Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please for the love of god help me Remember to do your problem in Excel or Word. Remember to submit on Canvas by the due

please for the love of god help me

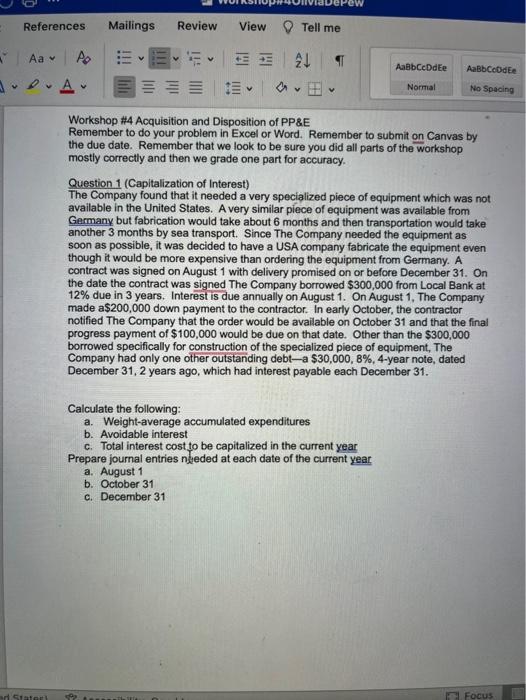

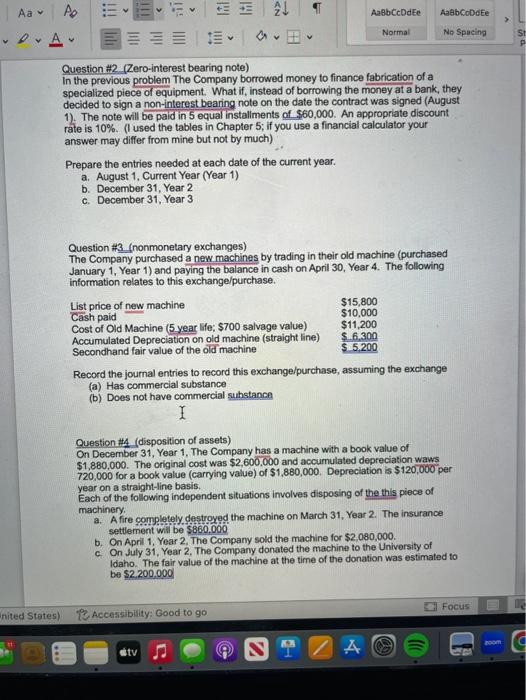

Remember to do your problem in Excel or Word. Remember to submit on Canvas by the due date. Remember that we look to be sure you did all parts of the workshop mostly correctly and then we grade one part for accuracy. Question 1 (Capitalization of Interest) The Company found that it needed a very specialized piece of equipment which was not available in the United States. A very similar piece of equipment was available from Germany but fabrication would take about 6 months and then transportation would take another 3 months by sea transport. Since The Company needed the equipment as soon as possible, it was decided to have a USA company fabricate the equipment even though it would be more expensive than ordering the equipment from Germany. A contract was signed on August 1 with delivery promised on or before December 31 . On the date the contract was signed The Company borrowed $300,000 from Local Bank at 12% due in 3 years. Interest is due annually on August 1 . On August 1, The Company made a\$200,000 down payment to the contractor. In early October, the contractor notified The Company that the order would be available on October 31 and that the final progress payment of $100,000 would be due on that date. Other than the $300,000 borrowed specifically for construction of the specialized piece of equipment, The Company had only one other outstanding debt-a $30,000,8%, 4-year note, dated December 31,2 years ago, which had interest payable each December 31 . Calculate the following: a. Weight-average accumulated expenditures b. Avoidable interest c. Total interest cost to be capitalized in the current year Prepare journal entries ndeded at each date of the current year a. August 1 b. October 31 c. December 31 Question \#2. (Zero-interest bearing note) In the previous problem The Company borrowed money to finance fabrication of a specialized piece of equipment. What if, instead of borrowing the money at a bank, they decided to sign a non-interest bearing note on the date the contract was signed (August 1). The note will be paid in 5 equal installments of $60,000. An appropriate discount rate is 10%. (I used the tables in Chapter 5 ; if you use a financial calculator your answer may differ from mine but not by much) Prepare the entries needed at each date of the current year. a. August 1, Current Year (Year 1) b. December 31, Year 2 c. December 31, Year 3 Question \#3 (nonmonetary exchanges) The Company purchased a new machines by trading in their old machine (purchased January 1, Year 1) and paying the balance in cash on April 30, Year 4. The following information relates to this exchange/purchase. Record the journal entries to record this exchange/purchase, assuming the exchange (a) Has commercial substance (b) Does not have commercial suhstance I Question \#4 (disposition of assets) On December 31, Year 1, The Company has a machine with a book value of $1,880,000. The original cost was $2,600,000 and accumulated depreciation waws 720,000 for a book value (carrying value) of $1,880,000. Depreciation is $120,000 per year on a straight-line basis. Each of the following independent situations involves disposing of the this piece of machinery. a. A fire completely destroxed the machine on March 31, Year 2. The insurance settlement wili be $860.000 b. On April 1, Year 2. The Company sold the machine for $2,080,000. c. On July 31, Year 2, The Company donated the machine to the University of Idaho. The fair value of the machine at the time of the donation was estimated to be $2.200.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started