at the end of Chapter Eight. Solve the problem manually and then visit Modules on Canvas to

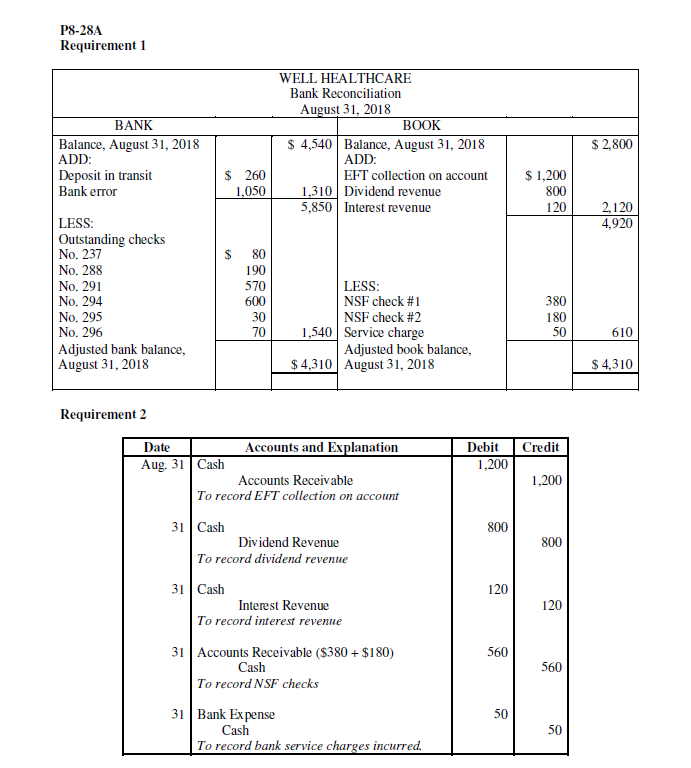

Please first solve the assigned problem 8-28A located at the end of Chapter Eight. Solve the problem manually and then visit "Modules" on Canvas to view the answer key to this problem and correct your numbers if needed. The answer key following pictureto the assigned problem is displayed in PDF format. The only change you need to make is to enter your answers (solutions to the problem) in Excel format. You may then open a blank Excel spreadsheet to enter your solutions.

Please read the spreadsheet instructions included in your class syllabus carefully to make sure you have followed all Eight criteria before you submit the assignment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started