Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give full explanation on how the answer are got in simple way The following data were selected from the records of Tunga Company for

please give full explanation on how the answer are got in simple way

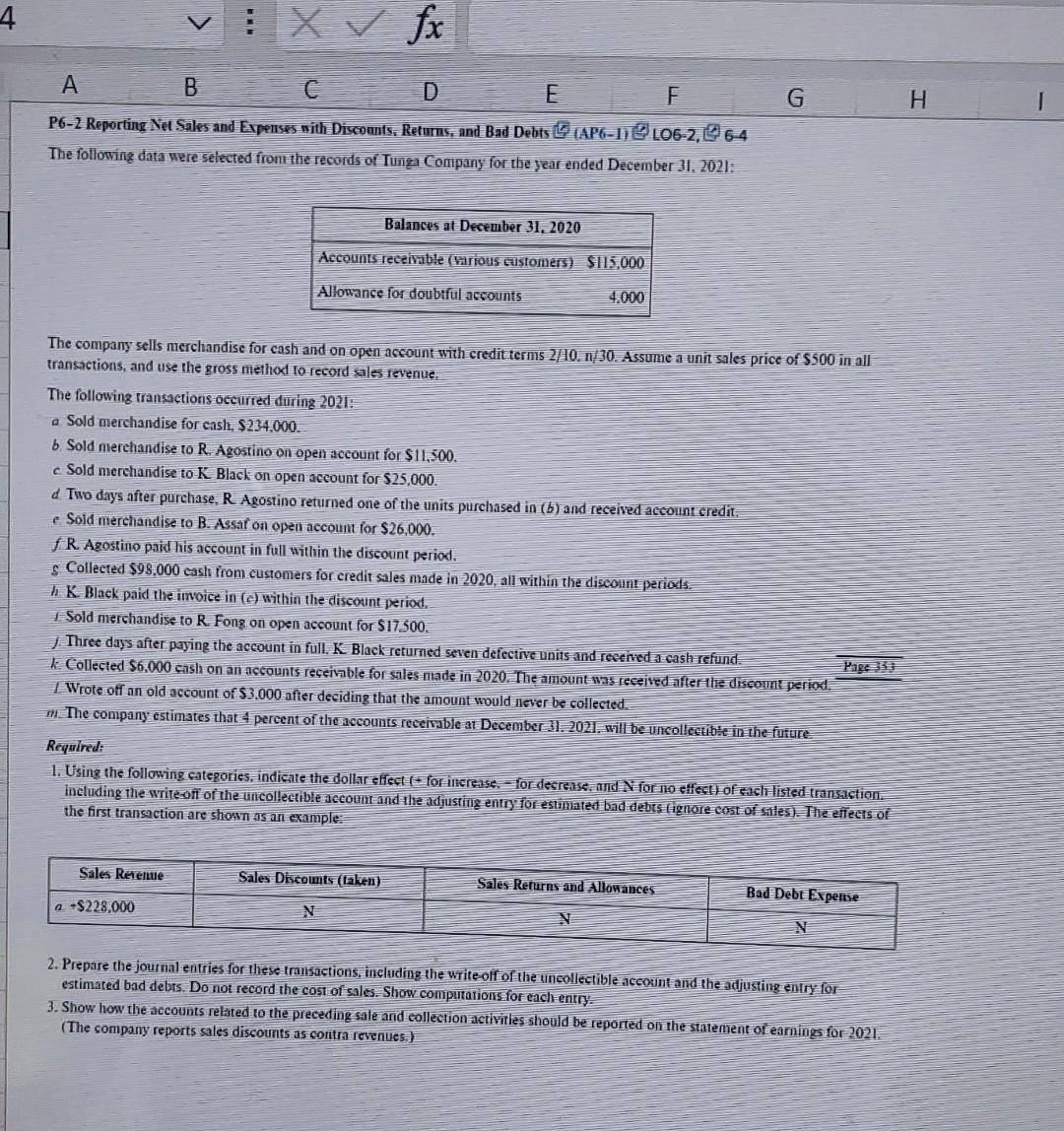

The following data were selected from the records of Tunga Company for the year ended December 31. 2021: The company sells merchandise for cash and on open account with credit terms 2/10. n/30. Assume a thit sales price of $500 in all transactions, and use the gross miethox to record sales revenue. The following transactions oceurred diring 2021: a Sold merchandise for cash, $234,000. b. Sold merchandise to R. Agostino on open account for $11,500. c. Sold merehandise to K. Black on open account for $25,000. d Two days after purchase, R Agostino returned one of the units purchased in (b) and received aceolnt credit: e Sold merchandise to B. Assaf on open account for $26,000. fR. Azostino paid his account in full within the discount period. S. Collected $98,000 castr from customers for credit sales made in 2020 , all within the discount perieats. hK Black paid the imoice in (c) within the discount period. I. Sold merchandise to R. Fong on opell account for $17.500. 1. Three days after paying the account in full. K. Black returned seven defective units and received a cash refund. Wrote Pare 333 including the write-off of the uncollectible accoumt and hle adjusting entry for estinlated bad debis (ignore cost of siles). The effects of the first transaction are shown as an example: 2. Prepare the journal entries for these transactions, incliding the write-off of the uneollectible account and the adjusting enlry for estimated bad debis. Do not record the cost of sales. Show computations for each entry: 3. Show how the accounts related to the preceding sale and eollection activities should be reported on the statement of earnings for 2021. (The sompany reports sales discounts as contra revenues)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started