Answered step by step

Verified Expert Solution

Question

1 Approved Answer

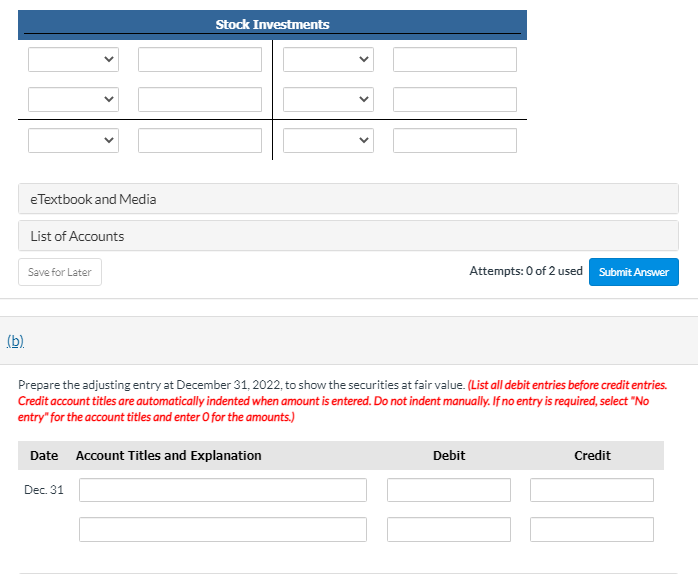

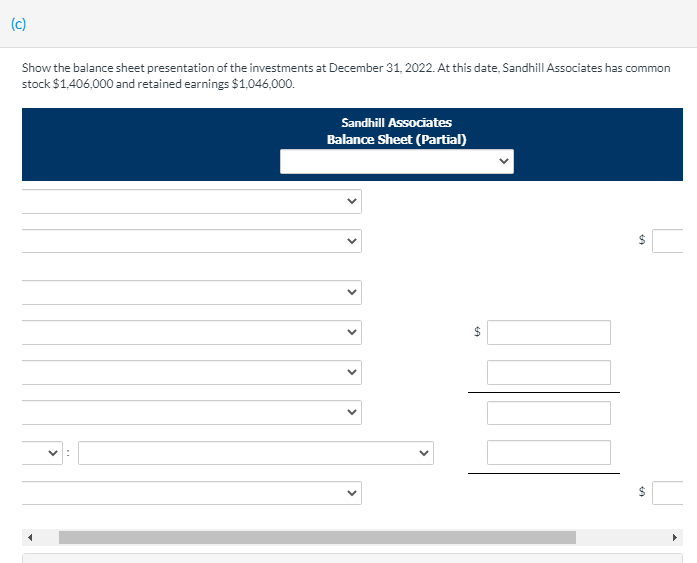

Please follow the same format above and make sure to count the boxes properly List to use Bonds Payable Buildings Cash Cash Dividends Common Stock

Please follow the same format above and make sure to count the boxes properly

List to use

- Bonds Payable

- Buildings

- Cash

- Cash Dividends

- Common Stock

- Common Stock Dividends Distributable

- Debt Investments

- Discount on Bonds Payable

- Dividend Revenue

- Dividends Payable

- Fair Value Adjustment-Available-for-Sale

- Fair Value Adjustment-Stock

- Fair Value Adjustment-Trading

- Gain on Sale of Debt Investments

- Gain on Sale of Stock Investments

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Loss on Sale of Debt Investments

- Loss on Sale of Stock Investments

- No Entry

- Paid-in Capital in Excess of Par-Common Stock

- Revenue from Stock Investments

- Short-Term Investments

- Stock Dividends

- Stock Investments

- Unrealized Gain or Loss-Equity

- Unrealized Gain or Loss-Income

Thank you~

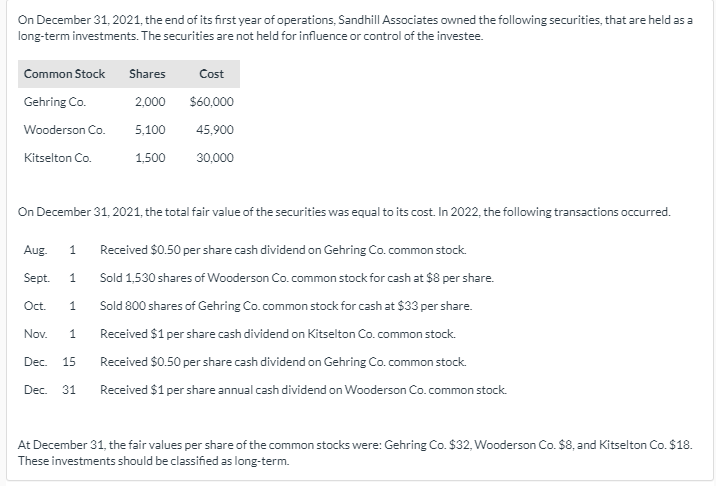

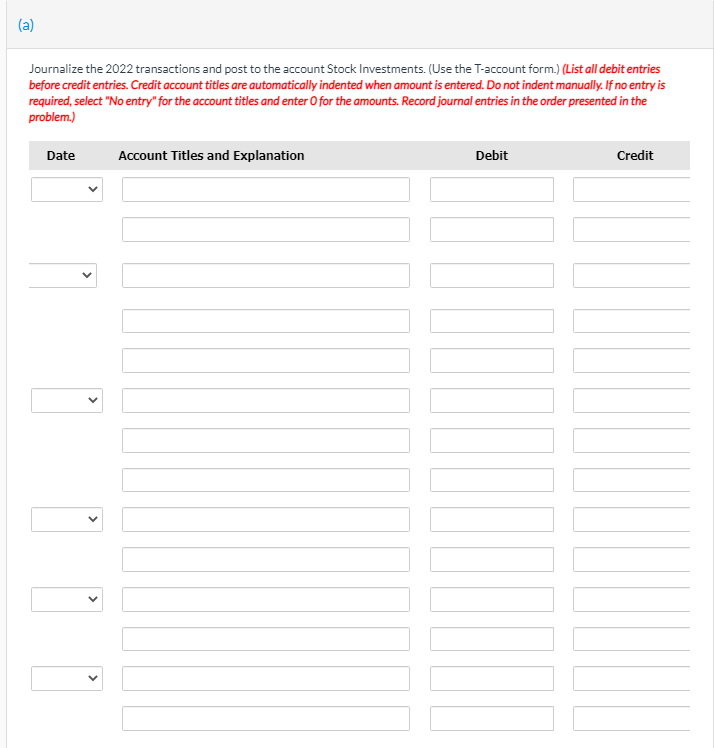

On December 31, 2021, the end of its first year of operations, Sandhill Associates owned the following securities, that are held as a long-term investments. The securities are not held for influence or control of the investee. Common Stock Shares Cost Gehring Co. 2,000 $60,000 Wooderson Co. 5,100 45,900 Kitselton Co. 1,500 30.000 On December 31, 2021, the total fair value of the securities was equal to its cost. In 2022, the following transactions occurred. Aug 1 Received $0.50 per share cash dividend on Gehring Co. common stock Sept. 1 Sold 1.530 shares of Wooderson Co.common stock for cash at $8 per share. Sold 800 shares of Gehring Co.common stock for cash at $33 per share. Oct. 1 Nov. 1 Received $1 per share cash dividend on Kitselton Co.common stock. Dec. 15 Received $0.50 per share cash dividend on Gehring Co.common stock. Dec. 31 Received $1 per share annual cash dividend on Wooderson Co.common stock At December 31, the fair values per share of the common stocks were: Gehring Co. $32, Wooderson Co. $8, and Kitselton Co. $18. These investments should be classified as long-term. (a) Journalize the 2022 transactions and post to the account Stock Investments. Use the T-account form.(List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started