Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please giving the new answer which is not posted in the chegg with solving steps. thank u. Problem 3 (10 points) Tempo Fitness is another

please giving the new answer which is not posted in the chegg with solving steps. thank u.

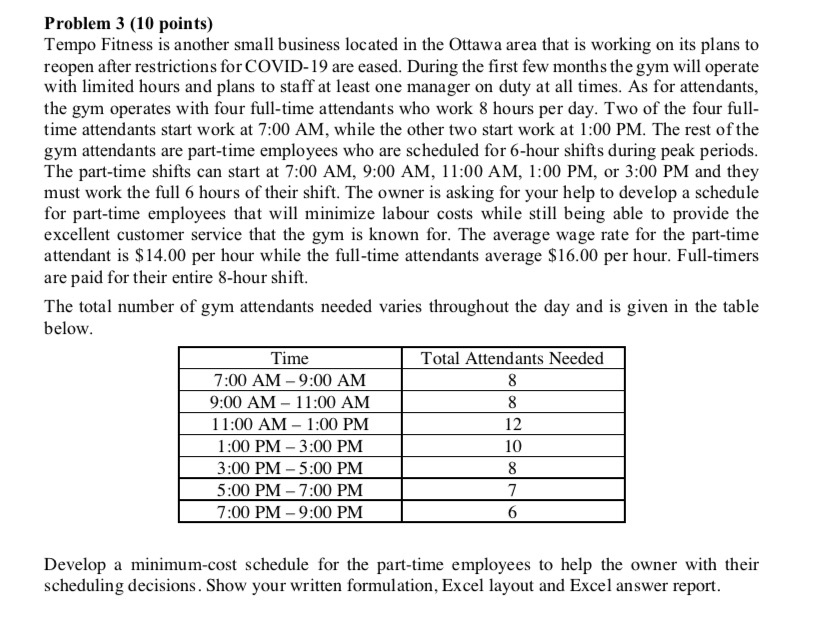

Problem 3 (10 points) Tempo Fitness is another small business located in the Ottawa area that is working on its plans to reopen after restrictions for COVID-19 are eased. During the first few months the gym will operate with limited hours and plans to staff at least one manager on duty at all times. As for attendants, the gym operates with four full-time attendants who work 8 hours per day. Two of the four full- time attendants start work at 7:00 AM, while the other two start work at 1:00 PM. The rest of the gym attendants are part-time employees who are scheduled for 6-hour shifts during peak periods. The part-time shifts can start at 7:00 AM, 9:00 AM, 11:00 AM, 1:00 PM, or 3:00 PM and they must work the full 6 hours of their shift. The owner is asking for your help to develop a schedule for part-time employees that will minimize labour costs while still being able to provide the excellent customer service that the gym is known for. The average wage rate for the part-time attendant is $ 14.00 per hour while the full-time attendants average $16.00 per hour. Full-timers are paid for their entire 8-hour shift. The total number of gym attendants needed varies throughout the day and is given in the table below. Time Total Attendants Needed 7:00 AM - 9:00 AM 8 9:00 AM - 11:00 AM 8 11:00 AM - 1:00 PM 12 1:00 PM - 3:00 PM 10 3:00 PM - 5:00 PM 8 5:00 PM - 7:00 PM 7 7:00 PM - 9:00 PM 6 Develop a minimum-cost schedule for the part-time employees to help the owner with their scheduling decisions. Show your written formulation, Excel layout and Excel answer reportStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started