Please give some recommendations as to the acquisition of Lincoln Inc. Like is there any advantage or problem based on exhibit 6 to exhibit 8?

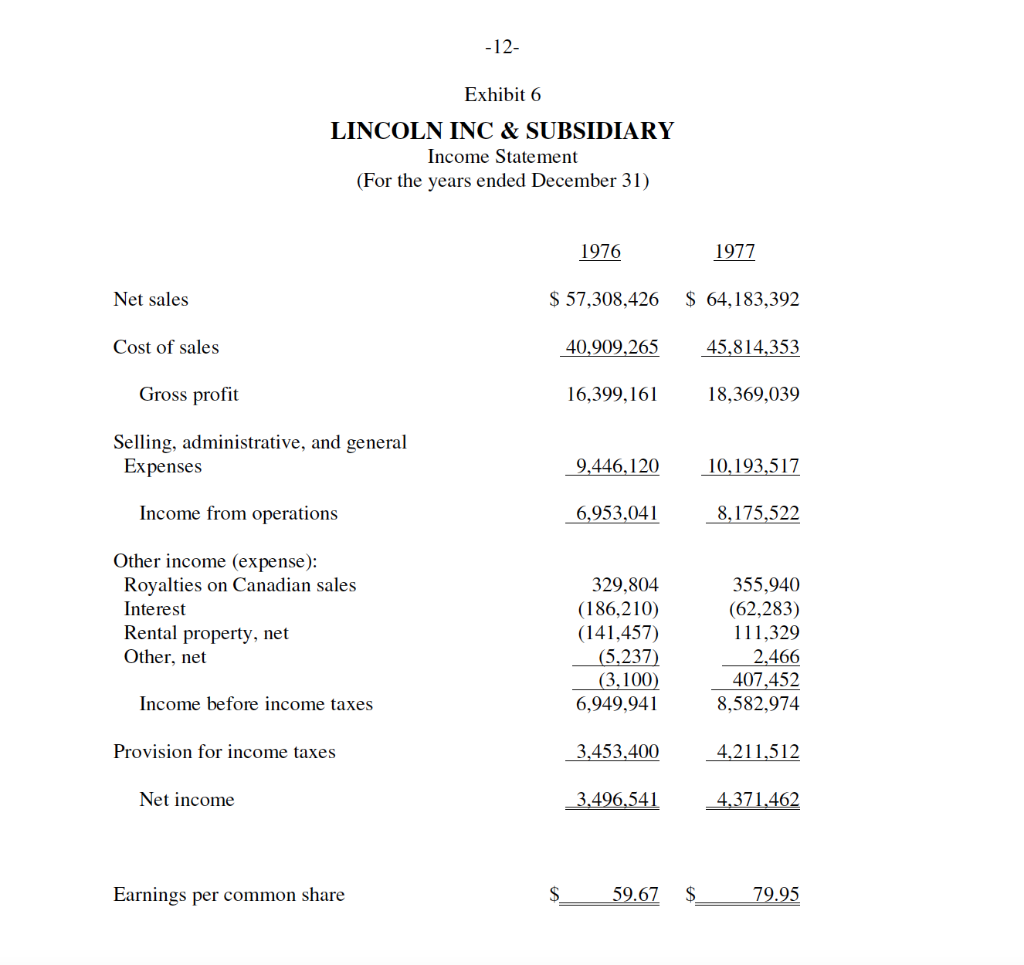

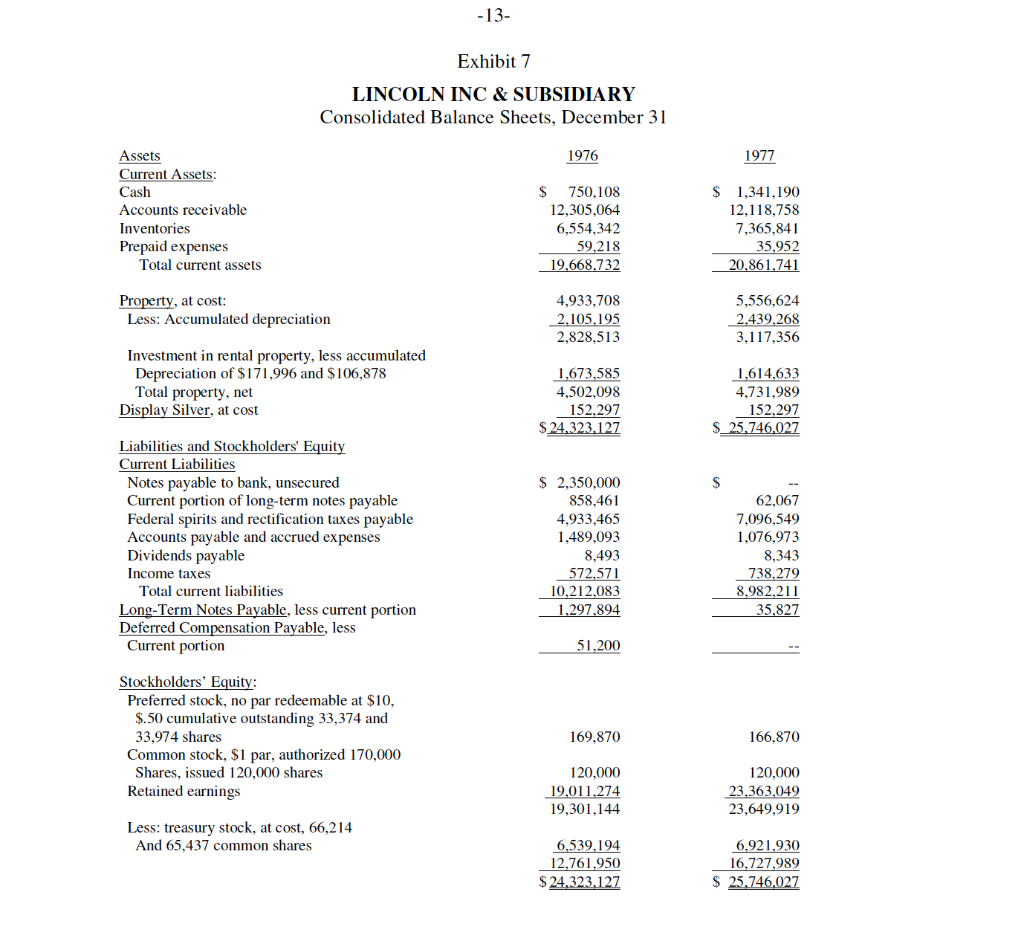

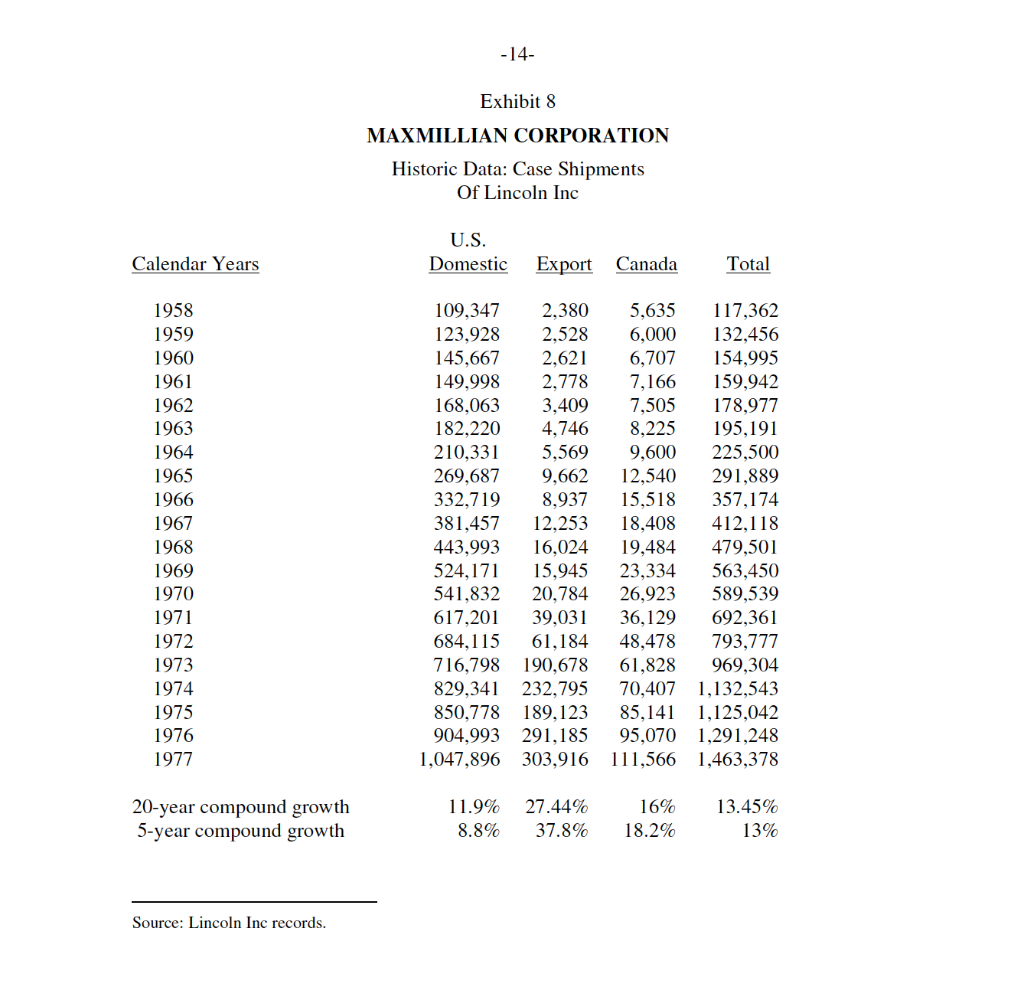

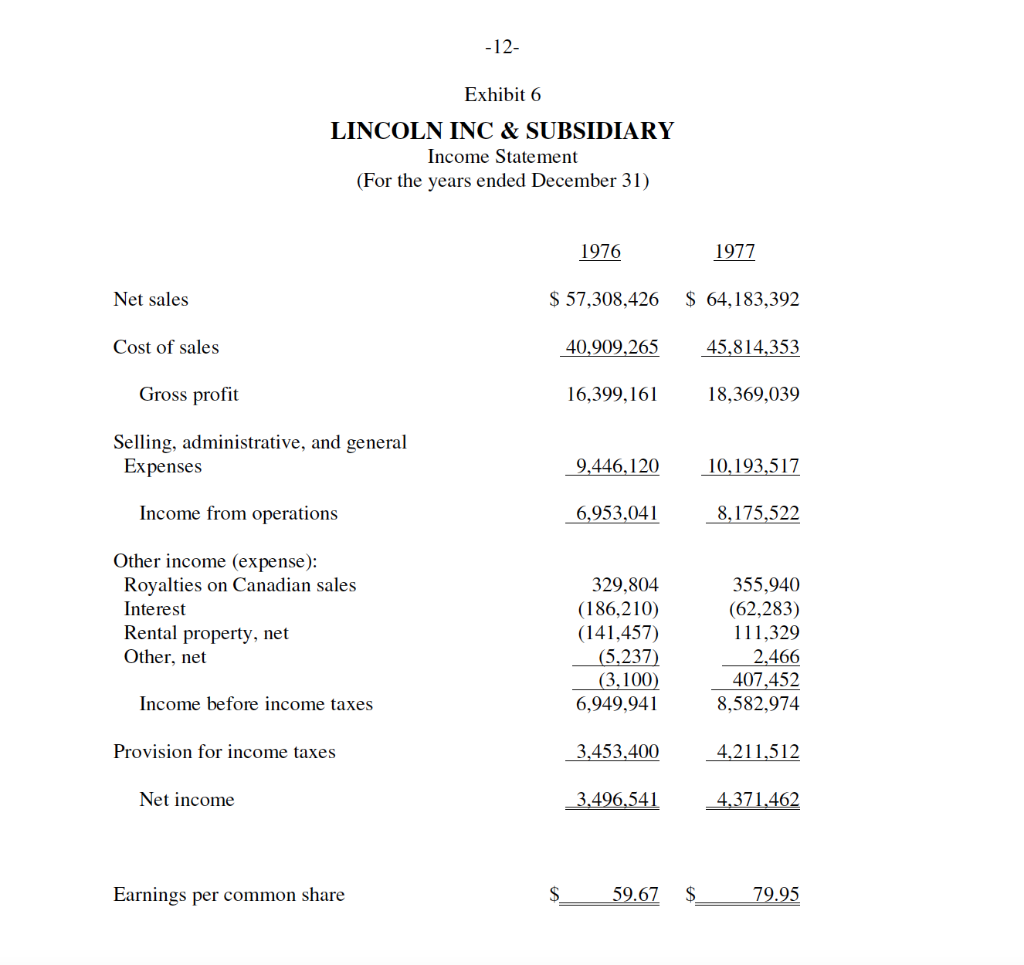

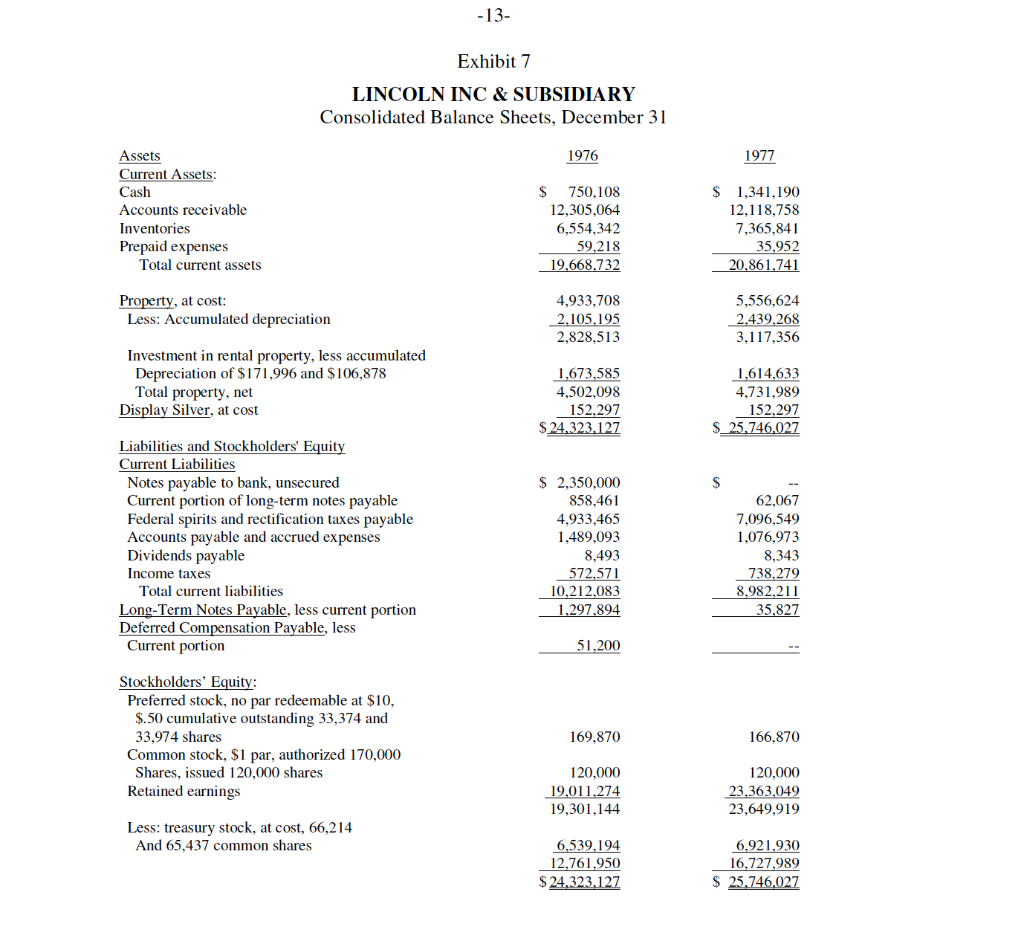

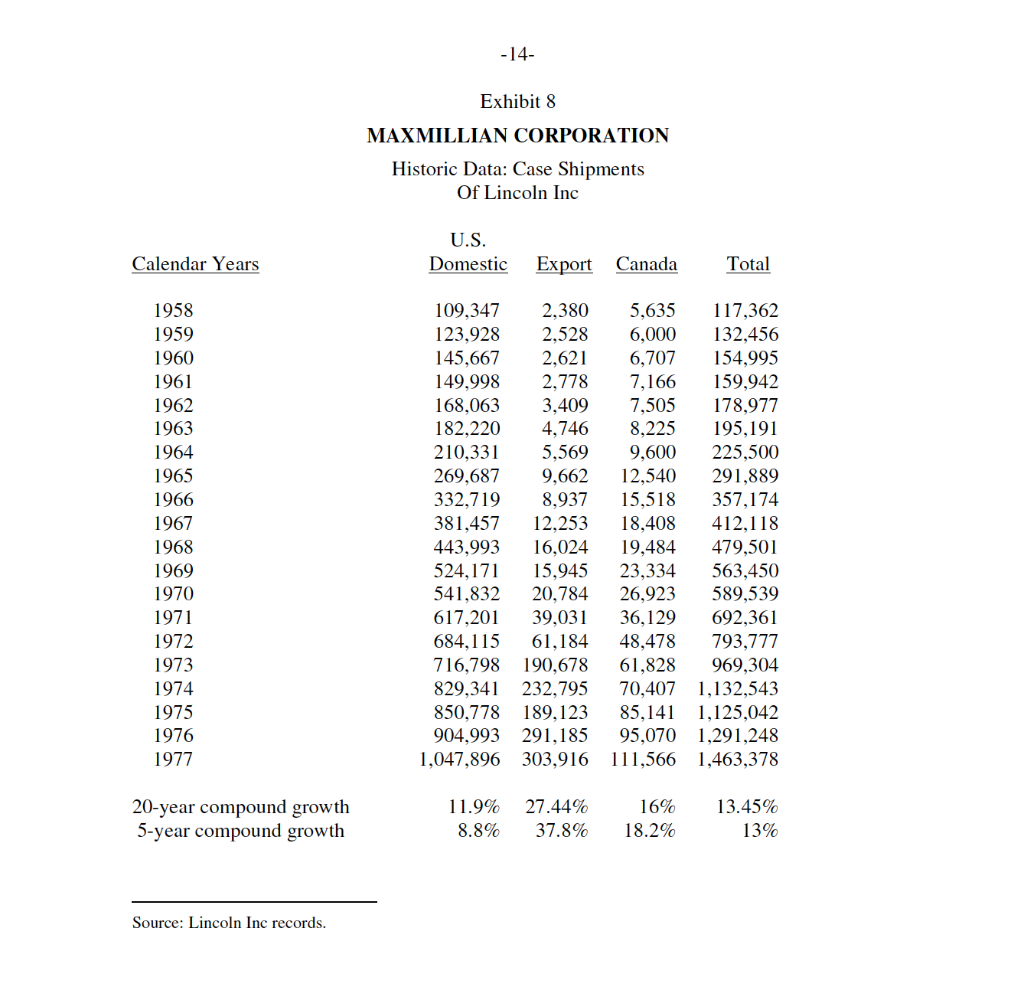

-12- Exhibit 6 LINCOLN INC & SUBSIDIARY Income Statement (For the years ended December 31) 1976 1977 Net sales $ 57,308,426 $ 64,183,392 Cost of sales 40,909,265 45,814,353 Gross profit 16,399,161 18,369,039 Selling, administrative, and general Expenses 9,446,120 10,193,517 Income from operations 6,953,041 8,175,522 Other income (expense): Royalties on Canadian sales Interest Rental property, net Other, net 329,804 (186,210) (141,457) (5,237) (3,100) 6,949,941 355,940 (62,283) 111,329 2.466 407,452 8,582,974 Income before income taxes Provision for income taxes 3,453,400 4,211,512 Net income 3,496,541 4,371,462 Earnings per common share 59.67 $ 79.95 -13- Exhibit 7 LINCOLN INC & SUBSIDIARY Consolidated Balance Sheets, December 31 1976 1977 Assets Current Assets: Cash Accounts receivable Inventories Prepaid expenses Total current assets $ 750,108 12,305,064 6,554,342 59,218 19,668,732 $ 1,341,190 12,118,758 7,365,841 35,952 20,861.741 Property, at cost: Less: Accumulated depreciation 4,933,708 2,105,195 2,828,513 5,556,624 2.439,268 3,117,356 Investment in rental property, less accumulated Depreciation of $171,996 and $106,878 Total property, net Display Silver, at cost 1,673,585 4,502,098 152.297 $ 24.323.127 1,614,633 4,731,989 152.297 $_25.746,027 $ Liabilities and Stockholders' Equity Current Liabilities Notes payable to bank, unsecured Current portion of long-term notes payable Federal spirits and rectification taxes payable Accounts payable and accrued expenses Dividends payable Income taxes Total current liabilities Long-Term Notes Payable, less current portion Deferred Compensation Payable, less Current portion $ 2,350,000 858,461 4,933,465 1,489,093 8,493 572,571 10,212,083 1.297.894 62,067 7,096,549 1,076,973 8,343 738,279 8,982,211 35,827 51,200 Stockholders' Equity: Preferred stock, no par redeemable at $10, $.50 cumulative outstanding 33,374 and 33,974 shares Common stock, $1 par, authorized 170,000 Shares, issued 120,000 shares Retained earnings 169,870 166,870 120,000 19.011.274 19,301,144 120,000 23,363,049 23,649,919 Less: treasury stock, at cost, 66,214 And 65,437 common shares 6,539,194 12,761,950 $ 24,323,127 6.921,930 16,727,989 25.746,027 -14- Exhibit 8 MAXMILLIAN CORPORATION Historic Data: Case Shipments Of Lincoln Inc Calendar Years U.S. Domestic Export Canada Total 8,937 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 109,347 2,380 5,635 117,362 123,928 2,528 6,000 132,456 145,667 2,621 6,707 154,995 149,998 2,778 7,166 159,942 168,063 3,409 7,505 178,977 182,220 4,746 8,225 195,191 210,331 5,569 9,600 225,500 269,687 9,662 12,540 291,889 332,719 15,518 357,174 381,457 12.253 18,408 412,118 443,993 16,024 19,484 479,501 524,171 15,945 23,334 563,450 541,832 20,784 26,923 589,539 617,201 39,031 36,129 692,361 684,115 61,184 48,478 793,777 716,798 190,678 61,828 969,304 829,341 232,795 70,407 1,132,543 850,778 189,123 85,141 1,125,042 904,993 291,185 95,070 1.291,248 1,047,896 303,916 111,566 1,463,378 20-year compound growth 5-year compound growth 11.9% 8.8% 27.44% 37.8% 16% 18.2% 13.45% 13% Source: Lincoln Inc records. -12- Exhibit 6 LINCOLN INC & SUBSIDIARY Income Statement (For the years ended December 31) 1976 1977 Net sales $ 57,308,426 $ 64,183,392 Cost of sales 40,909,265 45,814,353 Gross profit 16,399,161 18,369,039 Selling, administrative, and general Expenses 9,446,120 10,193,517 Income from operations 6,953,041 8,175,522 Other income (expense): Royalties on Canadian sales Interest Rental property, net Other, net 329,804 (186,210) (141,457) (5,237) (3,100) 6,949,941 355,940 (62,283) 111,329 2.466 407,452 8,582,974 Income before income taxes Provision for income taxes 3,453,400 4,211,512 Net income 3,496,541 4,371,462 Earnings per common share 59.67 $ 79.95 -13- Exhibit 7 LINCOLN INC & SUBSIDIARY Consolidated Balance Sheets, December 31 1976 1977 Assets Current Assets: Cash Accounts receivable Inventories Prepaid expenses Total current assets $ 750,108 12,305,064 6,554,342 59,218 19,668,732 $ 1,341,190 12,118,758 7,365,841 35,952 20,861.741 Property, at cost: Less: Accumulated depreciation 4,933,708 2,105,195 2,828,513 5,556,624 2.439,268 3,117,356 Investment in rental property, less accumulated Depreciation of $171,996 and $106,878 Total property, net Display Silver, at cost 1,673,585 4,502,098 152.297 $ 24.323.127 1,614,633 4,731,989 152.297 $_25.746,027 $ Liabilities and Stockholders' Equity Current Liabilities Notes payable to bank, unsecured Current portion of long-term notes payable Federal spirits and rectification taxes payable Accounts payable and accrued expenses Dividends payable Income taxes Total current liabilities Long-Term Notes Payable, less current portion Deferred Compensation Payable, less Current portion $ 2,350,000 858,461 4,933,465 1,489,093 8,493 572,571 10,212,083 1.297.894 62,067 7,096,549 1,076,973 8,343 738,279 8,982,211 35,827 51,200 Stockholders' Equity: Preferred stock, no par redeemable at $10, $.50 cumulative outstanding 33,374 and 33,974 shares Common stock, $1 par, authorized 170,000 Shares, issued 120,000 shares Retained earnings 169,870 166,870 120,000 19.011.274 19,301,144 120,000 23,363,049 23,649,919 Less: treasury stock, at cost, 66,214 And 65,437 common shares 6,539,194 12,761,950 $ 24,323,127 6.921,930 16,727,989 25.746,027 -14- Exhibit 8 MAXMILLIAN CORPORATION Historic Data: Case Shipments Of Lincoln Inc Calendar Years U.S. Domestic Export Canada Total 8,937 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 109,347 2,380 5,635 117,362 123,928 2,528 6,000 132,456 145,667 2,621 6,707 154,995 149,998 2,778 7,166 159,942 168,063 3,409 7,505 178,977 182,220 4,746 8,225 195,191 210,331 5,569 9,600 225,500 269,687 9,662 12,540 291,889 332,719 15,518 357,174 381,457 12.253 18,408 412,118 443,993 16,024 19,484 479,501 524,171 15,945 23,334 563,450 541,832 20,784 26,923 589,539 617,201 39,031 36,129 692,361 684,115 61,184 48,478 793,777 716,798 190,678 61,828 969,304 829,341 232,795 70,407 1,132,543 850,778 189,123 85,141 1,125,042 904,993 291,185 95,070 1.291,248 1,047,896 303,916 111,566 1,463,378 20-year compound growth 5-year compound growth 11.9% 8.8% 27.44% 37.8% 16% 18.2% 13.45% 13% Source: Lincoln Inc records