Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give step by step answer Question 3 The Wombat Shipbuilding Company is bidding on a contract to build a container vessel for XYZ Shipping

Please give step by step answer

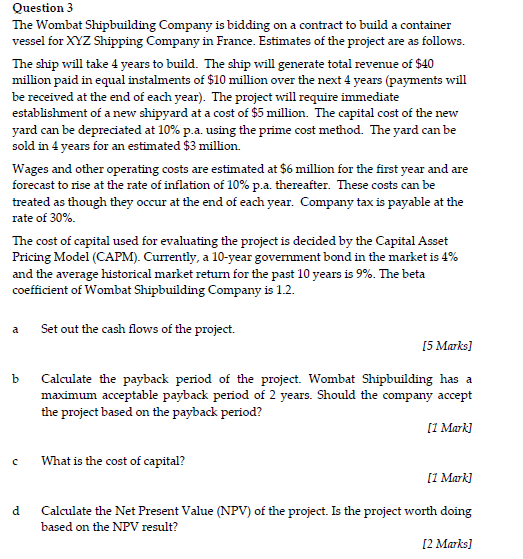

Question 3 The Wombat Shipbuilding Company is bidding on a contract to build a container vessel for XYZ Shipping Company in France. Estimates of the project are as follows. The ship will take 4 years to build. The ship will generate total revenue of $40 million paid in equal instalments of $10 million over the next 4 years (payments will be received at the end of each year). The project will require immediate establishment of a new shipyard at a cost of $5 million. The capital cost of the new yard can be depreciated at 10% pa. using the prime cost method. The yard can be sold in 4 years for an estimated $3 million. Wages and other operating costs are estimated at $6 million for the first year and are forecast to rise at the rate of inflation of 10% pa. thereafter. These costs can be treated as though they occur at the end of each year. Company tax is payable at the rate of 30%. The cost of capital used for evaluating the project is decided by the Capital Asset Pricing Model (CAPM). Currently, a 10-year government bond in the market is 4% and the average historical market return for the past 10 years is 9%. The beta coefficient of Wombat Shipbuilding Company is 12. a Set out the cash flows of the project. [5 Maks] b Calculate the payback period of the project. Wombat Shipbuilding has a maximum acceptable payback period of 2 years. Should the company accept the project based on the payback period? [I Mark] c What is the cost of capital? [I Mark] Calculate the Net Present Value (NPV) of the project. Is the project worth doing [2 Maks] d based on the NPV resultStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started