Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give the answer in 30 mins very urgent QUESTION 2 (20 MARKS) A U.S company needs to pay to her overseas supplier in Switzerland

please give the answer in 30 mins very urgent

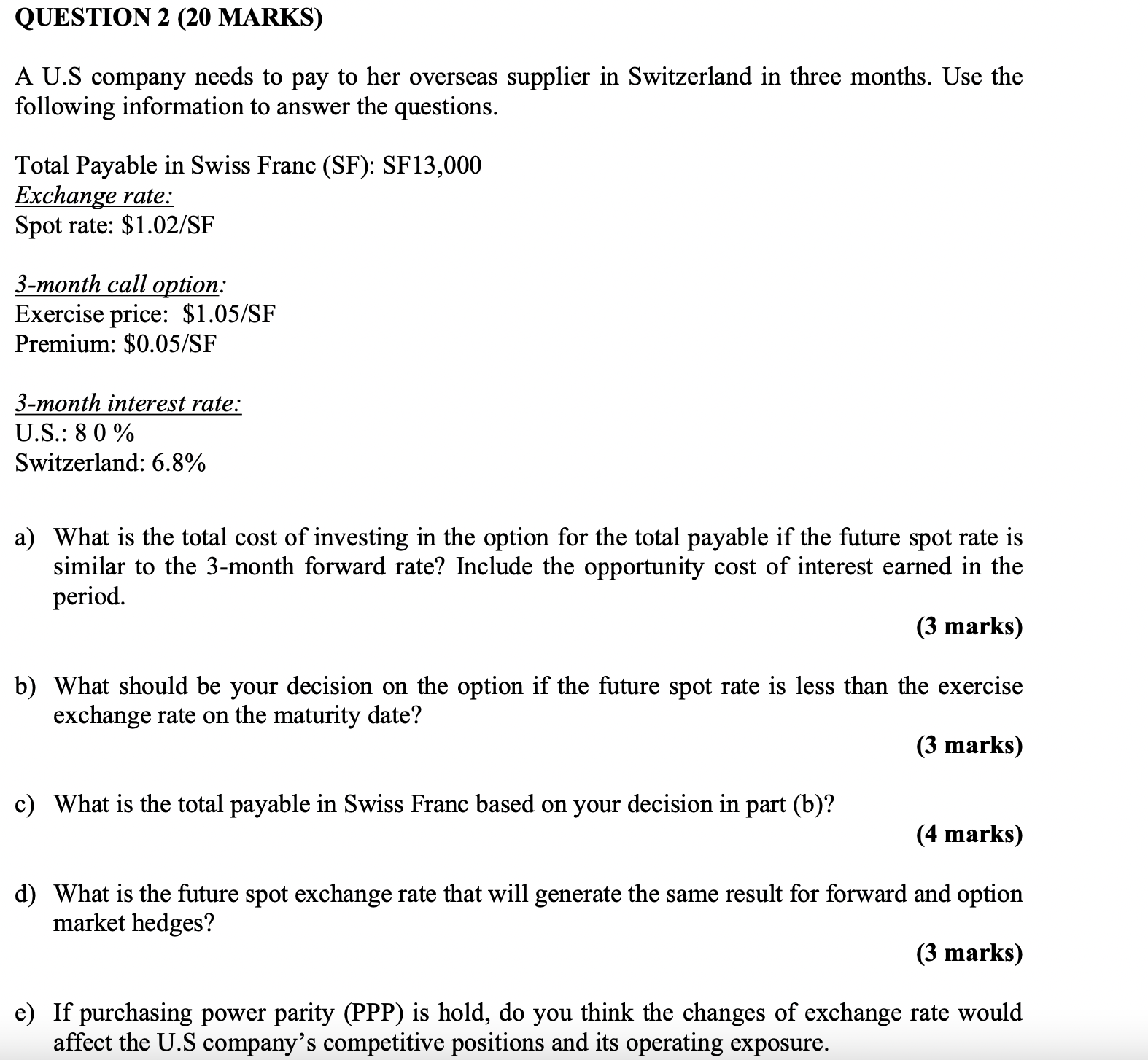

QUESTION 2 (20 MARKS) A U.S company needs to pay to her overseas supplier in Switzerland in three months. Use the following information to answer the questions. Total Payable in Swiss Franc (SF): SF13,000 Exchange rate: Spot rate: $1.02/SF 3-month call option: Exercise price: $1.05/SF Premium: $0.05/SF 3-month interest rate: U.S.: 80% Switzerland: 6.8% a) What is the total cost of investing in the option for the total payable if the future spot rate is similar to the 3-month forward rate? Include the opportunity cost of interest earned in the period. (3 marks) b) What should be your decision on the option if the future spot rate is less than the exercise exchange rate on the maturity date? (3 marks) c) What is the total payable in Swiss Franc based on your decision in part (b)? (4 marks) d) What is the future spot exchange rate that will generate the same result for forward and option market hedges? (3 marks) e) If purchasing power parity (PPP) is hold, do you think the changes of exchange rate would affect the U.S company's competitive positions and its operating exposure. QUESTION 2 (20 MARKS) A U.S company needs to pay to her overseas supplier in Switzerland in three months. Use the following information to answer the questions. Total Payable in Swiss Franc (SF): SF13,000 Exchange rate: Spot rate: $1.02/SF 3-month call option: Exercise price: $1.05/SF Premium: $0.05/SF 3-month interest rate: U.S.: 80% Switzerland: 6.8% a) What is the total cost of investing in the option for the total payable if the future spot rate is similar to the 3-month forward rate? Include the opportunity cost of interest earned in the period. (3 marks) b) What should be your decision on the option if the future spot rate is less than the exercise exchange rate on the maturity date? (3 marks) c) What is the total payable in Swiss Franc based on your decision in part (b)? (4 marks) d) What is the future spot exchange rate that will generate the same result for forward and option market hedges? (3 marks) e) If purchasing power parity (PPP) is hold, do you think the changes of exchange rate would affect the U.S company's competitive positions and its operating exposureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started