Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give detailed process Engineering Economics and Ethics 16. Yong Games is investing on a new video equipment for $9 million, with $4 million borrowed

Please give detailed process

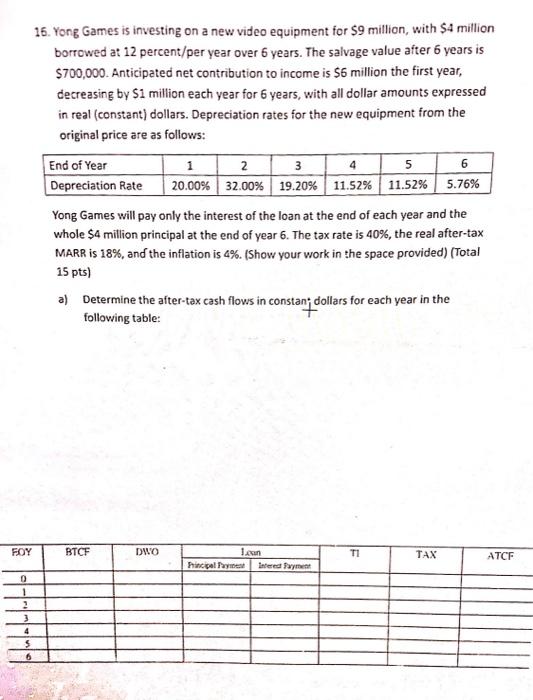

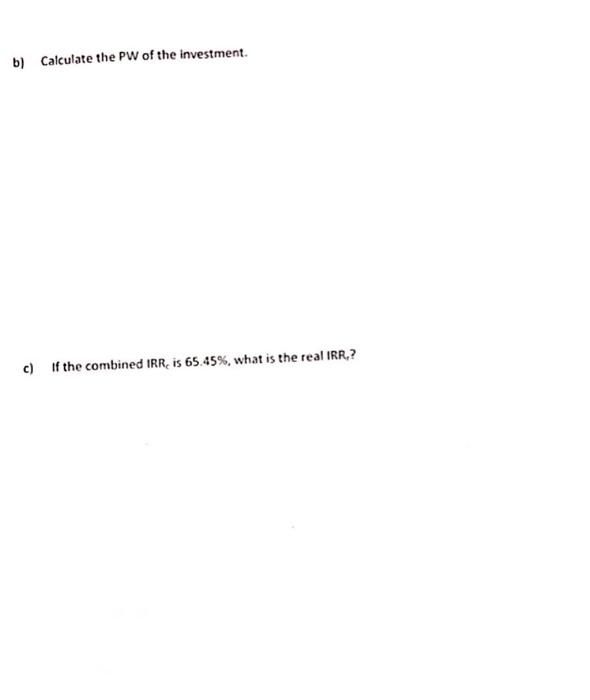

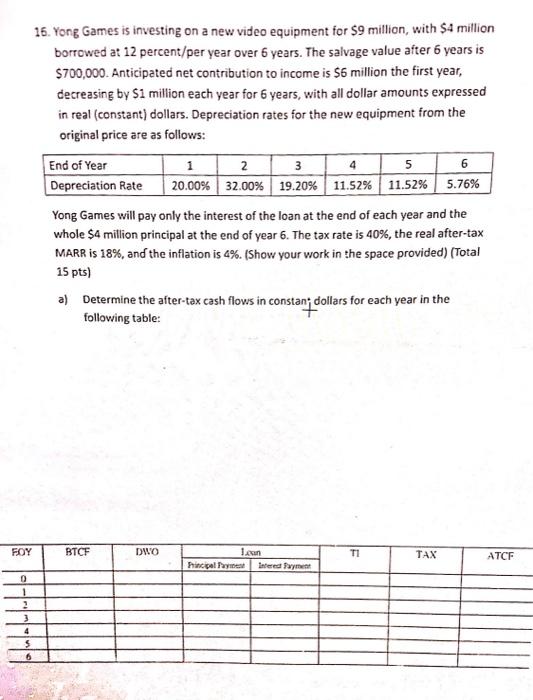

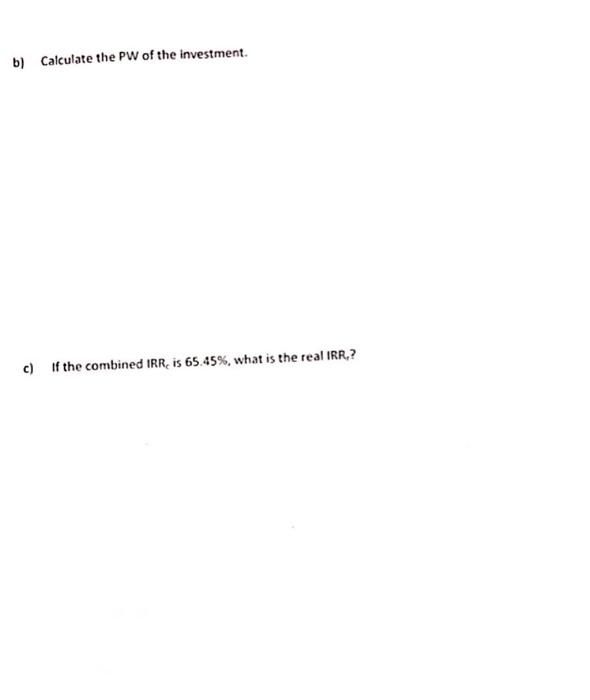

16. Yong Games is investing on a new video equipment for $9 million, with $4 million borrowed at 12 percent/per year over 6 years. The salvage value after 6 years is $700,000. Anticipated net contribution to income is $6 million the first year, decreasing by $1 million each year for 6 years, with all dollar amounts expressed in real (constant) dollars. Depreciation rates for the new equipment from the original price are as follows: End of Year 1 2 3 4 5 6 Depreciation Rate 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% Yong Games will pay only the interest of the loan at the end of each year and the whole $4 million principal at the end of year 6. The tax rate is 40%, the real after-tax MARR is 18%, and the inflation is 4%. (Show your work in the space provided) (Total 15 pts) a) Determine the after-tax cash flows in constan; dollars for each year in the following table: FOY BTCF DWO TI 1 x hincipale Interey TAX ATCF O 1 2 3 4 $ 6 b) Calculate the PW of the investment. c) If the combined IRR, is 65.45%, what is the real IRR Engineering Economics and Ethics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started