Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give me the answer of this question... I need it today. It's urgent. 4. The follow information given on 31 December 2016 in the

Please give me the answer of this question... I need it today. It's urgent.

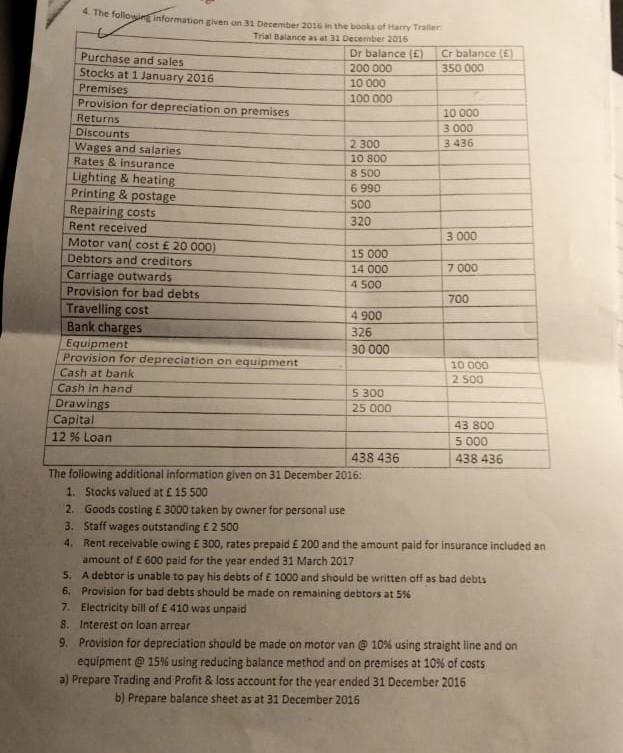

4. The follow information given on 31 December 2016 in the banks of Harry Traller Trial Balance as at 31 December 2015 Dr balance (E) Cr balance Purchase and sales 200 000 350 000 Stocks at 1 January 2016 10 000 Premises 100 000 Provision for depreciation on premises 10 000 Returns 3000 Discounts 2 300 3 436 Wages and salaries 10 800 Rates & insurance 8 500 Lighting & heating 6 990 Printing & postage 500 Repairing costs 320 Rent received 3 000 Motor van cost 20 000) 15 000 Debtors and creditors 14 000 7 000 Carriage outwards 4 500 Provision for bad debts 700 Travelling cost 4 900 Bank charges 326 Equipment 30 000 Provision for depreciation on equipment 10 000 Cash at bank 2 500 Cash in hand 5 300 Drawings 25 000 Capital 43 800 12 96 Loan 5 000 438 436 438 436 The following additional information given on 31 December 2016: 1. Stocks valued at 15 500 2. Goods costing 3000 taken by owner for personal use 3. Staff wages outstanding 2 500 4. Rent receivable owing E300, rates prepaid 200 and the amount paid for insurance included an amount of 600 paid for the year ended 31 March 2017 5. A debtor is unable to pay his debts of 1000 and should be written off as bad debts 6. Provision for bad debts should be made on remaining debtors at 596 7. Electricity bill of 410 was unpaid 8. Interest on loan arrear 9. Provision for depreciation should be made on motor van @ 10% using straight line and on equipment @ 15% using reducing balance method and on premises at 10% of costs a) Prepare Trading and Profit & loss account for the year ended 31 December 2016 b) Prepare balance sheet as at 31 December 2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started