Answered step by step

Verified Expert Solution

Question

1 Approved Answer

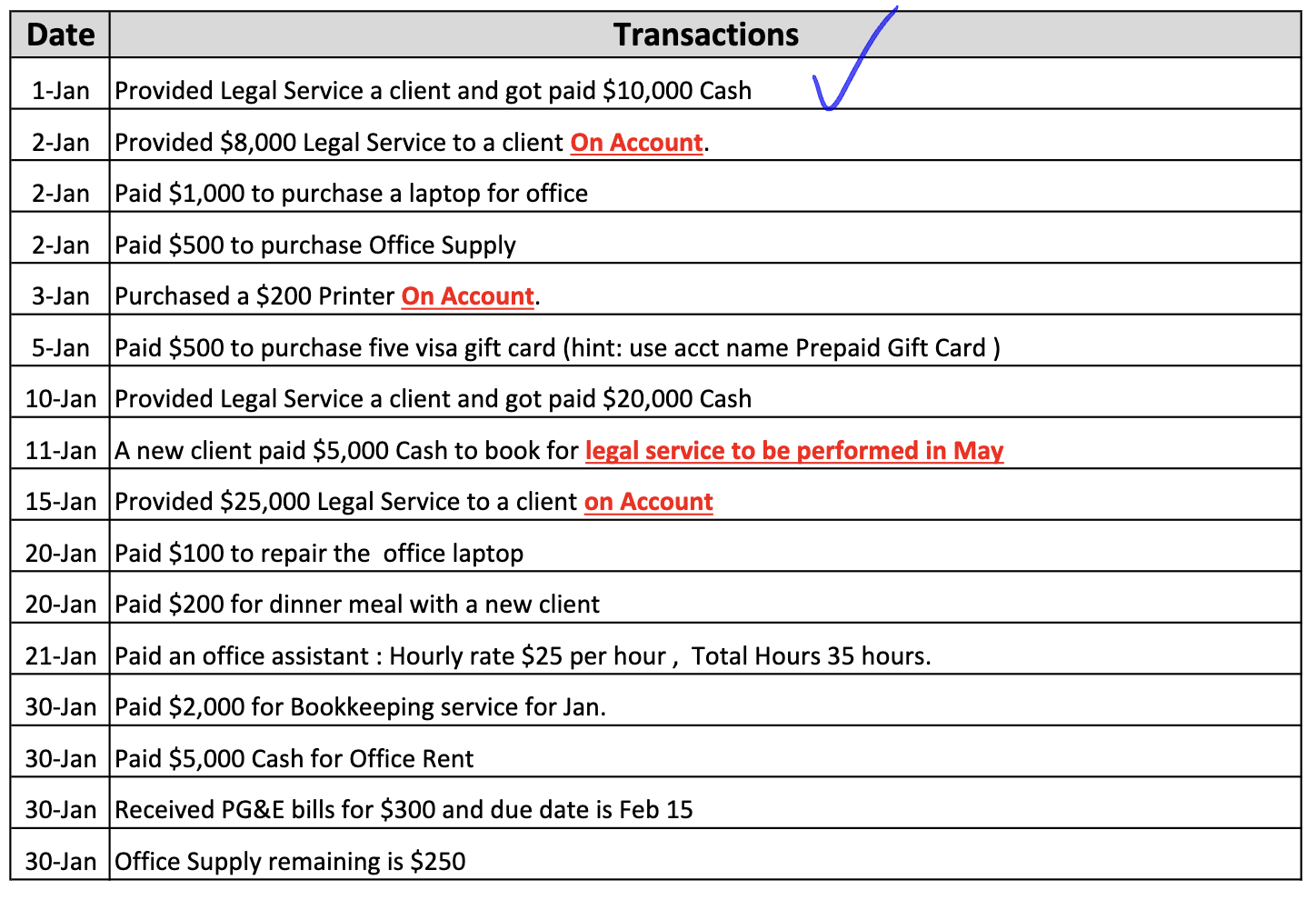

Please follow the instructions below: 1. Recording All the January transactions. 2. All the invoices for every revenue transactions. 3. Trial Balance 4. Income statement

Please follow the instructions below:

Please follow the instructions below:

1. Recording All the January transactions.

2. All the invoices for every revenue transactions.

3. Trial Balance

4. Income statement aka profit and loss

5. Balance sheet

A thumb-up will be given. Thanks!

\begin{tabular}{|l|l|} \hline Date & \multicolumn{1}{|c|}{ Transactions } \\ \hline 1-Jan & Provided Legal Service a client and got paid $10,000 Cash \\ \hline 2-Jan & Provided $8,000 Legal Service to a client On Account. \\ \hline 2-Jan & Paid $1,000 to purchase a laptop for office \\ \hline 2-Jan & Paid $500 to purchase Office Supply \\ \hline 3-Jan & Purchased a $200 Printer On Account. \\ \hline 5-Jan & Paid $500 to purchase five visa gift card (hint: use acct name Prepaid Gift Card ) \\ \hline 10-Jan & Provided Legal Service a client and got paid $20,000 Cash \\ \hline 11-Jan & A new client paid $5,000 Cash to book for legal service to be performed in May \\ \hline 15-Jan & Provided $25,000 Legal Service to a client on Account \\ \hline 20-Jan & Paid $100 to repair the office laptop \\ \hline 20-Jan & Paid $200 for dinner meal with a new client \\ \hline 21-Jan & Paid an office assistant : Hourly rate $25 per hour , Total Hours 35 hours. \\ \hline 30-Jan & Paid $2,000 for Bookkeeping service for Jan. \\ \hline 30-Jan & Paid $5,000 Cash for Office Rent \\ \hline 30-Jan & Received PG\&E bills for $300 and due date is Feb 15 \\ \hline 30-Jan & Office Supply remaining is $250 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started