Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please full procedure 4. You are interested in creating a portfolio of two stocks: Coca-Loc and Texts DisUtilis. You have the following that could be

please full procedure

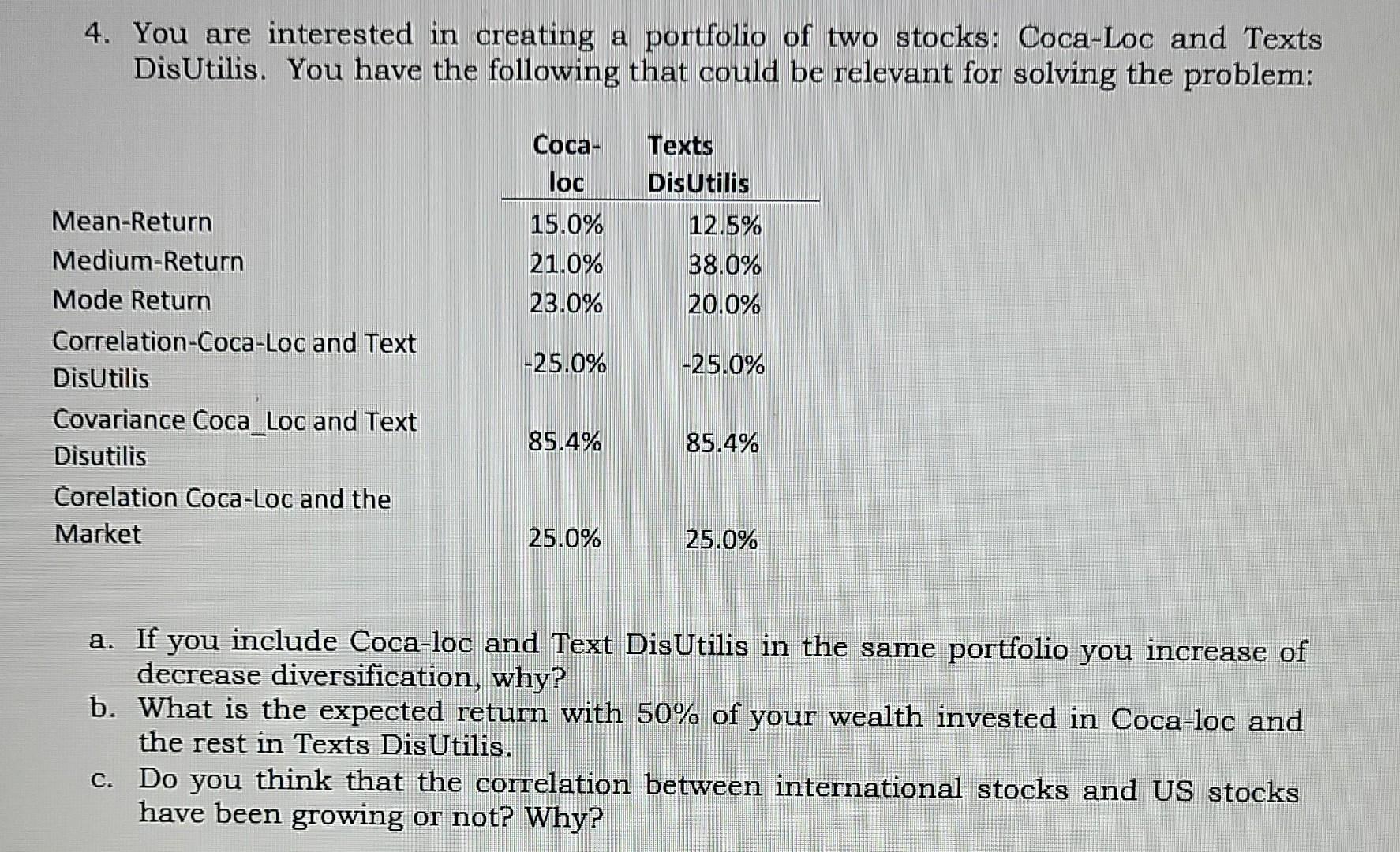

4. You are interested in creating a portfolio of two stocks: Coca-Loc and Texts DisUtilis. You have the following that could be relevant for solving the problem: Coca- Texts loc DisUtilis Mean-Return 15.0% 12.5% Medium-Return 21.0% 38.0% Mode Return 23.0% 20.0% Correlation-Coca-Loc and Text -25.0% -25.0% DisUtilis Covariance Coca_Loc and Text Disutilis 85.4% 85.4% Corelation Coca-Loc and the Market 25.0% 25.0% a. If you include Coca-loc and Text DisUtilis in the same portfolio you increase of decrease diversification, why? b. What is the expected return with 50% of your wealth invested in Coca-loc and the rest in Texts DisUtilis. c. Do you think that the correlation between international stocks and US stocks have been growing or not? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started