Answered step by step

Verified Expert Solution

Question

1 Approved Answer

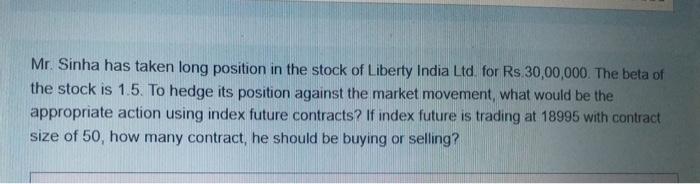

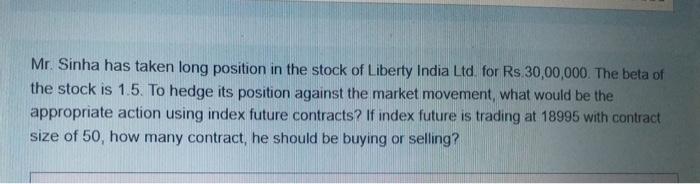

Please give answer in 5 minutes Mr. Sinha has taken long position in the stock of Liberty India Ltd for Rs 30,00,000. The beta of

Please give answer in 5 minutes

Mr. Sinha has taken long position in the stock of Liberty India Ltd for Rs 30,00,000. The beta of the stock is 1.5. To hedge its position against the market movement, what would be the appropriate action using index future contracts? If index future is trading at 18995 with contract size of 50, how many contract, he should be buying or selling

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started