please give me the financial statement analysis report of PHU NHUAN GOLD SILVER JOINT STOCK COMPANY ( PNJ ) from 2019-2021. thanks so much !

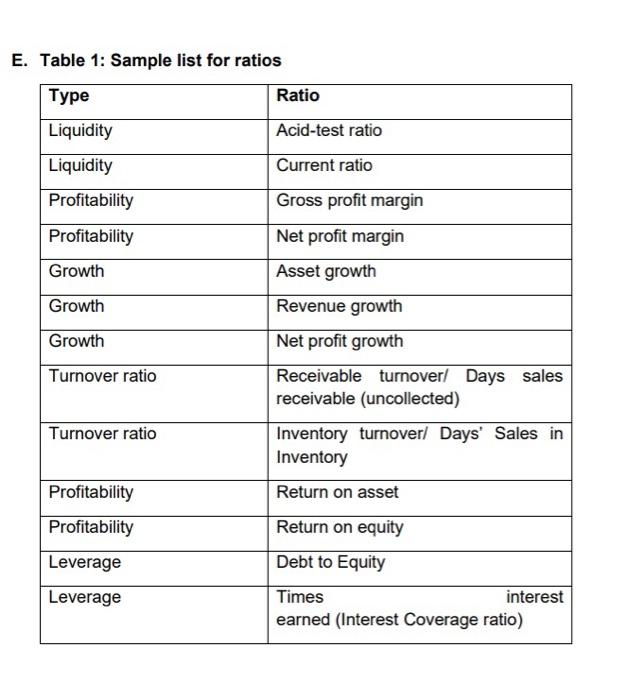

Individual Assignment Guideline DUE DATE 10/08/2022, 5pm A. Assessment Questions Assumed that you are a credit analyst in ANX Bank, your daily job is to evaluate financial soundness of clients applying for credit from the bank and provide the credit evaluation reports to Head of Credit Approval. Your job is to "pick up a company in the stock market at home or abroad, analyze the financial statement of that company and give advice to relevant stakeholders in 3 years 2019-2021'". In order to provide a comprehensive analysis report, you must undertake the following action: a. Consolidate the list of financial ratios necessary for your analysis. Examples of ratios according to each group are in Table 1. Additional research for more ratios beside scope of class are strongly encouraged with added marks. b. Briefly explain the formula and meanings of ratio groups to report users c. Compute the relative annual ratios of the company chosen in 3 years 2019-2021 d. Analyze, outline performance revealed in the ratios e. Identify any operating problems revealed in the fluctuation of ratios. f. Recommend the solutions that the client company should do to overcome the problems to then be qualified for the credit amount. E. Individual Assignment Guideline DUE DATE 10/08/2022, 5pm A. Assessment Questions Assumed that you are a credit analyst in ANX Bank, your daily job is to evaluate financial soundness of clients applying for credit from the bank and provide the credit evaluation reports to Head of Credit Approval. Your job is to "pick up a company in the stock market at home or abroad, analyze the financial statement of that company and give advice to relevant stakeholders in 3 years 2019-2021'". In order to provide a comprehensive analysis report, you must undertake the following action: a. Consolidate the list of financial ratios necessary for your analysis. Examples of ratios according to each group are in Table 1. Additional research for more ratios beside scope of class are strongly encouraged with added marks. b. Briefly explain the formula and meanings of ratio groups to report users c. Compute the relative annual ratios of the company chosen in 3 years 2019-2021 d. Analyze, outline performance revealed in the ratios e. Identify any operating problems revealed in the fluctuation of ratios. f. Recommend the solutions that the client company should do to overcome the problems to then be qualified for the credit amount. E