Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give right method of calculations and explain every steps if possible. Klausenheimer Inc. just issued a $80 million bond. The bond has a coupon

Please give right method of calculations and explain every steps if possible.

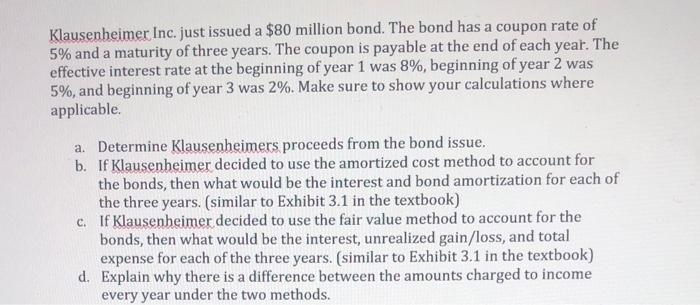

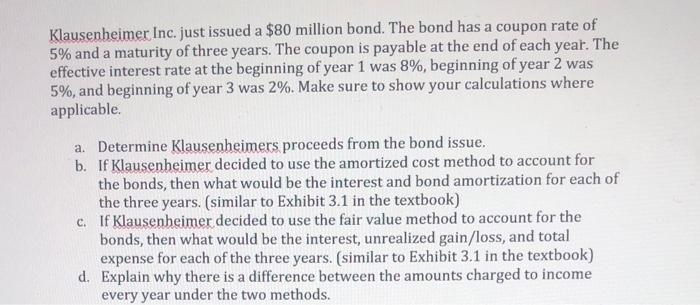

Klausenheimer Inc. just issued a $80 million bond. The bond has a coupon rate of 5% and a maturity of three years. The coupon is payable at the end of each year. The effective interest rate at the beginning of year 1 was 8%, beginning of year 2 was 5%, and beginning of year 3 was 2%. Make sure to show your calculations where applicable. a. Determine Klausenheimers proceeds from the bond issue. b. If Klausenheimer decided to use the amortized cost method to account for the bonds, then what would be the interest and bond amortization for each of the three years. (similar to Exhibit 3.1 in the textbook) c. If Klausenheimer decided to use the fair value method to account for the bonds, then what would be the interest, unrealized gain/loss, and total expense for each of the three years. (similar to Exhibit 3.1 in the textbook) d. Explain why there is a difference between the amounts charged to income every year under the two methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started