Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give me a answer this questition as soon as posible. Following are transactions of The Bamett Company: 2023 Des- 16 Accepted a $22, eog,

please give me a answer this questition as soon as posible.

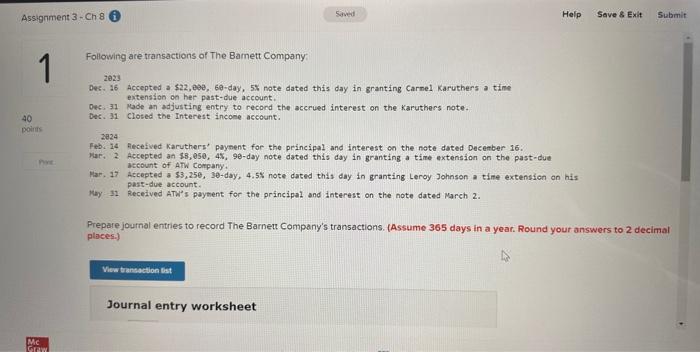

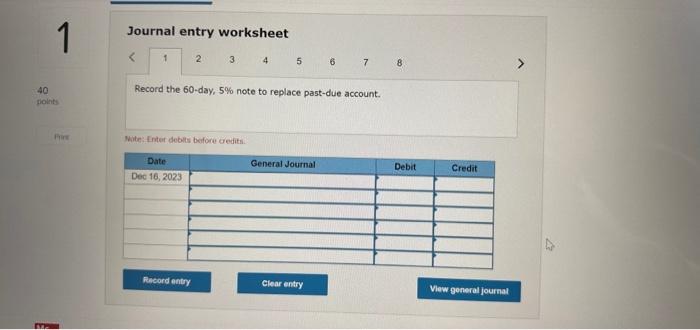

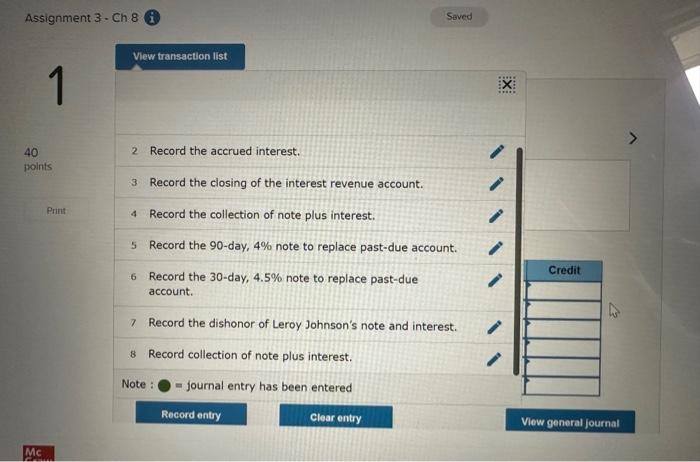

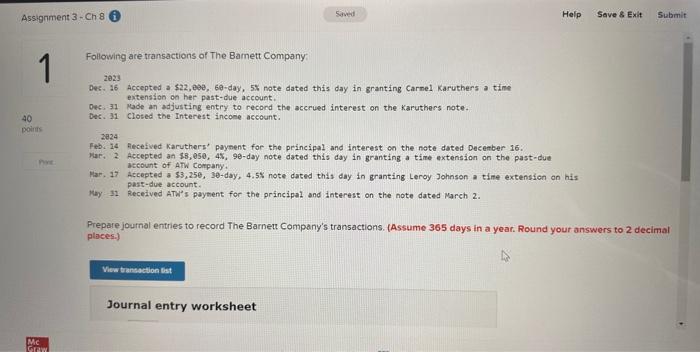

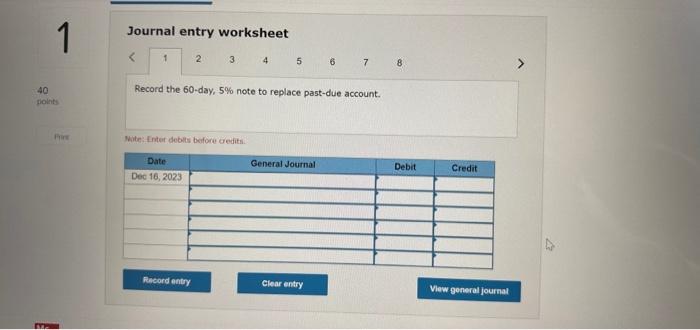

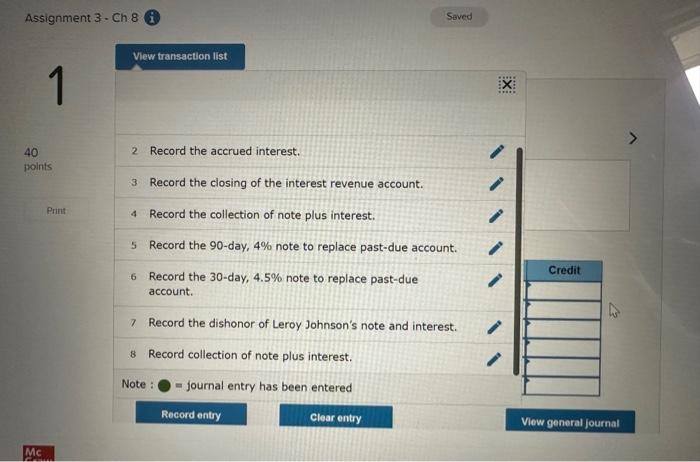

Following are transactions of The Bamett Company: 2023 Des- 16 Accepted a $22, eog, 60 -day, 5% note dated this day in granting Carnel Karuthers a time extension on her past-due account. 0ec: 31 Kade an adjusting entry to record the accrued interest on the Karuthers note. Dec. 31 Closed the Interest incoee account. 2824 Feb. 24 Aecefved Karuthers' paynent for the principal and interest on the note dated Decenber 16 : Mar, 2 Accepted an $8,050,45,90-day note dated this day in granting a time extension on the past-due account of ATW Company. Mar. 17 Accepted a $3,256,30-day, 4.5$ note dated this day in granting Leroy Johnson a time extension on his Khy: 32 Rast-due account. Prepare journal entries to record The Barneu Company's transactions. (Assume 365 days in a year. Round your answers to 2 decin places.) Journal entry worksheet 34567 Record the 60 -day, 5% note to replace past-due account. Nite: Inter deblts before credits. 2 Record the accrued interest. 3 Record the closing of the interest revenue account. 4 Record the collection of note plus interest. 5 Record the 90 -day, 4% note to replace past-due account. 6 Record the 30-day, 4.5% note to replace past-due account. 7 Record the dishonor of Leroy Johnson's note and interest. 8 Record collection of note plus interest. Note : O= journal entry has been entered

Following are transactions of The Bamett Company: 2023 Des- 16 Accepted a $22, eog, 60 -day, 5% note dated this day in granting Carnel Karuthers a time extension on her past-due account. 0ec: 31 Kade an adjusting entry to record the accrued interest on the Karuthers note. Dec. 31 Closed the Interest incoee account. 2824 Feb. 24 Aecefved Karuthers' paynent for the principal and interest on the note dated Decenber 16 : Mar, 2 Accepted an $8,050,45,90-day note dated this day in granting a time extension on the past-due account of ATW Company. Mar. 17 Accepted a $3,256,30-day, 4.5$ note dated this day in granting Leroy Johnson a time extension on his Khy: 32 Rast-due account. Prepare journal entries to record The Barneu Company's transactions. (Assume 365 days in a year. Round your answers to 2 decin places.) Journal entry worksheet 34567 Record the 60 -day, 5% note to replace past-due account. Nite: Inter deblts before credits. 2 Record the accrued interest. 3 Record the closing of the interest revenue account. 4 Record the collection of note plus interest. 5 Record the 90 -day, 4% note to replace past-due account. 6 Record the 30-day, 4.5% note to replace past-due account. 7 Record the dishonor of Leroy Johnson's note and interest. 8 Record collection of note plus interest. Note : O= journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started