Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please full solving without financial calculator Q3: . You have been asked to estimate the weighted average cost of capital (WACC) for the PMC Co.

Please full solving without financial calculator

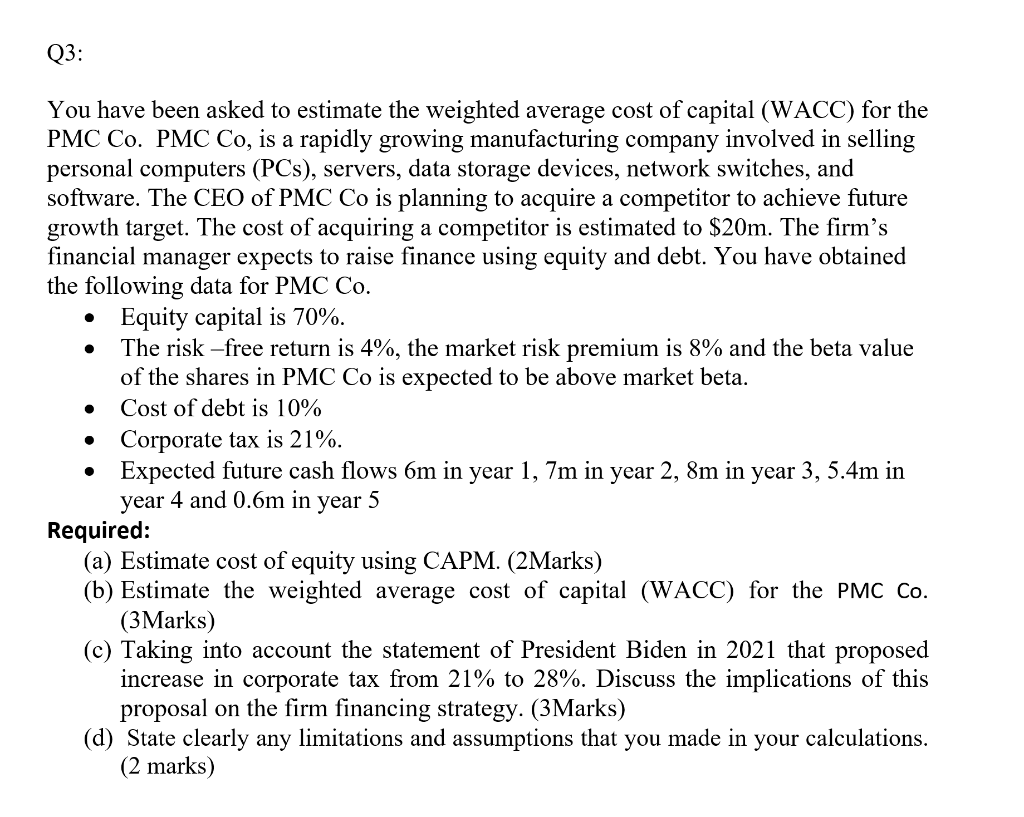

Q3: . You have been asked to estimate the weighted average cost of capital (WACC) for the PMC Co. PMC Co, is a rapidly growing manufacturing company involved in selling personal computers (PCs), servers, data storage devices, network switches, and software. The CEO of PMC Co is planning to acquire a competitor to achieve future growth target. The cost of acquiring a competitor is estimated to $20m. The firm's financial manager expects to raise finance using equity and debt. You have obtained the following data for PMC Co. Equity capital is 70%. The risk-free return is 4%, the market risk premium is 8% and the beta value of the shares in PMC Co is expected to be above market beta. Cost of debt is 10% Corporate tax is 21%. Expected future cash flows 6m in year 1, 7m in year 2, 8m in year 3, 5.4m in year 4 and 0.6m in year 5 Required: (a) Estimate cost of equity using CAPM. (2Marks) (b) Estimate the weighted average cost of capital (WACC) for the PMC Co. (3Marks) (c) Taking into account the statement of President Biden in 2021 that proposed increase in corporate tax from 21% to 28%. Discuss the implications of this proposal on the firm financing strategy. (3Marks) (d) State clearly any limitations and assumptions that you made in your calculations. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started