Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give me not only answers but explanation as well. Ace Company's income statements for the three years 2012, 2011, and 2010 are given below

Please give me not only answers but explanation as well.

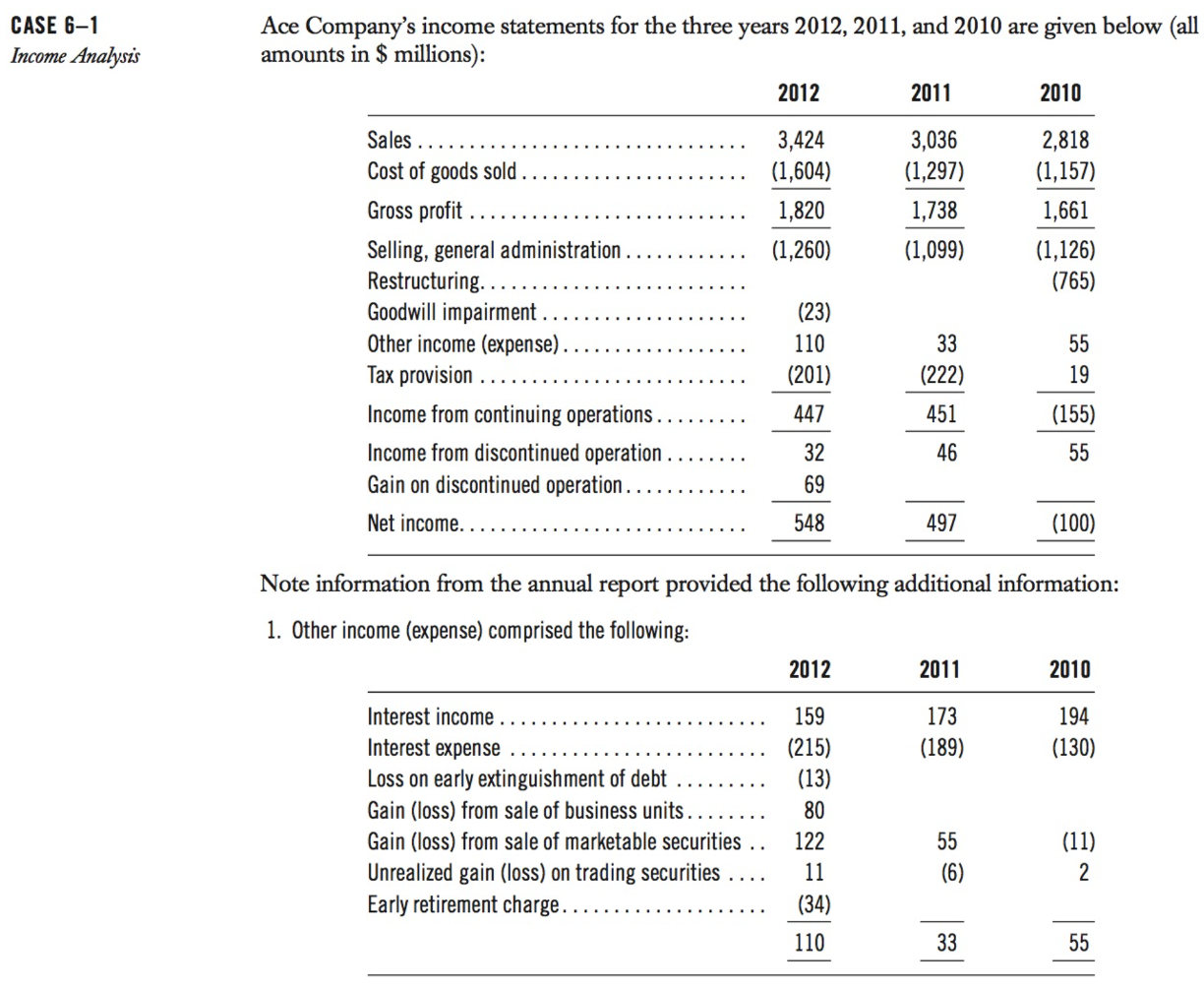

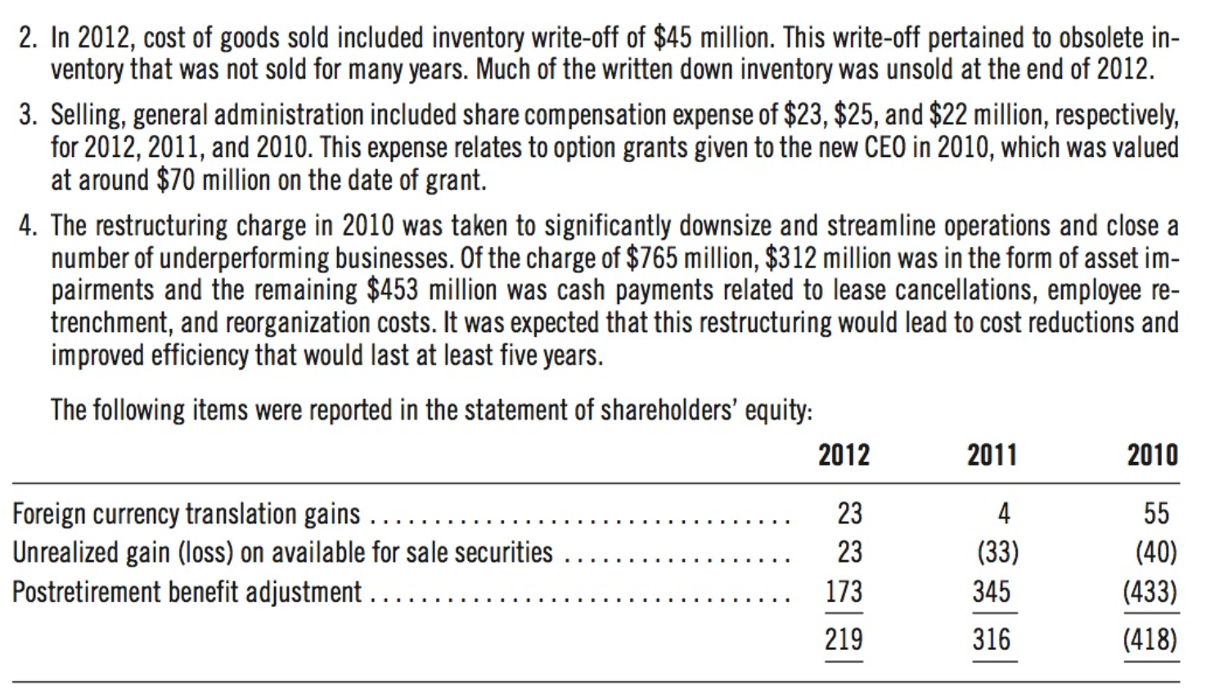

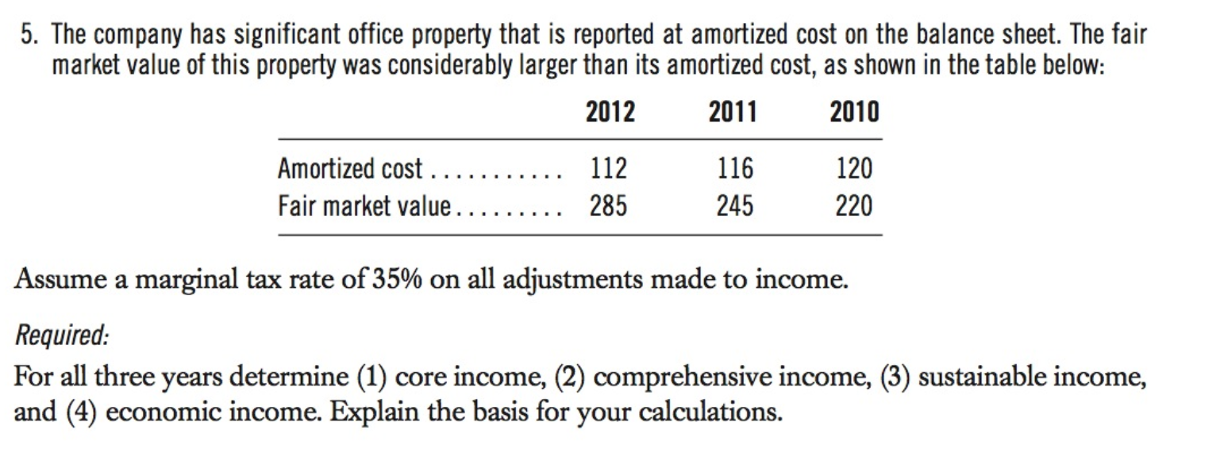

Ace Company's income statements for the three years 2012, 2011, and 2010 are given below (al amounts in \$ millions): Note information from the annual report provided the following additional information: 1. Other income (expense) comprised the following: 5. The company has significant office property that is reported at amortized cost on the balance sheet. The fair market value of this property was considerably larger than its amortized cost, as shown in the table below: Assume a marginal tax rate of 35% on all adjustments made to income. Required: For all three years determine (1) core income, (2) comprehensive income, (3) sustainable income, and (4) economic income. Explain the basis for your calculations. 2. In 2012 , cost of goods sold included inventory write-off of $45 million. This write-off pertained to obsolete inventory that was not sold for many years. Much of the written down inventory was unsold at the end of 2012. 3. Selling, general administration included share compensation expense of $23,$25, and $22 million, respectively, for 2012, 2011, and 2010. This expense relates to option grants given to the new CEO in 2010, which was valued at around $70 million on the date of grant. 4. The restructuring charge in 2010 was taken to significantly downsize and streamline operations and close a number of underperforming businesses. Of the charge of $765 million, $312 million was in the form of asset impairments and the remaining $453 million was cash payments related to lease cancellations, employee retrenchment, and reorganization costs. It was expected that this restructuring would lead to cost reductions and improved efficiency that would last at least five years. The following items were reported in the statement of shareholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started