Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please get back to me quickly and I will rate and thumbs up! AMC Limited issued five year, 5% bonds for their par value of

please get back to me quickly and I will rate and thumbs up!

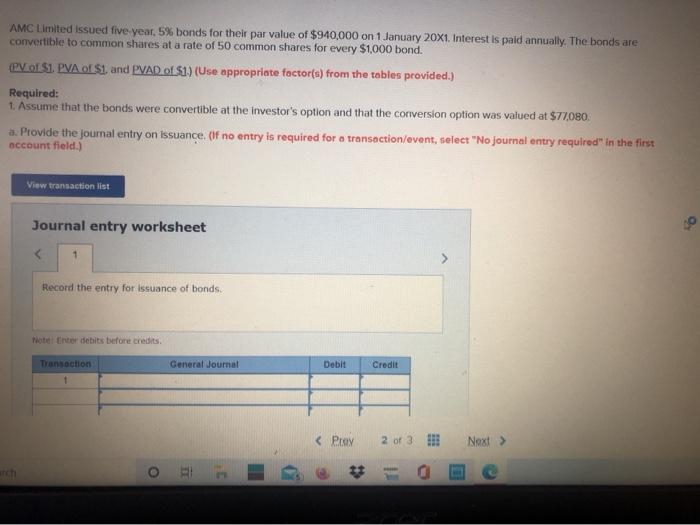

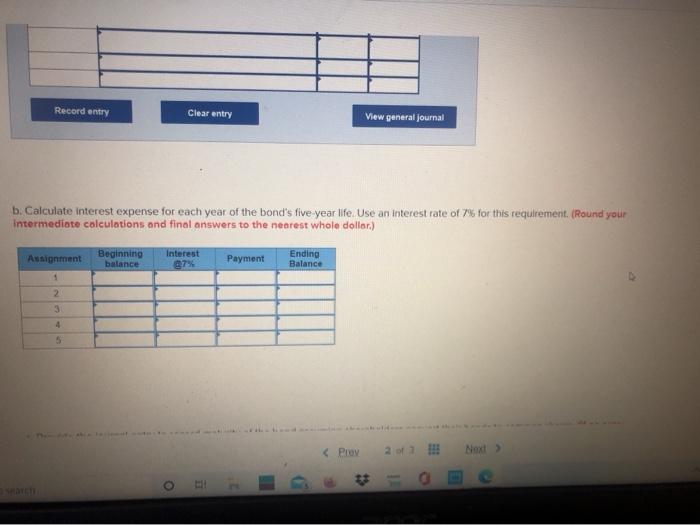

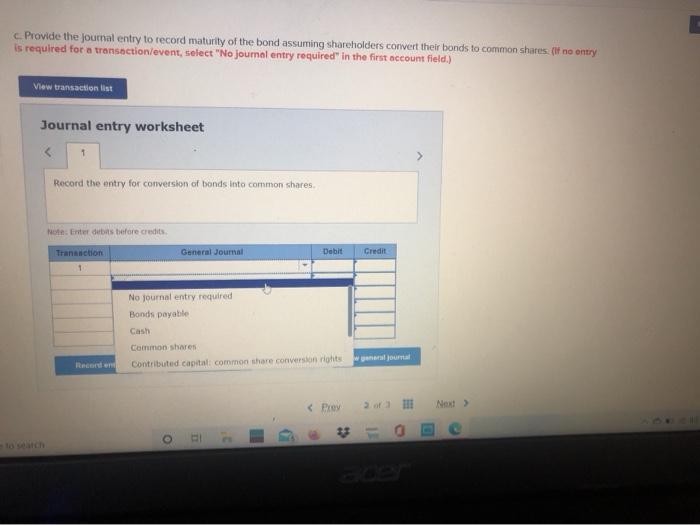

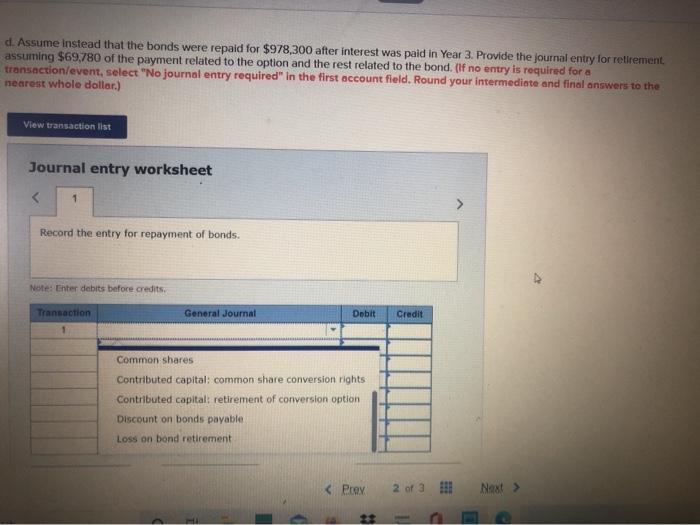

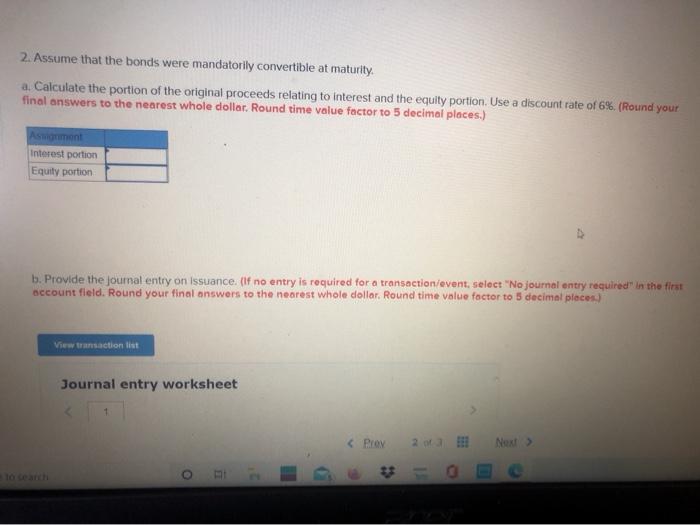

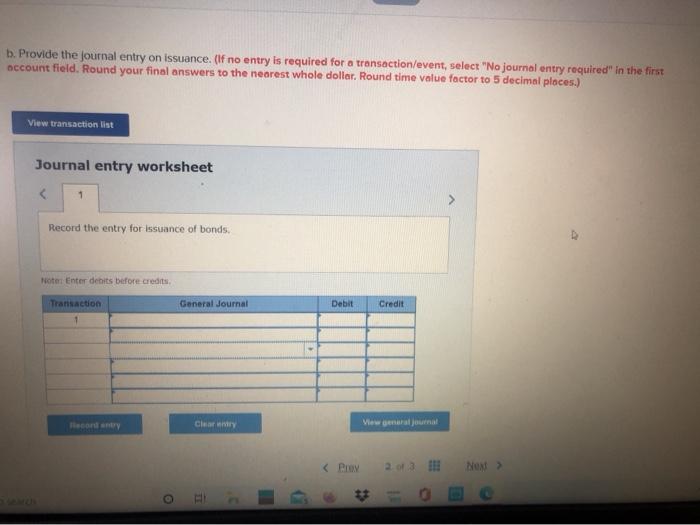

AMC Limited issued five year, 5% bonds for their par value of $940,000 on 1 January 20X1. Interest is paid annually. The bonds are convertible to common shares at a rate of 50 common shares for every $1.000 bond. PVS1 PVA $1. and PVAD. of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Assume that the bonds were convertible at the investor's option and that the conversion option was valued at $71,080 a. Provide the journal entry on issuance of no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 9 Record the entry for Issuance of bonds Hotel Erter debits before credits Transaction General Journal Debit Credit o . Record entry Clear entry View general journal b. Calculate interest expense for each year of the bond's five year life. Use an interest rate of 7% for this requirement. (Round your Intermediate calculations and final answers to the nearest whole dollar) Ansignment Beginning balance Interest 27% Payment Ending Balance 1 2 5 & Prov Nox c. Provide the Joumal entry to record maturity of the bond assuming shareholders convert their bonds to common shares. (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field) View transaction ist Journal entry worksheet 1 Record the entry for conversion of bonds into common shares Not: Enter derbas before cred Transaction General Journal Debit Credit 1 No journal entry required Bonds payable Cash Common shares Contributed capital common share conversion rights ar journal Reconden & Prov Nerd O d. Assume Instead that the bonds were repaid for $978,300 after interest was paid in Year 3. Provide the journal entry for retirement assuming $69,780 of the payment related to the option and the rest related to the bond. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 2. Assume that the bonds were mandatorily convertible at maturity. a. Calculate the portion of the original proceeds relating to interest and the equity portion. Use a discount rate of 6%. (Round your final answers to the nearest whole dollar. Round time value factor to 5 decimal places.) Interest portion Equity portion b. Provide the journal entry on Issuance. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your final answers to the nearest whole dollar. Round time value factor to 5 decimal places) View transaction list Journal entry worksheet 1 C Prov 2013 Next > b. Provide the journal entry on issuance. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar. Round time value factor to 5 decimal places.) View transaction list Journal entry worksheet 1 Record the entry for Issuance of bonds. Note Enter debits before credits Transaction General Journal Debit Credit View general Journal Nont> Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started