Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give detailed answers for all 4 sub questions! The country P had a Current Account Deficit of $1 billion and a Non-Reserve Financial Account

Please give detailed answers for all 4 sub questions!

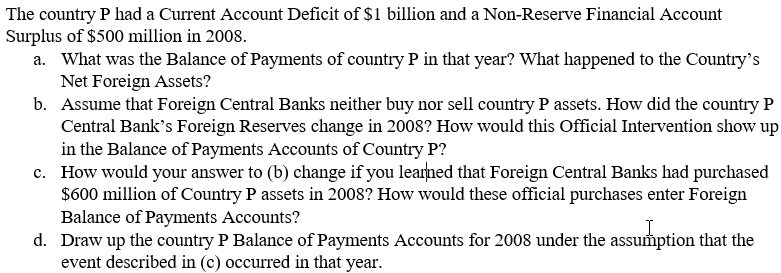

The country P had a Current Account Deficit of $1 billion and a Non-Reserve Financial Account Surplus of $500 million in 2008. a. What was the Balance of Payments of country P in that year? What happened to the Country's Net Foreign Assets? b. Assume that Foreign Central Banks neither buy nor sell country P assets. How did the country P Central Bank's Foreign Reserves change in 2008? How would this Official Intervention show up in the Balance of Payments Accounts of Country P? c. How would your answer to (b) change if you learned that Foreign Central Banks had purchased $600 million of Country P assets in 2008? How would these official purchases enter Foreign Balance of Payments Accounts? d. Draw up the country P Balance of Payments Accounts for 2008 under the assumption that the event described in (c) occurred in that year. The country P had a Current Account Deficit of $1 billion and a Non-Reserve Financial Account Surplus of $500 million in 2008. a. What was the Balance of Payments of country P in that year? What happened to the Country's Net Foreign Assets? b. Assume that Foreign Central Banks neither buy nor sell country P assets. How did the country P Central Bank's Foreign Reserves change in 2008? How would this Official Intervention show up in the Balance of Payments Accounts of Country P? c. How would your answer to (b) change if you learned that Foreign Central Banks had purchased $600 million of Country P assets in 2008? How would these official purchases enter Foreign Balance of Payments Accounts? d. Draw up the country P Balance of Payments Accounts for 2008 under the assumption that the event described in (c) occurred in that yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started