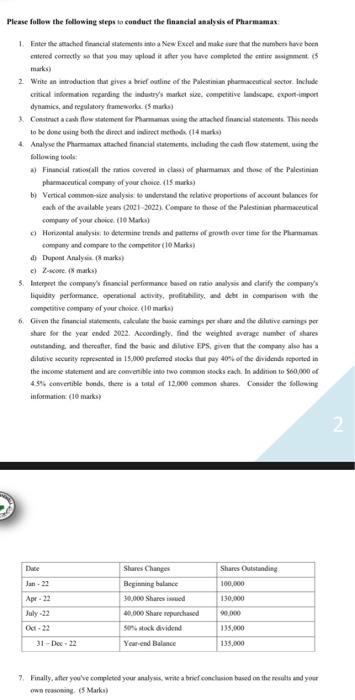

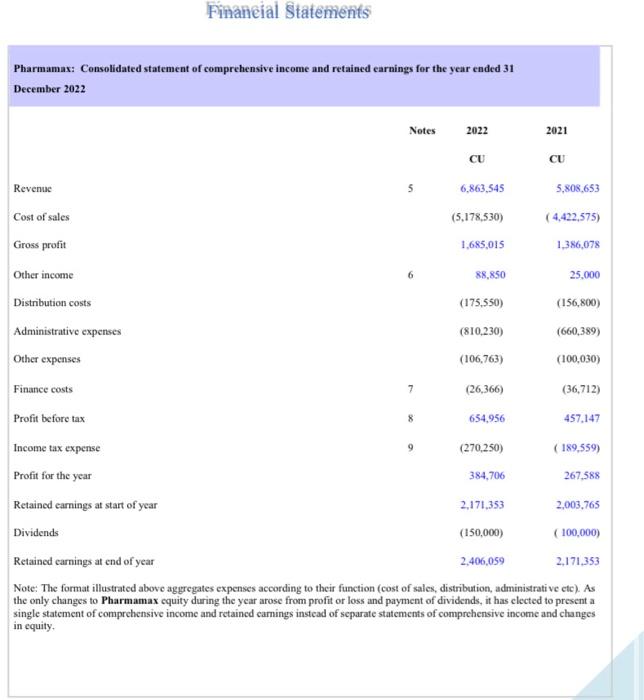

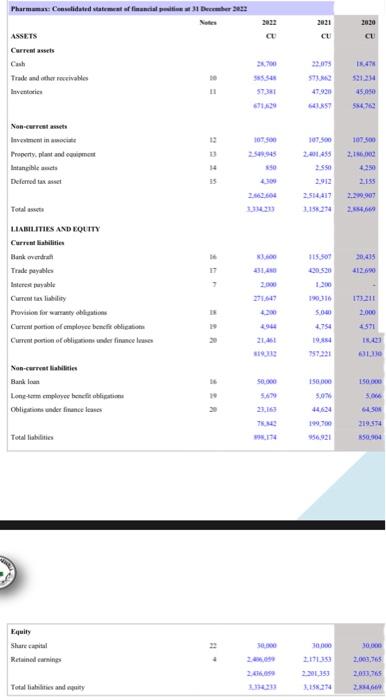

Please follew the fellowing steps to conduct the financial analysix of Pharmamax: marks) 2. Write an ineroduction than gives a brief carline of the Palestimian pharmacentical sector. Include dynamics, and repulatory framesorks. (s mark) 1. Costsinuct a cad flow stakement far Pharnamas eving the attached financial statenents. Nais noeds io be doee using both the direst and indirect methosk. (14 marks) 4. Analyse the Farmarnax attached financial statements, includiey the ced flow itatement, ueine the Gllawing tools: phirmaceutical company of your choice. (15 marks) b) Vertical commoe-rie analysis: to undontand the relative propertiens of acoeunt balances for cach of the available ycars (20212022). Ceeppare io those of the Palestinia pharmaceutical company of your chaice. (10 Marka) company and compare to the conrestilicr (10 Mtarks) d) Dupent Analyen (8 marks) c) 2-wote. (8 maks) 3. Laterpet the company's finaxial perfomance bued ee ratio analyses and charify the eempany's comprtitive company of your choice. (10 mark) 6. Given the financial stakements, falculase the basic caminge per ahare and the dilutive carningo per share for the your ended 3022. Accondingly. Find the weighted werage number of shares owatusding and thereafier. find the baic and dilutive FPS, poven that the compiny ales has a the incoese statcment and are comotible inko two conmon socks cach. In addinion to 560,000 of 4546 comertible bondk, there is a tatial af 12.000 commos shere. Consider the following information: (10 marks) own resonsing. (5 Mtarka) Pharmamax: Consolidated statement of comprehensive income and retained earnings for the year ended 31 December 2022 Revenue Cost of sales Gross profit Other income Distribution costs Administrative expenses Other expenses Finance costs Profit before tax Income tax expense Profit for the year Retained carnings at start of year Dividends Retained carnings at end of year Note: The format illustrated above aggegates expenses according to their function (cost of sales, distribution, administrative ete). As the only changes to Pharmamax equity during the year arose from profit or loss and payment of dividends, it has elected to present a single statement of comprehensive income and retained carnings instead of separate statements of comprehensive income and changes in equity