Please give explaination and answer them all (A-F). Thank you!!

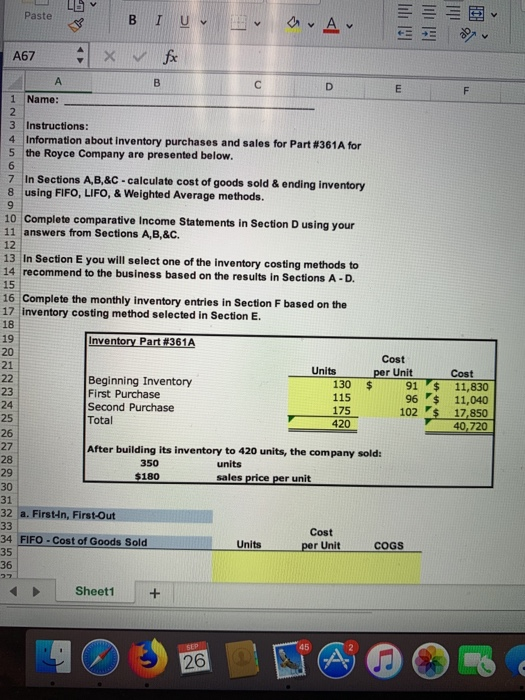

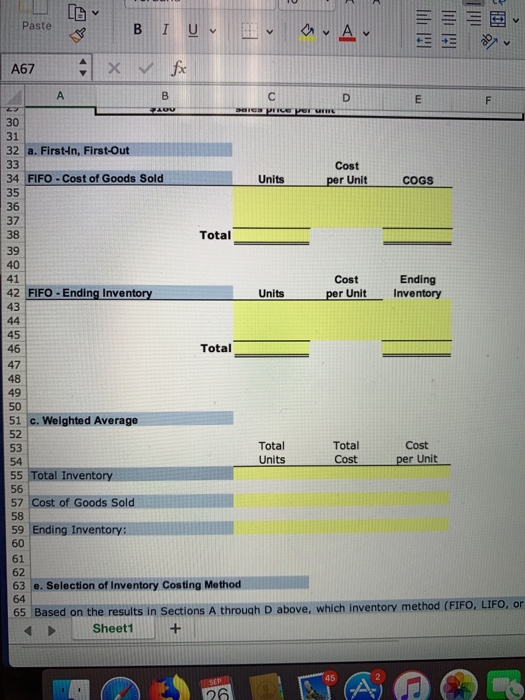

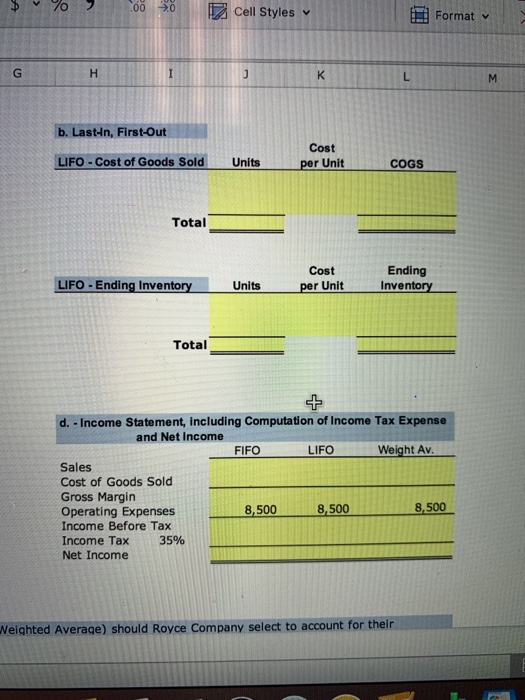

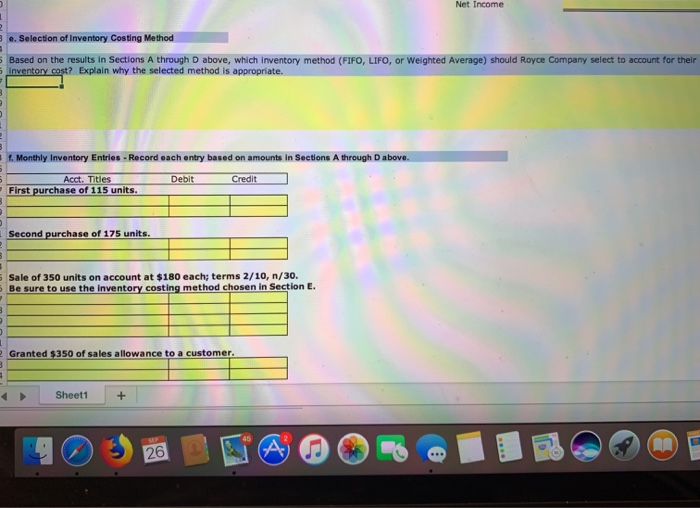

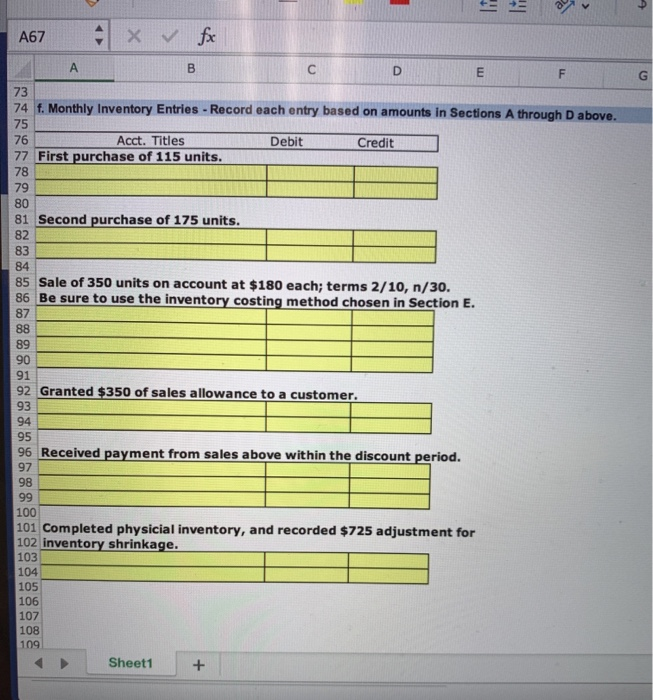

Paste BIU E B A A67 XV fx 1 Name: 3 Instructions: 4 Information about inventory purchases and sales for Part #361A for 5 the Royce Company are presented below. 7 In Sections A,B,&C - calculate cost of goods sold & ending inventory 8 using FIFO, LIFO, & Weighted Average methods. 10 Complete comparative Income Statements in Section D using your 11 answers from Sections A,B,&C. 12 13 In Section E you will select one of the inventory costing methods to 14 recommend to the business based on the results in Sections A-D. 15 16 Complete the monthly Inventory entries in Section F based on the 17 Inventory costing method selected in Section E. Inventory Part #361A Units 130 Beginning Inventory First Purchase Second Purchase Total Cost per Unit 91 96 102 $ Cost 11,830 11,040 17,850 40,720 After building its inventory to 420 units, the company sold: 350 units $180 sales price per unit 32 a. First-In, First-Out 33 34 FIFO - Cost of Goods Sold Units Cost per UnitCOGS 35 36 Sheet1 + Paste v BIU A A67 x fe BATES PRICE WE WIE 32 a. First-n, First-Out 34 FIFO - Cost of Goods Sold Units Cost per Unit COGS Total FIFO - Ending Inventory Cost per Unit Ending Inventory Units Total de c. Weighted Average Total Units Total Cost Cost per Unit 55 Total Inventory Cost of Goods Sold Ending Inventory: 63 e. Selection of Inventory Costing Method 65 Based on the results in Sections A through D above, which inventory method (FIFO, LIFO, or Sheet1 $ % 1 00 % Cell Styles L! Format b. Last-In, First-Out Cost LIFO - Cost of Goods Sold Units COGS Total LIFO - Ending Inventory Units Cost per Unit Ending Inventory Total d. - Income Statement, including Computation of Income Tax Expense and Net Income FIFO LIFO Weight Av. Sales Cost of Goods Sold Gross Margin Operating Expenses 8,500 8,500 8,500 Income Before Tax Income Tax 35% Net Income Weighted Average) should Royce Company select to account for their Net Income Be. Selection of Inventory Costing Method 5 Based on the results in Sections A through D above, which inventory method (FIFO, LIFO, or Weighted Average) should Royce Company select to account for their s inventory cost? Explain why the selected method is appropriate. Monthly Inventory Entries - Record each entry based on amounts in Sections A through D above. Acct. Titles First purchase of 115 units. Debit Credit Second purchase of 175 units. Sale of 350 units on account at $180 each; terms 2/10, n/30. Be sure to use the inventory costing method chosen in Section E. Granted $350 of sales allowance to a customer. Sheet1 + A67 x fx 74 f. Monthly Inventory Entries - Record each entry based on amounts in Sections A through D above. Debit Credit Acct. Titles 77 First purchase of 115 units. Second purchase of 175 units. Sale of 350 units on account at $180 each; terms 2/10, n/30. Be sure to use the inventory costing method chosen in Section E. Granted $350 of sales allowance to a customer. Received payment from sales above within the discount period. Completed physicial inventory, and recorded $725 adjustment for inventory shrinkage. Sheet1