Please handle this..

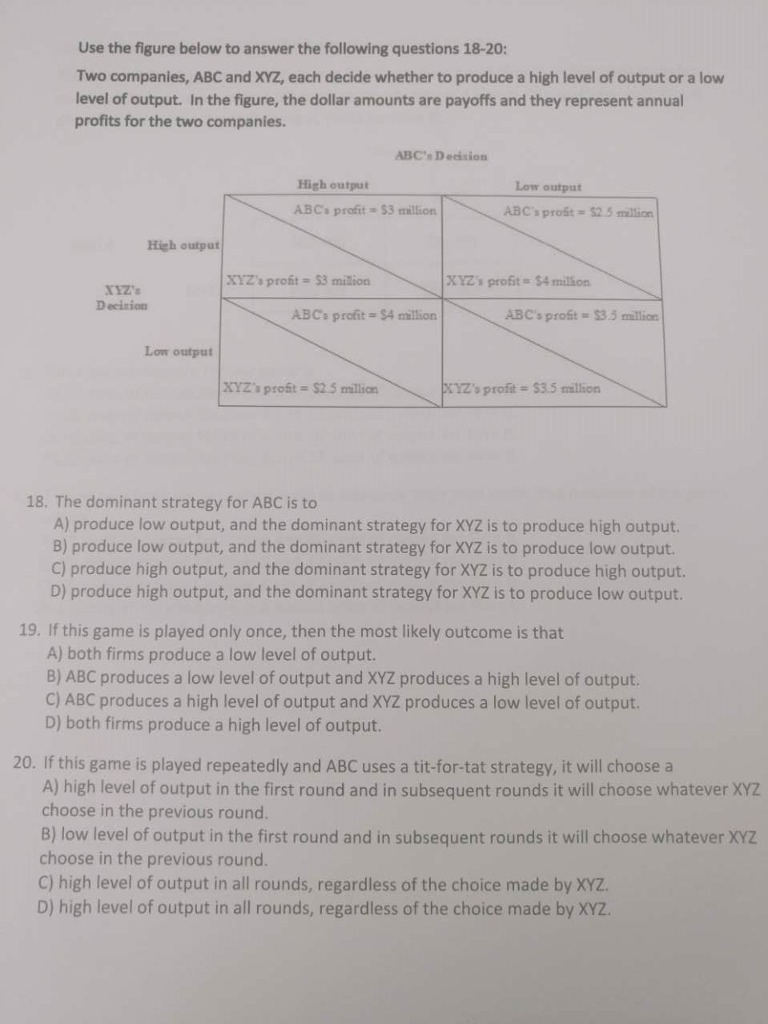

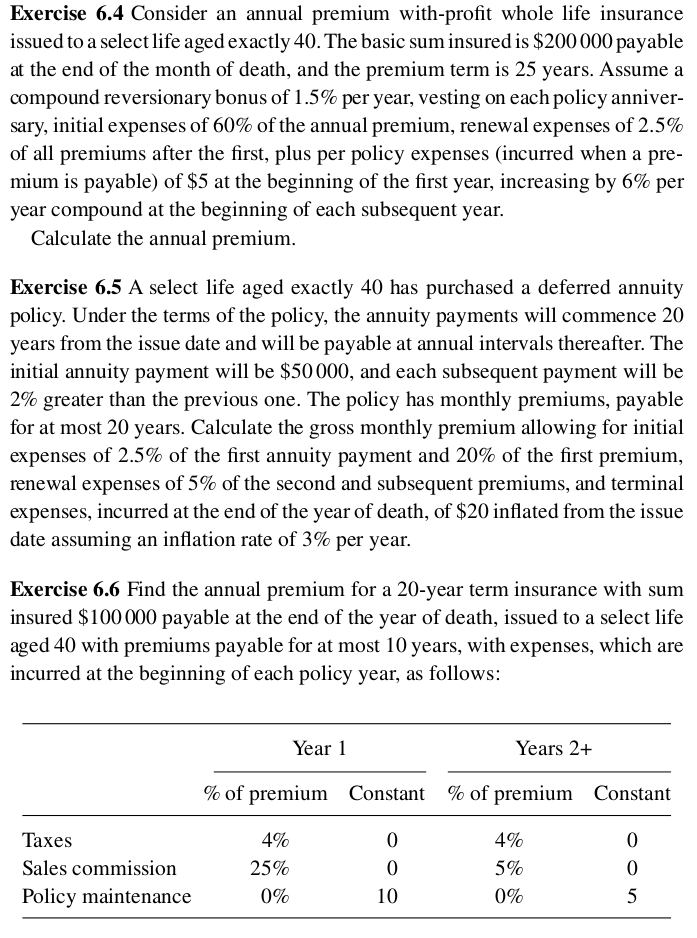

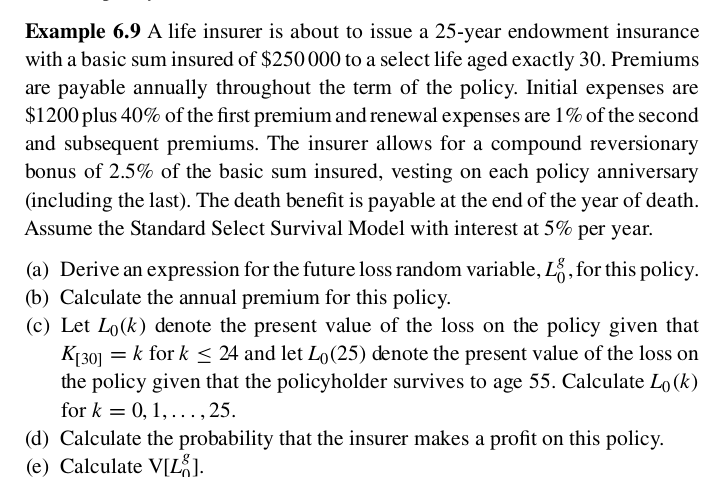

Use the figure below to answer the following questions 18-20: Two companies, ABC and XYZ, each decide whether to produce a high level of output or a low level of output. In the figure, the dollar amounts are payoffs and they represent annual profits for the two companies. ABC's Decision High output Low output ABCa profit = $3 million ABC's profit = $2 5 million High output XYZ's profit = $3 million XYZ's profit = $4 million XYZ's Decision ABC's profit = $4 million ABC's profit = $3.5 million Low output XYZ's profit = $2:5 million XYZ's profit = $3.5 million 18. The dominant strategy for ABC is to A) produce low output, and the dominant strategy for XYZ is to produce high output. B) produce low output, and the dominant strategy for XYZ is to produce low output. C) produce high output, and the dominant strategy for XYZ is to produce high output. D) produce high output, and the dominant strategy for XYZ is to produce low output. 19. If this game is played only once, then the most likely outcome is that A) both firms produce a low level of output. B) ABC produces a low level of output and XYZ produces a high level of output. C) ABC produces a high level of output and XYZ produces a low level of output. D) both firms produce a high level of output. 20. If this game is played repeatedly and ABC uses a tit-for-tat strategy, it will choose a A) high level of output in the first round and in subsequent rounds it will choose whatever XYZ choose in the previous round. B) low level of output in the first round and in subsequent rounds it will choose whatever XYZ choose in the previous round. C) high level of output in all rounds, regardless of the choice made by XYZ. D) high level of output in all rounds, regardless of the choice made by XYZ.Exercise 6.4 Consider an annual premium with-prot whole life insurance issued to a select life aged exactly 40. The basic sum insured is $200000payable at the end of the month of death, and the premium term is 25 years. Assume a compound reversionary bonus of 1.5% per year, vesting on each policy anniver- sary, initial expenses of 60% of the annual premium, renewal expenses of 2.5% of all premiums after the rst, plus per policy expenses (incurred when a pre- mium is payable) of $5 at the beginning of the rst year, increasing by {5% per year compound at the beginning of each subsequent year. Calculate the annual premium. Exercise 65 A select life aged exactly 40 has purchased a deferred annuity policy. Under the terms of the policy, the annuity payments will commence 20 years from the issue date and will be payable at annual intervals thereafter. The initial annuity payment will be $50 000, and each subsequent payment will be 2% greater than the previous one. The policy has monthly premiums, payable for at most 20 years. Calculate the gross monthly premium allowing for initial expenses of 2.5% of the rst annuity payment and 20% of the rst premium, renewal expenses of 5% of the second and subsequent premiums, and terminal expenses, incurred at the end of the year of death, of $20 inated from the issue date assuming an ination rate of 3% per year. Exercise 6.6 Find the annual premium for a 20-year term insurance with sum insured $100000 payable at the end of the year of death, issued to a select life aged 40 with premiums payable for at most 10 years, with expenses, which are incurred at the beginning of each policy year, as follows: Year 1 Years 2+ % of premium Constant % of premium Constant Taxes 4% 0 4% 0 Sales commission 25% 0 5% 0 Policy maintenance 0% l0 0% 5 Example 6.9 A life insurer is about to issue a 25-year endowment insurance with a basic sum insured of $250 000 to a select life aged exactly 30. Premiums are payable annually throughout the term of the policy. Initial expenses are $1200 plus 40% of the first premium and renewal expenses are 1% of the second and subsequent premiums. The insurer allows for a compound reversionary bonus of 2.5% of the basic sum insured, vesting on each policy anniversary (including the last). The death benefit is payable at the end of the year of death. Assume the Standard Select Survival Model with interest at 5% per year. (a) Derive an expression for the future loss random variable, Lo, for this policy. (b) Calculate the annual premium for this policy. (c) Let Lo(k) denote the present value of the loss on the policy given that K1301 = k for k