Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Genius answer the Whole answer for me . God will help you Question 3 Margerita Ltd ('Margerita') has business operations in fizzy drinks. The

Please Genius answer the Whole answer for me . God will help you

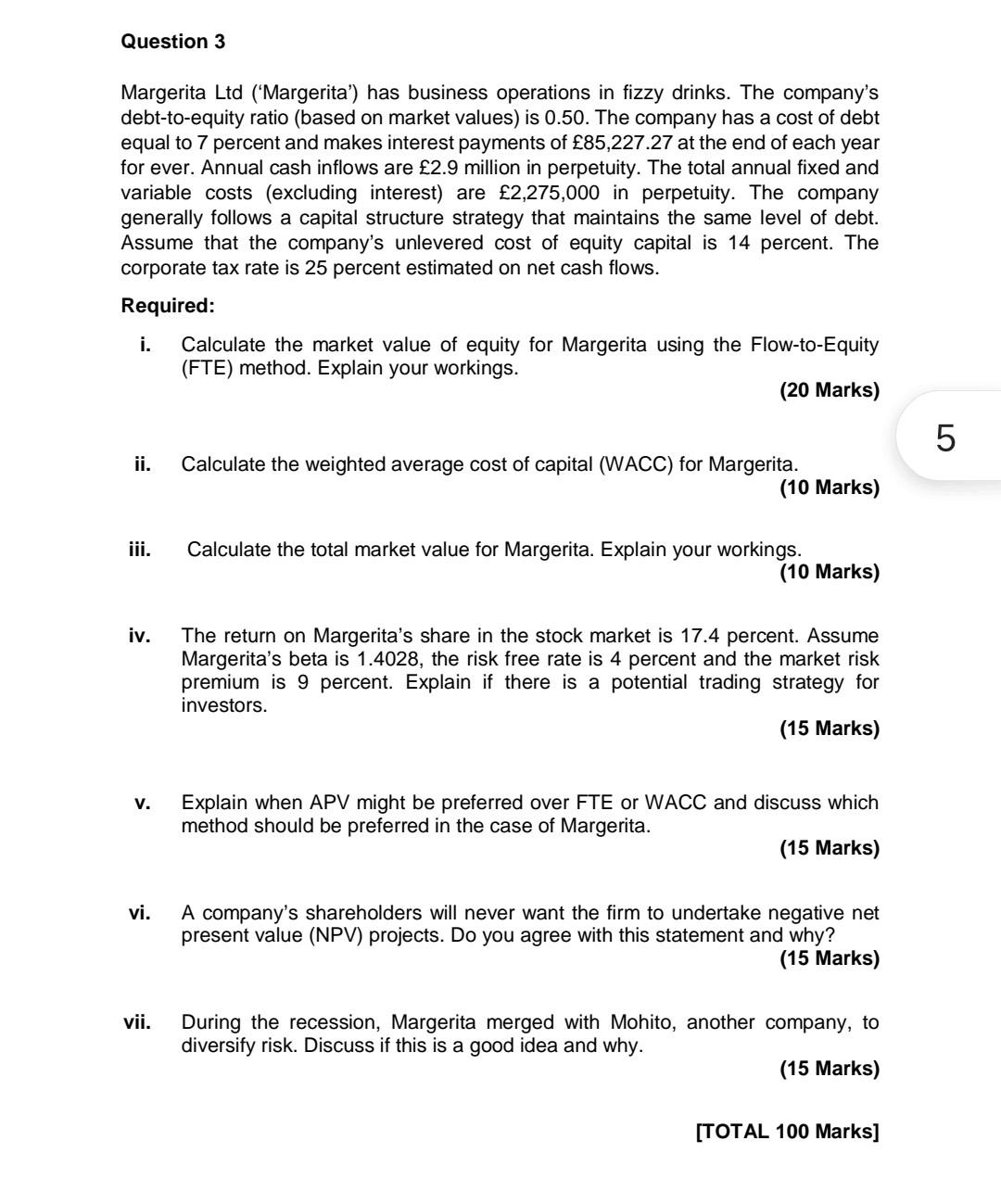

Question 3 Margerita Ltd ('Margerita') has business operations in fizzy drinks. The company's debt-to-equity ratio (based on market values) is 0.50. The company has a cost of debt equal to 7 percent and makes interest payments of 85,227.27 at the end of each year for ever. Annual cash inflows are 2.9 million in perpetuity. The total annual fixed and variable costs (excluding interest) are 2,275,000 in perpetuity. The company generally follows a capital structure strategy that maintains the same level of debt. Assume that the company's unlevered cost of equity capital is 14 percent. The corporate tax rate is 25 percent estimated on net cash flows. Required: i. Calculate the market value of equity for Margerita using the Flow-to-Equity (FTE) method. Explain your workings. (20 Marks) ii. Calculate the weighted average cost of capital (WACC) for Margerita. (10 Marks) iii. Calculate the total market value for Margerita. Explain your workings. (10 Marks) iv. The return on Margerita's share in the stock market is 17.4 percent. Assume Margerita's beta is 1.4028, the risk free rate is 4 percent and the market risk premium is 9 percent. Explain if there is a potential trading strategy for investors. (15 Marks) V. Explain when APV might be preferred over FTE or WACC and discuss which method should be preferred in the case of Margerita. (15 Marks) vi. A company's shareholders will never want the firm to undertake negative net present value (NPV) projects. Do you agree with this statement and why? (15 Marks) vii. During the recession, Margerita merged with Mohito, another company, to diversify risk. Discuss if this is a good idea and why. (15 Marks) [TOTAL 100 Marks] LO 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started