Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Please give step-by-step instructions and show what formula can be used to calculate it) 8. Caribou River. Caribou River, Ltd., a Canadian manufacturer of raincoats,

(Please give step-by-step instructions and show what formula can be used to calculate it)

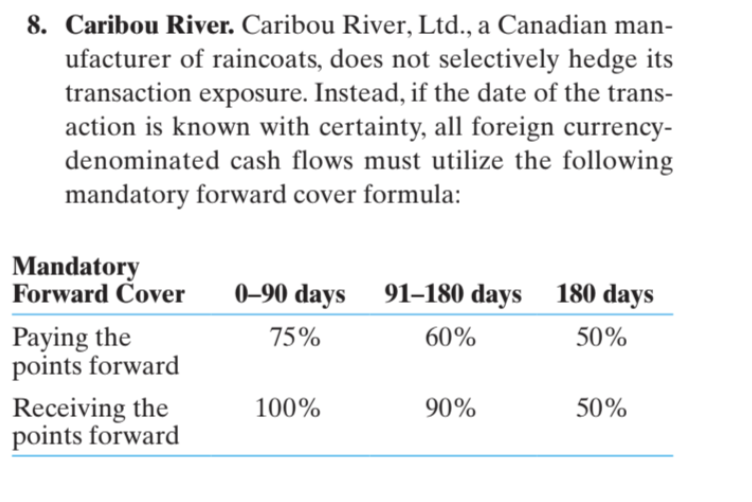

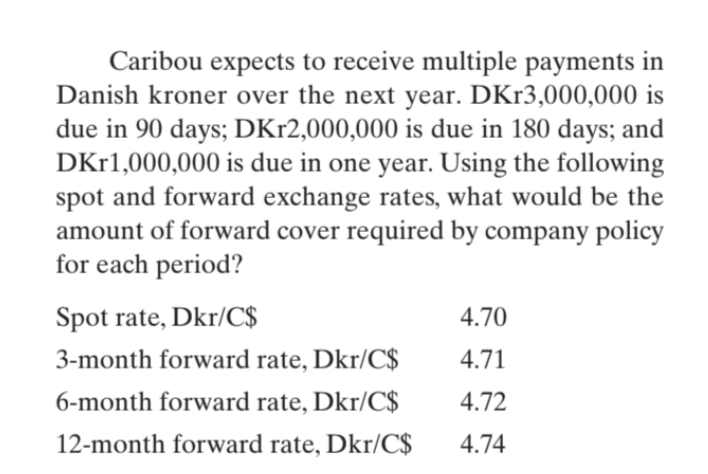

8. Caribou River. Caribou River, Ltd., a Canadian manufacturer of raincoats, does not selectively hedge its transaction exposure. Instead, if the date of the transaction is known with certainty, all foreign currencydenominated cash flows must utilize the following mandatory forward cover formula: Caribou expects to receive multiple payments in Danish kroner over the next year. DKr3,000,000 is due in 90 days; DKr2,000,000 is due in 180 days; and DKr1,000,000 is due in one year. Using the following spot and forward exchange rates, what would be the amount of forward cover required by company policy for each period? \begin{tabular}{ll} Spot rate, Dkr/C$ & 4.70 \\ 3-month forward rate, Dkr/C$ & 4.71 \\ 6-month forward rate, Dkr/C$ & 4.72 \\ 12-month forward rate, Dkr/C$ & 4.74 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started