Answered step by step

Verified Expert Solution

Question

1 Approved Answer

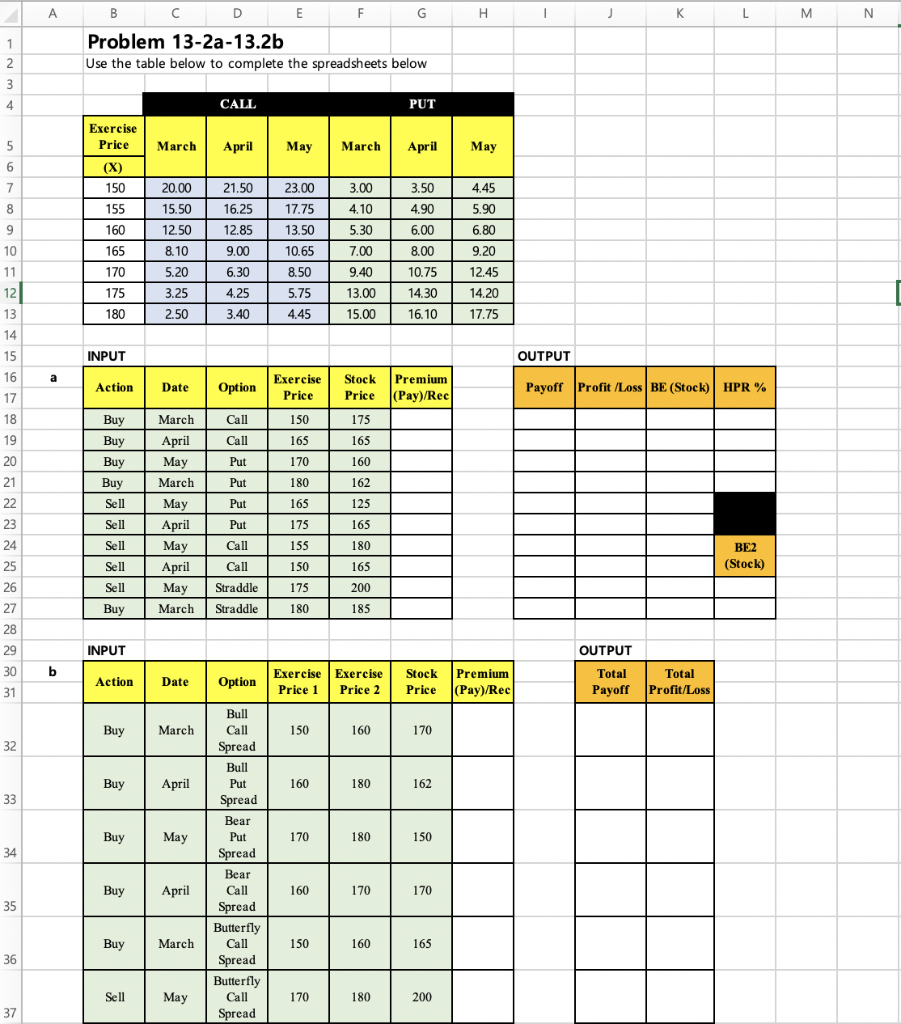

please give me answer and work. A H 1 J K L M N 1 2 3 B C D E F G Problem 13-2a-13.2b

please give me answer and work.

A H 1 J K L M N 1 2 3 B C D E F G Problem 13-2a-13.2b Use the table below to complete the spreadsheets below 4 CALL PUT Exercise Price (X) March April May March April 5 6 May 7 20.00 21.50 150 155 3.00 4.10 8 4.45 5.90 6.80 9 160 5.30 7.00 10 3.50 4.90 6.00 8.00 10.75 15.50 12.50 8.10 5.20 3.25 2.50 165 170 175 180 23.00 17.75 13.50 10.65 8.50 5.75 4.45 16.25 12.85 9.00 6.30 4.25 3.40 9.40 13.00 15.00 9.20 12.45 14.20 17.75 14.30 16.10 INPUT OUTPUT a Action Date Option Exercise Price Stock Price Premium (Pay)/Rec Payoff Profit /Loss BE (Stock)| HPR % 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Call 150 175 March April May Call 165 Buy Buy Buy Buy Sell 165 Put 170 March Put 180 160 162 125 Put 165 Sell Put 175 Sell Call 155 May April May April May March 165 180 165 BE2 (Stock) Sell Call 150 Straddle 175 200 26 27 Sell Buy Straddle 180 185 28 29 INPUT 30 b Action Date Exercise Exercise Price 1 Price 2 OUTPUT Total Total Payoff Profit/Loss Option Stock Price Premium (Pay)/Rec 31 Buy March 150 160 170 32 Bull Call Spread Bull Put Spread Buy April 160 180 162 33 Buy May 170 180 150 34 Buy April 160 170 170 35 Bear Put Spread Bear Call Spread Butterfly Call Spread Butterfly Call Spread Buy March 150 160 165 36 Sell May 170 180 200 37 A H 1 J K L M N 1 2 3 B C D E F G Problem 13-2a-13.2b Use the table below to complete the spreadsheets below 4 CALL PUT Exercise Price (X) March April May March April 5 6 May 7 20.00 21.50 150 155 3.00 4.10 8 4.45 5.90 6.80 9 160 5.30 7.00 10 3.50 4.90 6.00 8.00 10.75 15.50 12.50 8.10 5.20 3.25 2.50 165 170 175 180 23.00 17.75 13.50 10.65 8.50 5.75 4.45 16.25 12.85 9.00 6.30 4.25 3.40 9.40 13.00 15.00 9.20 12.45 14.20 17.75 14.30 16.10 INPUT OUTPUT a Action Date Option Exercise Price Stock Price Premium (Pay)/Rec Payoff Profit /Loss BE (Stock)| HPR % 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Call 150 175 March April May Call 165 Buy Buy Buy Buy Sell 165 Put 170 March Put 180 160 162 125 Put 165 Sell Put 175 Sell Call 155 May April May April May March 165 180 165 BE2 (Stock) Sell Call 150 Straddle 175 200 26 27 Sell Buy Straddle 180 185 28 29 INPUT 30 b Action Date Exercise Exercise Price 1 Price 2 OUTPUT Total Total Payoff Profit/Loss Option Stock Price Premium (Pay)/Rec 31 Buy March 150 160 170 32 Bull Call Spread Bull Put Spread Buy April 160 180 162 33 Buy May 170 180 150 34 Buy April 160 170 170 35 Bear Put Spread Bear Call Spread Butterfly Call Spread Butterfly Call Spread Buy March 150 160 165 36 Sell May 170 180 200 37Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started