Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please follow the same format above and make sure to count the empty boxes right List to use Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated

Please follow the same format above and make sure to count the empty boxes right

List to use

- Accounts Payable

- Accounts Receivable

- Accumulated Depreciation-Buildings

- Accumulated Depreciation-Equipment

- Allowance for Doubtful Accounts

- Bad Debt Expense

- Bonds Payable

- Buildings

- Cash

- Cash Dividends

- Common Stock

- Depreciation Expense

- Discount on Bonds Payable

- Dividends Payable

- Equipment

- Gain on Bond Redemption

- Interest Expense

- Interest Payable

- Inventory

- Land

- Lease Liability

- Leased Asset-Equipment

- Loss on Bond Redemption

- Mortgage Payable

- Notes Payable

- Other Operating Expenses

- Paid-in Capital in Excess of Par-Common Stock

- Paid-in Capital in Excess of Par-Preferred Stock

- Preferred Stock

- Premium on Bonds Payable

- Rent Expense

- Rent Revenue

- Retained Earnings

- Right-of-Use-Asset

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Treasury Stock

- Unearned Rent Revenue

Thank you~

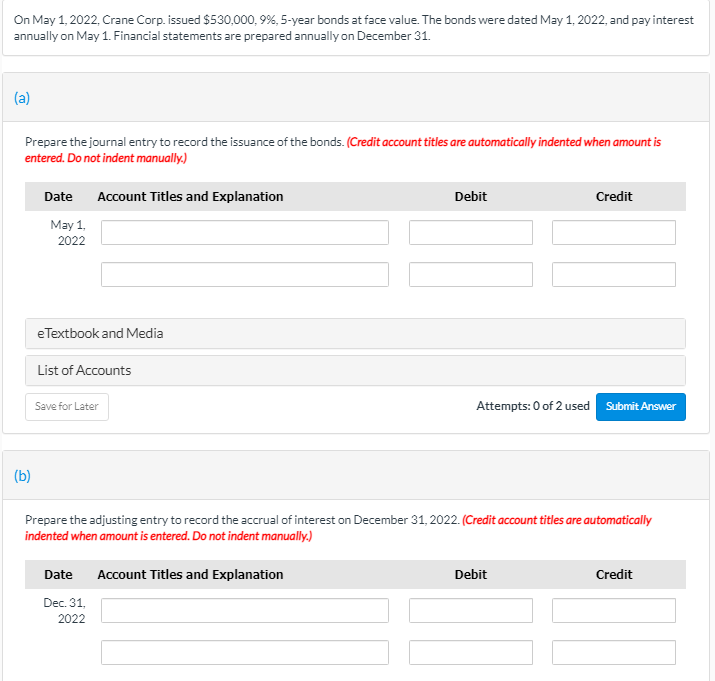

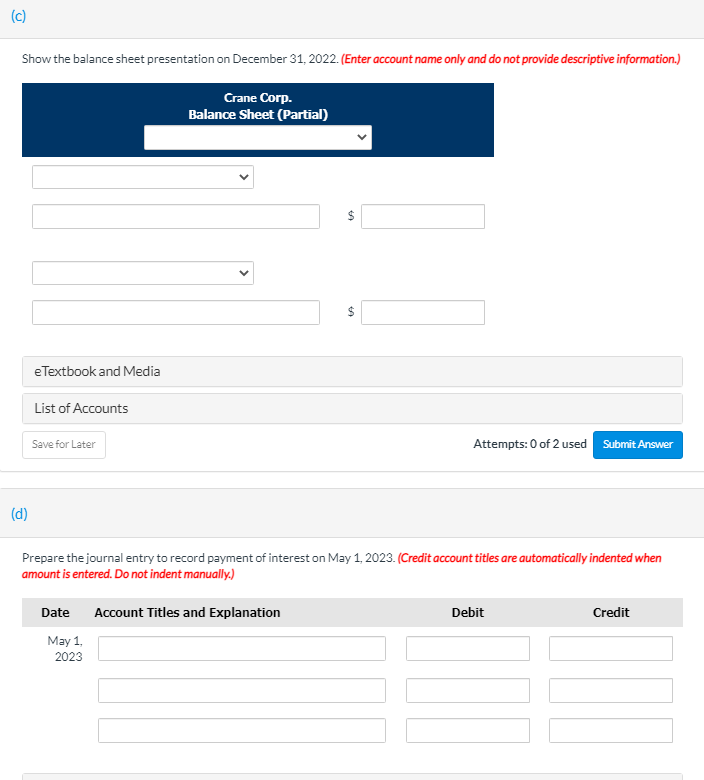

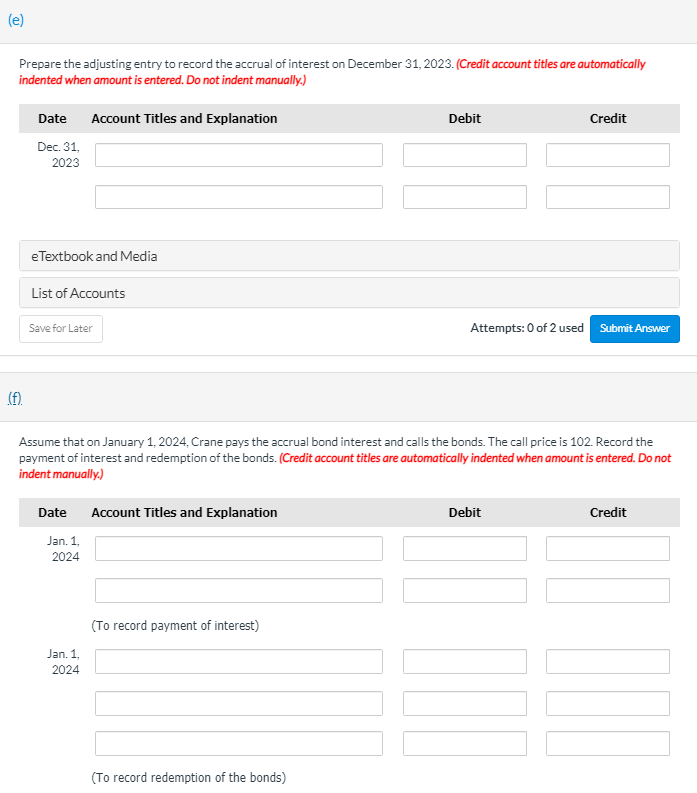

On May 1, 2022, Crane Corp. issued $530,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2022, and pay interest annually on May 1. Financial statements are prepared annually on December 31. (a) Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit May 1, 2022 eTextbook and Media List of Accounts Save for Later Attempts: 0 of 2 used Submit Answer (b) Prepare the adjusting entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2022 (c) Show the balance sheet presentation on December 31, 2022. (Enter account name only and do not provide descriptive information.) Crane Corp Balance Sheet (Partial) $ e Textbook and Media List of Accounts Save for Later Attempts: 0 of 2 used Submit Answer (d) Prepare the journal entry to record payment of interest on May 1, 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit May 1, 2023 (e) Prepare the adjusting entry to record the accrual of interest on December 31, 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2023 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 2 used Submit Answer (f). Assume that on January 1, 2024. Crane pays the accrual bond interest and calls the bonds. The call price is 102. Record the payment of interest and redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1, 2024 (To record payment of interest) Jan. 1. 2024 (To record redemption of the bonds)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started