please give me the right answer for this asap. thank you!!!

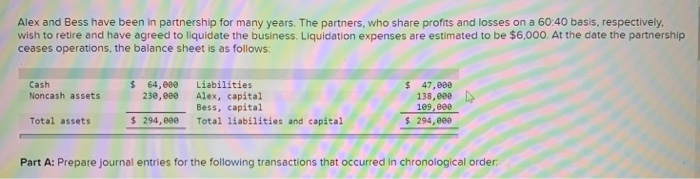

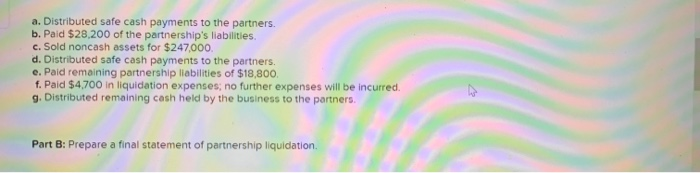

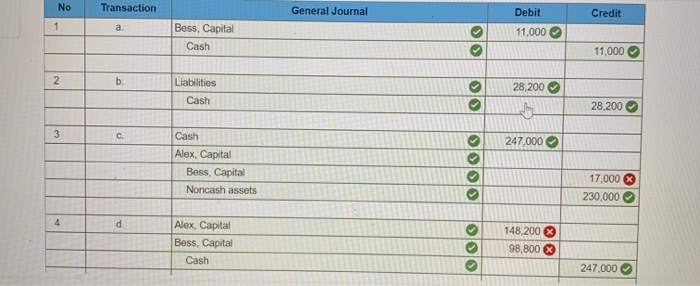

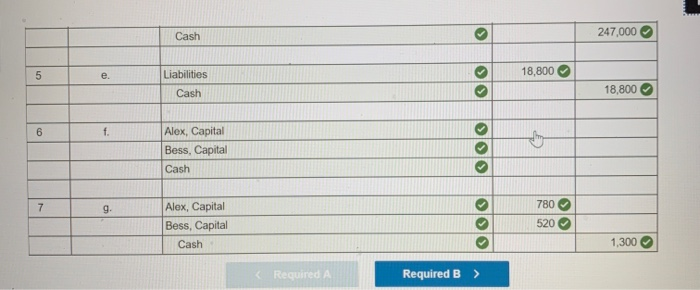

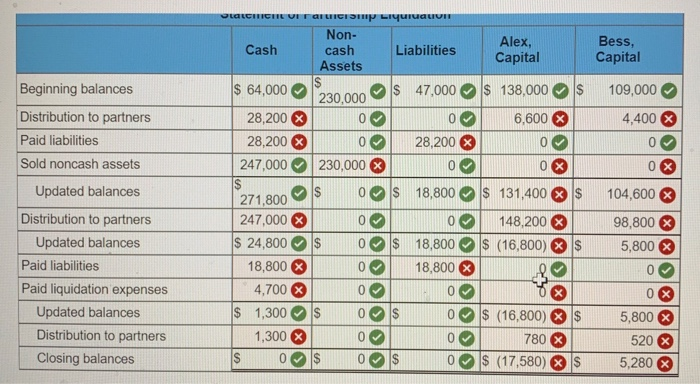

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 60:40 basis, respectively. wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,000. At the date the partnership ceases operations, the balance sheet is as follows: Cash Noncash assets $ 64,000 23e, eee Liabilities Alex, capital Bess, capital Total liabilities and capital $ 47,000 138,000 109,000 $ 294, eee Total assets $ 294, eee Part A: Prepare journal entries for the following transactions that occurred in chronological order. a. Distributed safe cash payments to the partners. b. Paid $28,200 of the partnership's liabilities c. Sold noncash assets for $247,000. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $18,800. f. Paid $4.700 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final statement of partnership liquidation No Transaction General Journal Credit 1 a. Bess, Capital Cash Debit 11,000 11,000 2 b. Liabilities Cash 28,200 00 28,200 3 C 247,000 Cash Alex, Capital Bess, Capital Noncash assets OOOO 17,000 230.000 4 d Alex, Capital Bess, Capital Cash oo 148.2008 98,800 247.000 > Cash 247,000 0 5 e. 18,800 Liabilities Cash 18,800 6 f. Alex, Capital Bess, Capital Cash 7 780 9 Alex, Capital Bess, Capital Cash 520 BIO 1,300 Required A Required B > QUALCHICIILUFFALICISIR Liquruaui Non- Cash cash Liabilities Assets Alex, Capital Bess, Capital $ 64,000 $ 47,000 $ 138,000 $ 109,000 230,000 0 0 6,600 X 4,400 X 28,200 X 28,200 X 247,000 28,200 X 0 0 0 230,000 X 0 0 x $ $ 18,800 104,600 X Beginning balances Distribution to partners Paid liabilities Sold noncash assets Updated balances Distribution to partners Updated balances Paid liabilities Paid liquidation expenses Updated balances Distribution to partners Closing balances 0% $ 131,400 X $ 148,200 $ (16,800) $ 98,800 X 5,800 $ 0 $ 18,800 18,800 X 0 0 271,800 247,000 $ 24,800 18,800 4,700 $ 1,300 1,300 S 0 0 $ 0 S Oo 0 $ (16,800) $ 780 X $ (17,580) XS 5,800 520 5,280 0