Please give simple answers so that can understand. Thanks for all teacher. If you want , can only post the question table .

Please give simple answers so that can understand. Thanks for all teacher. If you want , can only post the question table .

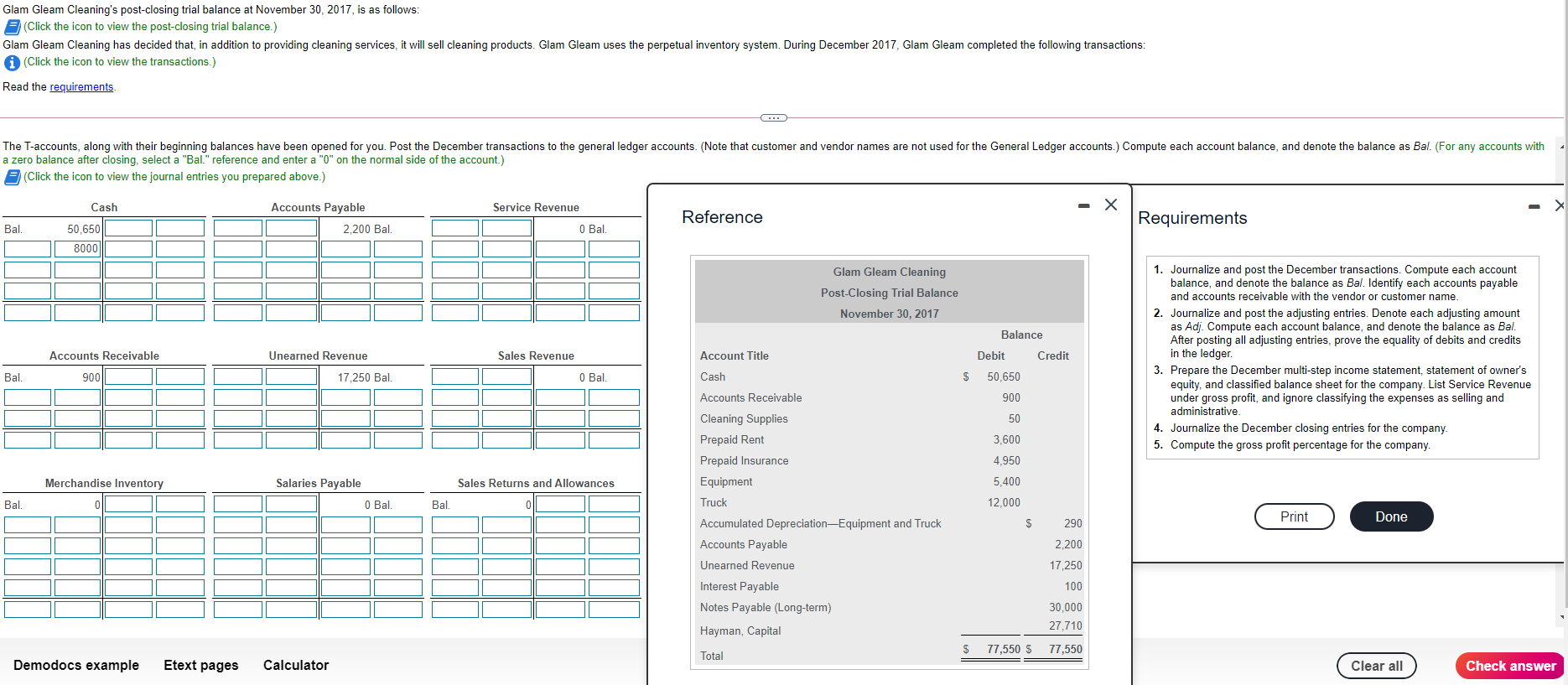

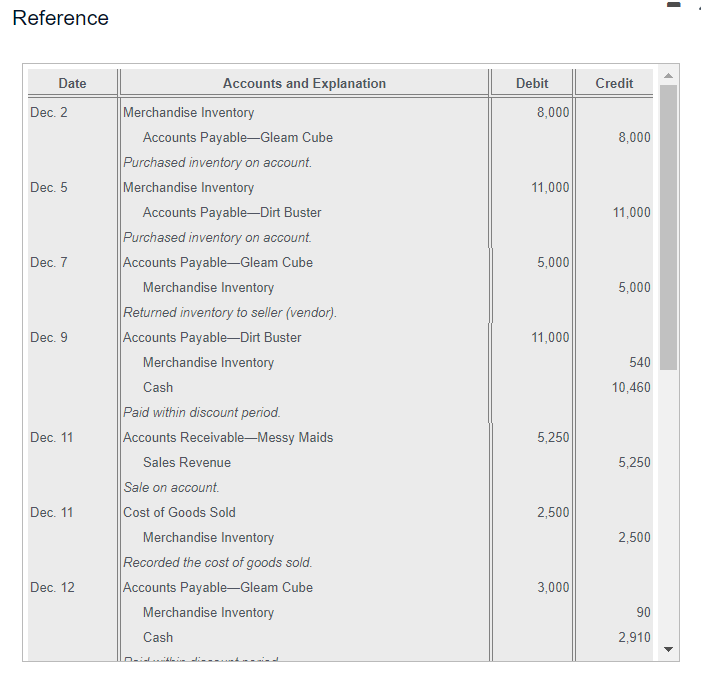

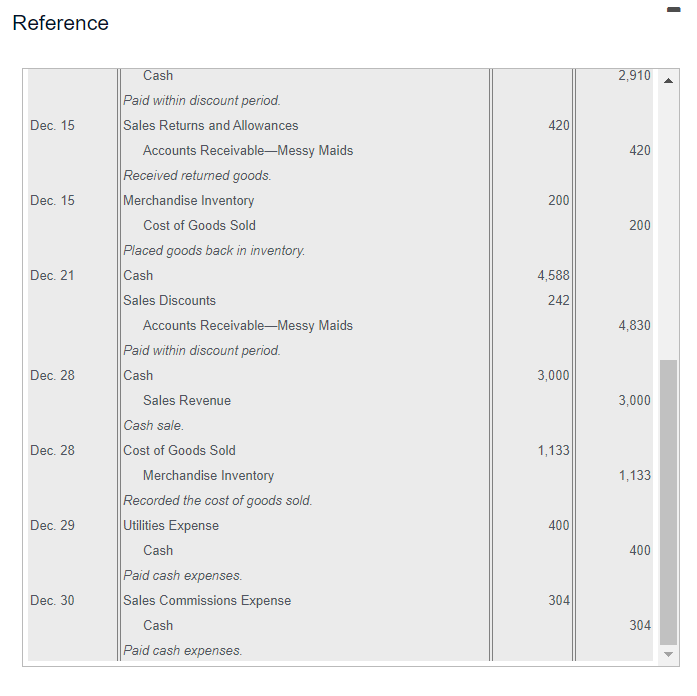

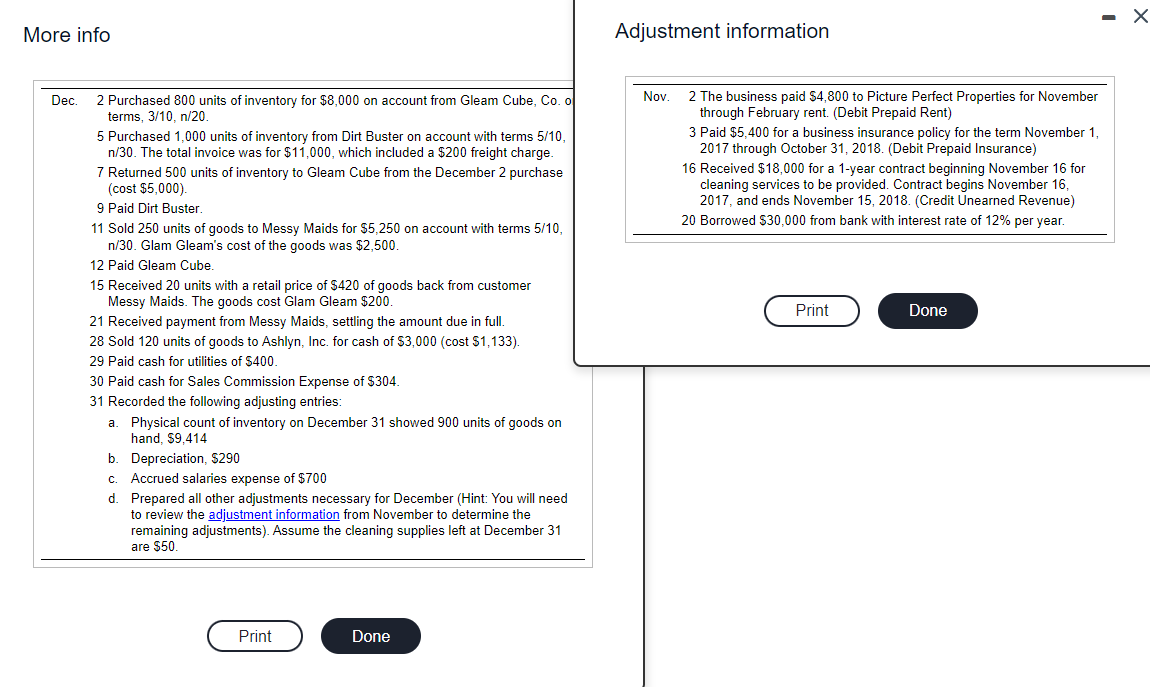

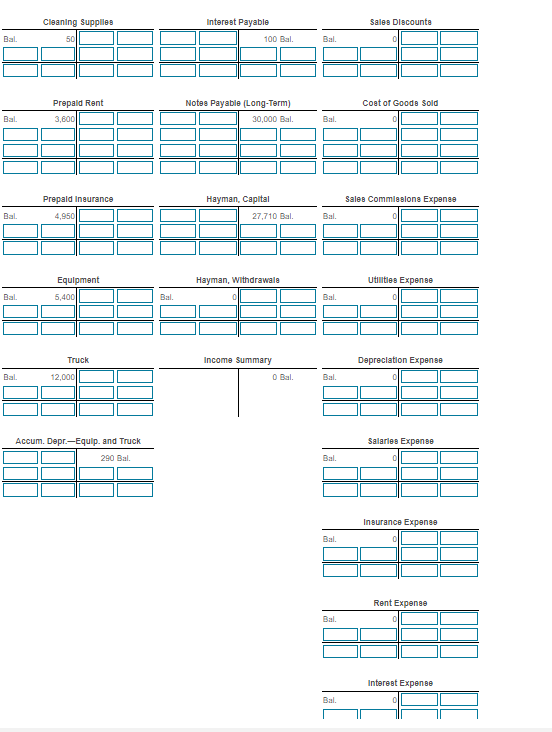

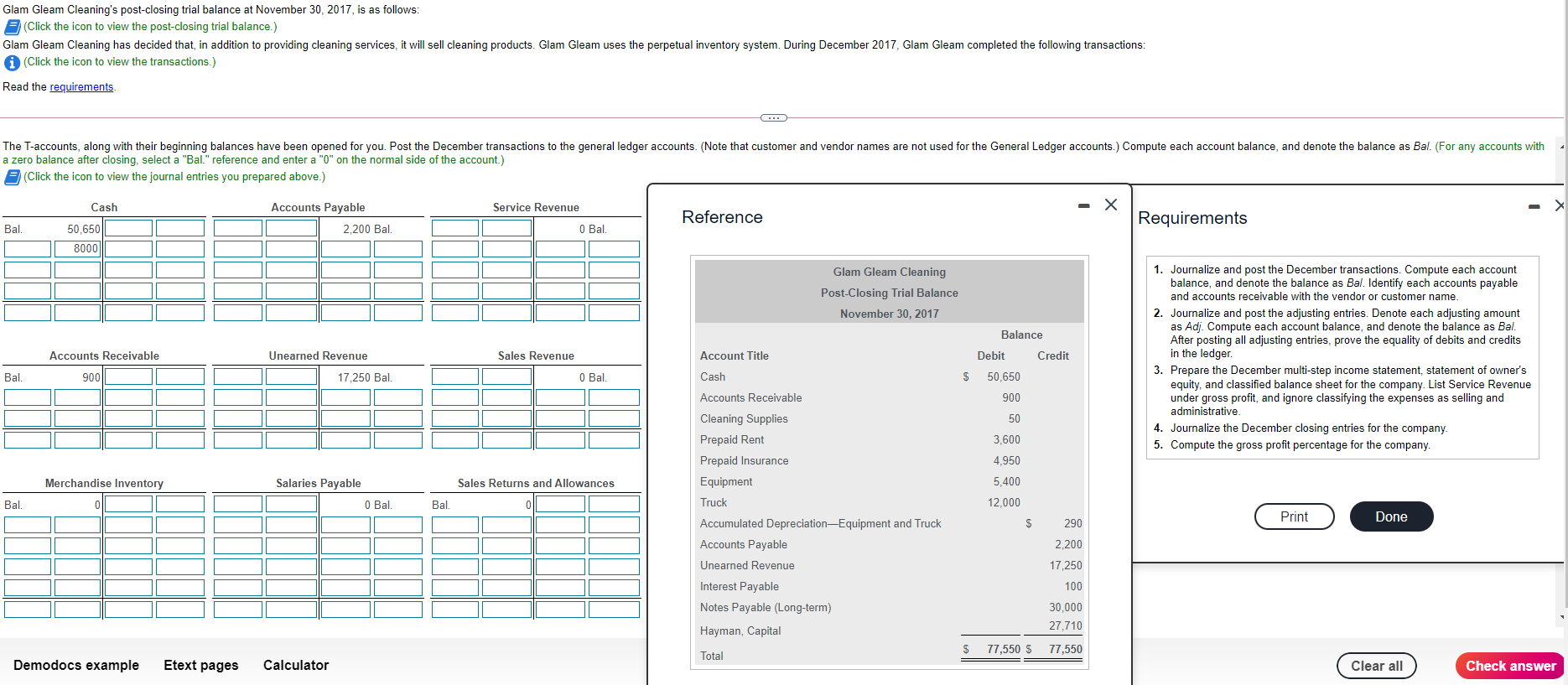

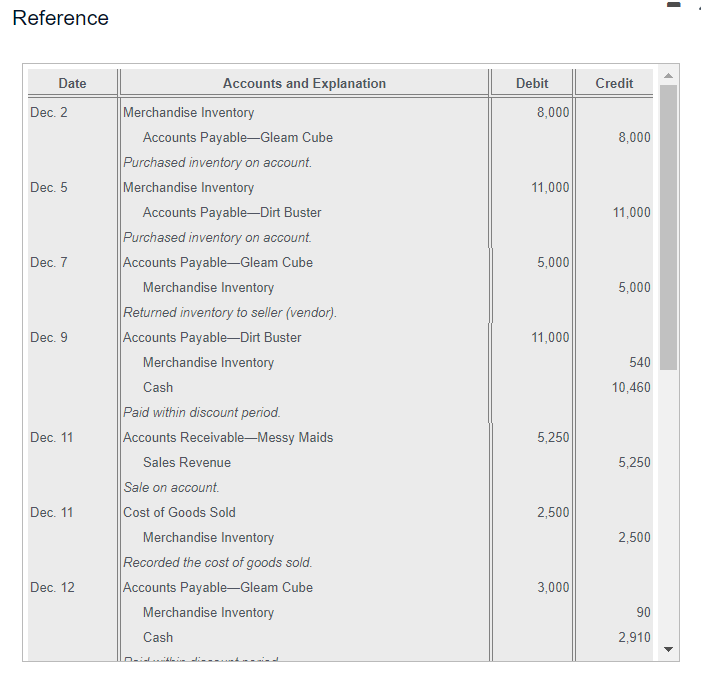

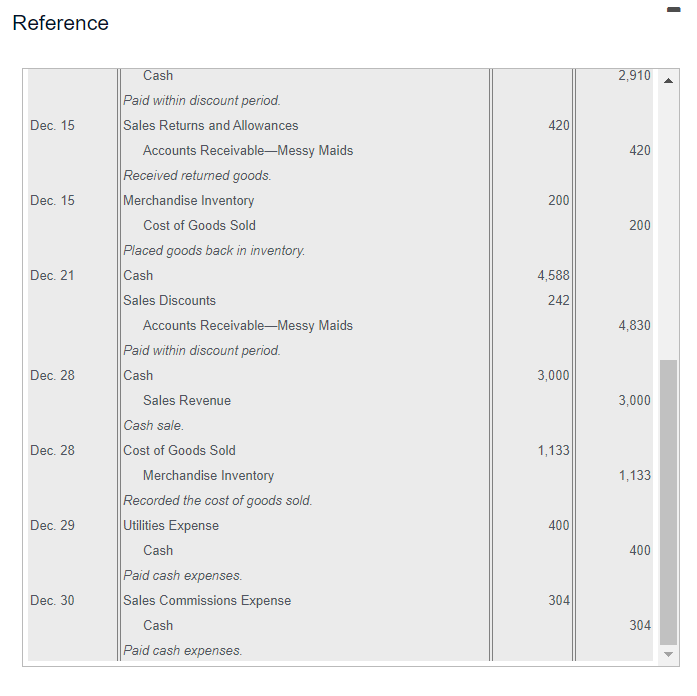

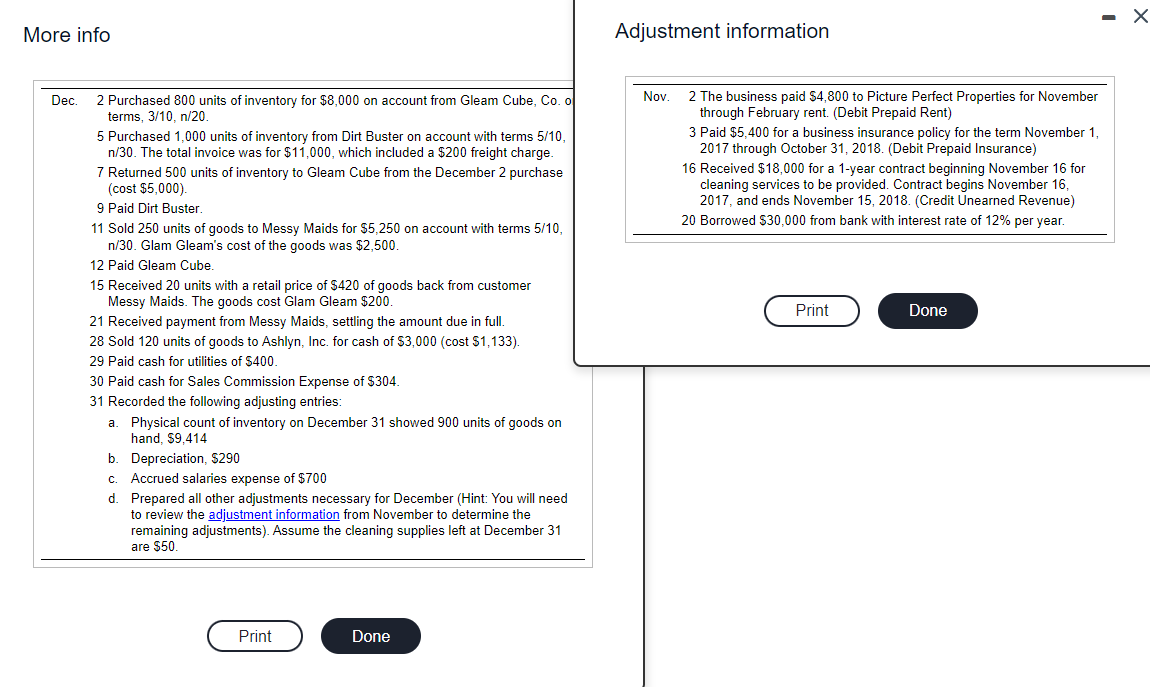

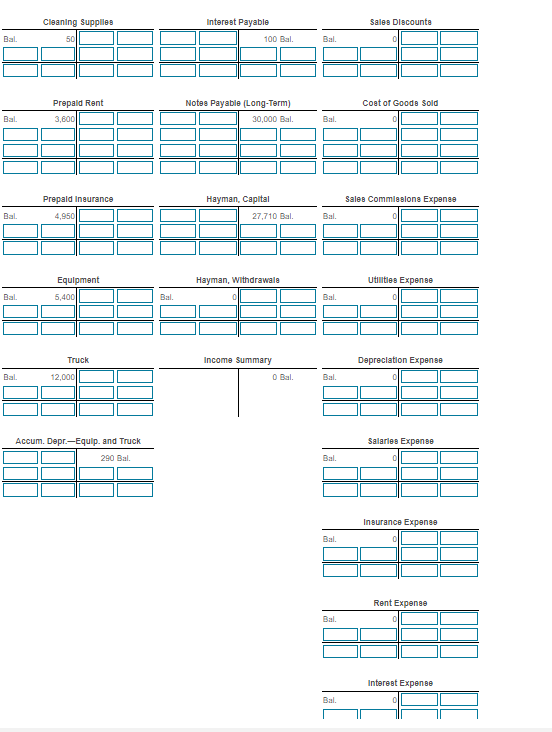

Cleaning Supplies Interest Payable Sales Discount Bal. 50 100 Bal. Bal. Coat of Goods Sold Prepaid Rent 3,6001 Notes Payable (Long-Term) 30,000 Bal. Bal. Bal. Sales Commissions Expense Prepaid Insurance 4,950 Hayman, Capital 27,710 Bal. Bal. Bal. Hayman, withdrawale Utilities Expense Equipment 5,4001 Bal. Bal. Bal. Truck Income Summary Depreciation Expense Bal. 12.000 O Bal Bal. Salaries Expense Accum. Depr.-Equip. and Truck 290 Bal. Bal. Insurance Expense Bal. Rent Expense Bal. Interest Expense Bal. Glam Gleam Cleaning's post-closing trial balance at November 30, 2017, is as follows: (Click the icon to view the post-closing trial balance.) Glam Gleam Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Glam Gleam uses the perpetual inventory system. During December 2017, Glam Gleam completed the following transactions: (Click the icon to view the transactions.) Read the requirements The T-accounts, along with their beginning balances have been opened for you. Post the December transactions to the general ledger accounts. (Note that customer and vendor names are not used for the General Ledger accounts.) Compute each account balance, and denote the balance as Bal. (For any accounts with a zero balance after closing, select a "Bal" reference and enter a "0" on the normal side of the account.) (Click the icon to view the journal entries you prepared above.) Cash Service Revenue - X Accounts Payable 2,200 Bal. Reference Requirements Bal. O Bal 50,650 8000 Glam Gleam Cleaning Post-Closing Trial Balance November 30, 2017 Accounts Receivable Unearned Revenue Sales Revenue Account Title Cash Balance Debit Credit 50,650 1. Journalize and post the December transactions. Compute each account balance, and denote the balance as Bal. Identify each accounts payable and accounts receivable with the vendor or customer name. 2. Journalize and post the adjusting entries. Denote each adjusting amount as Adj. Compute each account balance, and denote the balance as Bal. After posting all adjusting entries, prove the equality of debits and credits in the ledger. 3. Prepare the December multi-step income statement, statement of owner's equity, and classified balance sheet for the company. List Service Revenue under gross profit, and ignore classifying the expenses as selling and administrative. 4. Journalize the December closing entries for the company. 5. Compute the gross profit percentage for the company. Bal. 900 17,250 Bal. 0 Bal. $ Accounts Receivable 900 50 Cleaning Supplies Prepaid Rent Prepaid Insurance 3,600 4,950 Merchandise Inventory Salaries Payable Sales Returns and Allowances 5,400 Bal. 0 Bal. Bal. 12,000 Print Done S 290 Equipment Truck Accumulated DepreciationEquipment and Truck Accounts Payable Unearned Revenue Interest Payable Notes Payable (Long-term) 2,200 17,250 100 30,000 27,710 Hayman, Capital $ 77,550 $ 77,550 Total Demodocs example Etext pages Calculator (Clear all) Check answer - Reference Date Debit Credit Dec. 2 8,000 8,000 Dec. 5 11,000 11,000 Dec. 7 5,000 5,000 Dec. 9 11,000 Accounts and Explanation Merchandise Inventory Accounts PayableGleam Cube Purchased inventory on account Merchandise Inventory Accounts PayableDirt Buster Purchased inventory on account Accounts PayableGleam Cube Merchandise Inventory Returned inventory to seller (vendor). Accounts PayableDirt Buster Merchandise Inventory Cash Paid within discount period. Accounts ReceivableMessy Ma Sales Revenue Sale on account Cost of Goods Sold Merchandise Inventory Recorded the cost of goods sold. Accounts Payable-Gleam Cube Merchandise Inventory Cash 540 10,460 Dec. 11 5,250 5,250 Dec. 11 2,500 2,500 Dec. 12 3,000 90 2,910 Dll Reference 2,910 Dec. 15 420 420 Dec. 15 200 200 Dec. 21 4,588 242 4,830 Cash Paid within discount period. Sales Returns and Allowances Accounts ReceivableMessy Maids Received retumed goods. Merchandise Inventory Cost of Goods Sold Placed goods back in inventory. Cash Sales Discounts Accounts ReceivableMessy Maids Paid within discount period. Cash Sales Revenue Cash sale. Cost of Goods Sold Merchandise Inventory Recorded the cost of goods sold. Utilities Expense Cash Paid cash expenses Sales Commissions Expense Cash Paid cash expenses. Dec. 28 3,000 3,000 Dec. 28 1,133 1,133 Dec. 29 400 400 Dec. 30 304 304 More info Adjustment information Dec . 2 The business paid $4,800 to Picture Perfect Properties for November through February rent. (Debit Prepaid Rent) 3 Paid $5,400 for a business insurance policy for the term November 1, 2017 through October 31, 2018. (Debit Prepaid Insurance) 16 Received $18,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2017, and ends November 15, 2018. (Credit Unearned Revenue) 20 Borrowed $30,000 from bank with interest rate of 12% per year. Print Done 2 Purchased 800 units of inventory for $8,000 on account from Gleam Cube, Co.o terms, 3/10, n/20. 5 Purchased 1,000 units of inventory from Dirt Buster on account with terms 5/10, n/30. The total invoice was for $11,000, which included a $200 freight charge. 7 Returned 500 units of inventory to Gleam Cube from the December 2 purchase (cost $5,000). 9 Paid Dirt Buster 11 Sold 250 units of goods to Messy Maids for $5,250 on account with terms 5/10, n/30. Glam Gleam's cost of the goods was $2,500. 12 Paid Gleam Cube. 15 Received 20 units with a retail price of $420 of goods back from customer Messy Maids. The goods cost Glam Gleam $200. 21 Received payment from Messy Maids, settling the amount due in full. 28 Sold 120 units of goods to Ashlyn, Inc. for cash of $3,000 (cost $1,133). 29 Paid cash for utilities of $400. 30 Paid cash for Sales Commission Expense of $304. 31 Recorded the following adjusting entries: a. Physical count of inventory on December 31 showed 900 units of goods on hand, 59,414 b. Depreciation, $290 c. Accrued salaries expense of $700 d. Prepared all other adjustments necessary for December (Hint: You will need to review the adjustment information from November to determine the remaining adjustments). Assume the cleaning supplies left at December 31 are $50. Print Done

Please give simple answers so that can understand. Thanks for all teacher. If you want , can only post the question table .

Please give simple answers so that can understand. Thanks for all teacher. If you want , can only post the question table .