Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give the formula and answer 5. Suppose there is an investment project with the following cash flows to be received at the end of

Please give the formula and answer

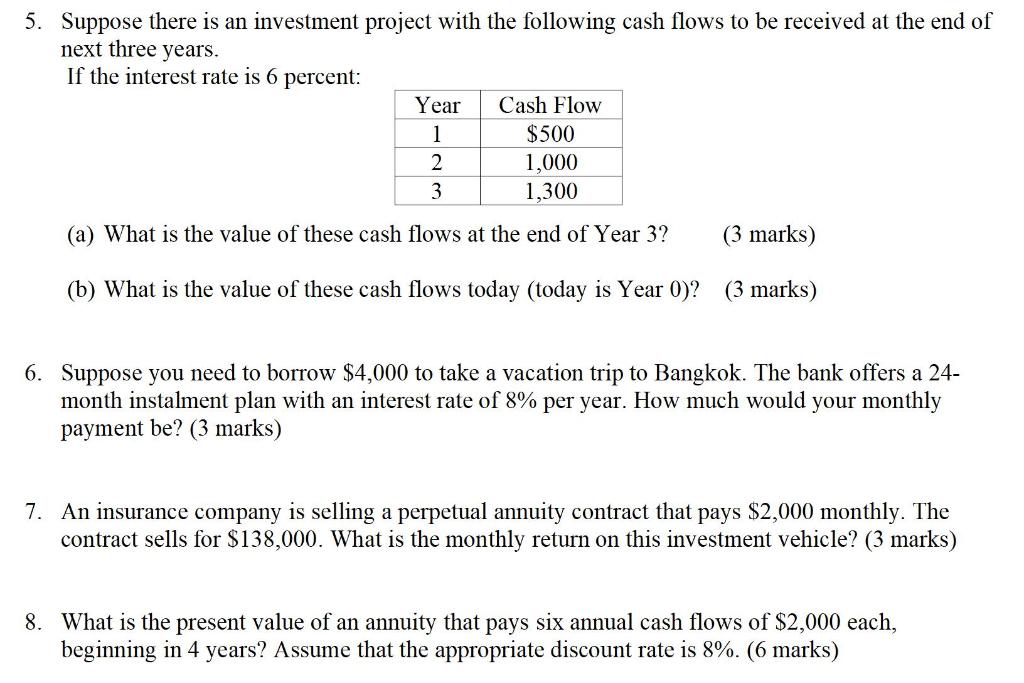

5. Suppose there is an investment project with the following cash flows to be received at the end of next three years. If the interest rate is 6 percent: (a) What is the value of these cash flows at the end of Year 3? (3 marks) (b) What is the value of these cash flows today (today is Year 0)? (3 marks) 6. Suppose you need to borrow $4,000 to take a vacation trip to Bangkok. The bank offers a 24month instalment plan with an interest rate of 8% per year. How much would your monthly payment be? (3 marks) 7. An insurance company is selling a perpetual annuity contract that pays $2,000 monthly. The contract sells for $138,000. What is the monthly return on this investment vehicle? ( 3 marks) 8. What is the present value of an annuity that pays six annual cash flows of $2,000 each, beginning in 4 years? Assume that the appropriate discount rate is 8%. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started