Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give it's proper complete ans I will thumb you up 8. For $100 US government bond let the interest rate be 11% (so price

please give it's proper complete ans I will thumb you up

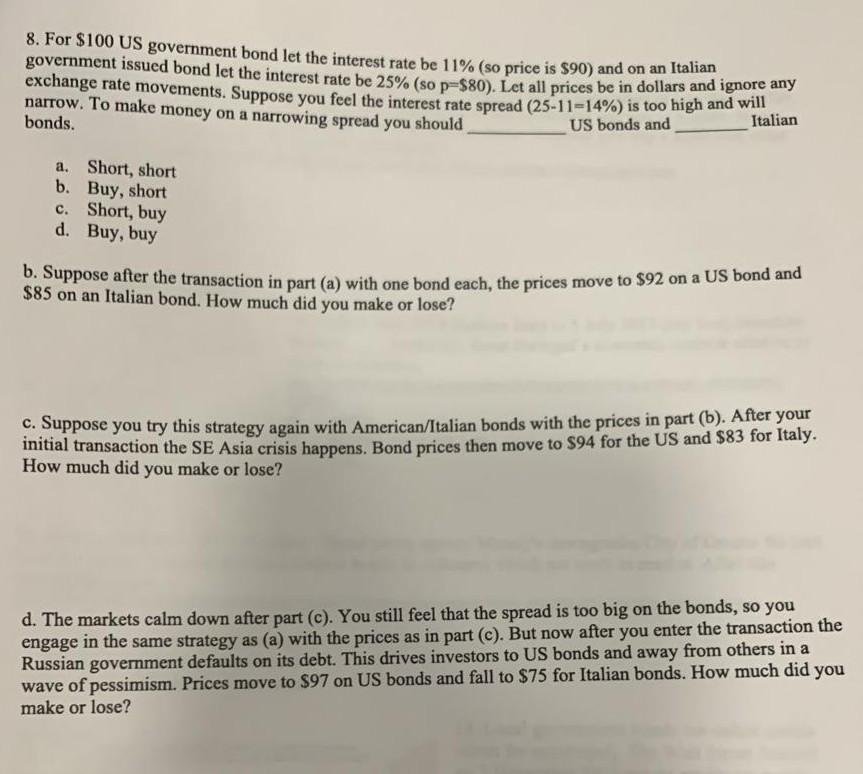

8. For $100 US government bond let the interest rate be 11% (so price is $90) and on an Italian government issued bond let the interest rate be 25% (so p-$80). Let all prices be in dollars and ignore any exchange rate movements. Suppose you feel the interest rate spread (25-11-14%) is too high and wit narrow. To make money on a narrowing spread you should Italian US bonds and bonds. a. Short, short b. Buy, short c. Short, buy d. Buy, buy b. Suppose after the transaction in part (a) with one bond each, the prices move to $92 on a US bond and $85 on an Italian bond. How much did you make or lose? c. Suppose you try this strategy again with American/Italian bonds with the prices in part (b). After your initial transaction the SE Asia crisis happens. Bond prices then move to $94 for the US and $83 for Italy. How much did you make or lose? d. The markets calm down after part (c). You still feel that the spread is too big on the bonds, so you engage in the same strategy as (a) with the prices as in part (c). But now after you enter the transaction the Russian government defaults on its debt. This drives investors to US bonds and away from others in a wave of pessimism. Prices move to $97 on US bonds and fall to $75 for Italian bonds. How much did you make or loseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started