Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please have the whole calculation step for this question.Thanks Use the following information for Questions 8 and 9 Runner Co. uses the effective interest method

Please have the whole calculation step for this question.Thanks

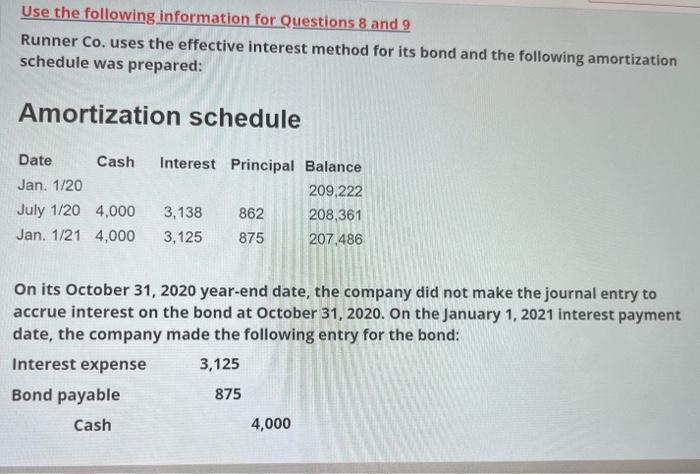

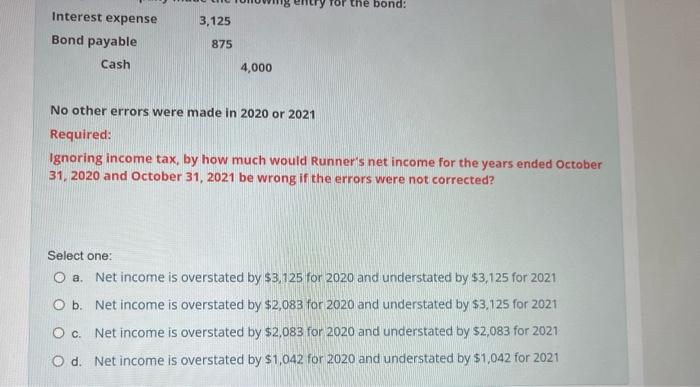

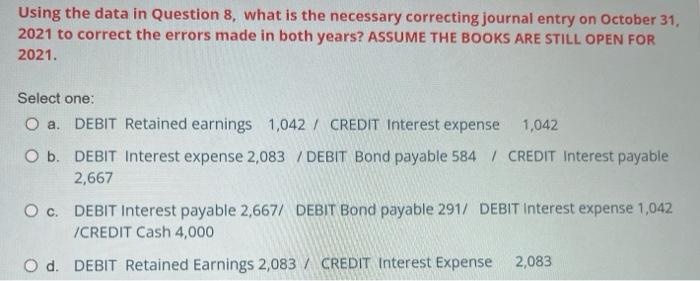

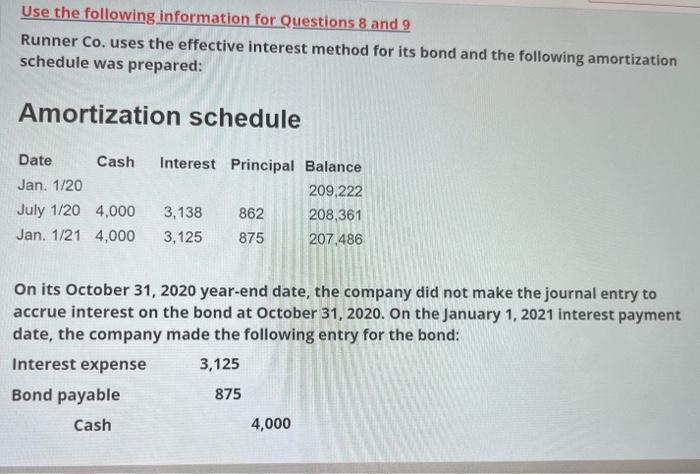

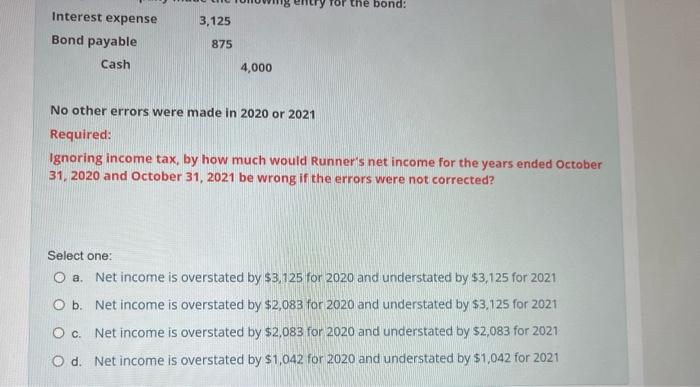

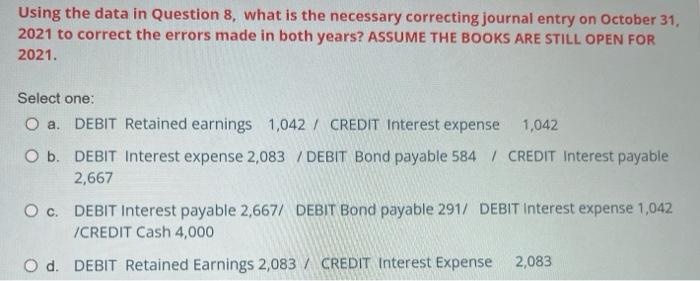

Use the following information for Questions 8 and 9 Runner Co. uses the effective interest method for its bond and the following amortization schedule was prepared: Amortization schedule Date Cash Jan. 1/20 July 1/20 4,000 Jan. 1/21 4,000 Interest Principal Balance 209,222 3,138 862 208,361 3,125 875 207,486 On its October 31, 2020 year-end date, the company did not make the journal entry to accrue interest on the bond at October 31, 2020. On the January 1, 2021 interest payment date, the company made the following entry for the bond: Interest expense 3,125 Bond payable 875 Cash 4,000 the bond! 3,125 Interest expense Bond payable Cash 875 4,000 No other errors were made in 2020 or 2021 Required: Ignoring income tax, by how much would Runner's net income for the years ended October 31, 2020 and October 31, 2021 be wrong if the errors were not corrected? Select one: O a. Net income is overstated by $3,125 for 2020 and understated by $3,125 for 2021 O b. Net income is overstated by $2,083 for 2020 and understated by $3,125 for 2021 Oc. Net income is overstated by $2,083 for 2020 and understated by $2,083 for 2021 O d. Net income is overstated by $1,042 for 2020 and understated by $1,042 for 2021 Using the data in Question 8, what is the necessary correcting journal entry on October 31, 2021 to correct the errors made in both years? ASSUME THE BOOKS ARE STILL OPEN FOR 2021. Select one: O a. DEBIT Retained earnings 1,042 / CREDIT Interest expense 1,042 O b. DEBIT Interest expense 2,083 / DEBIT Bond payable 584 / CREDIT Interest payable 2,667 O C. DEBIT Interest payable 2,667/ DEBIT Bond payable 291/ DEBIT Interest expense 1,042 /CREDIT Cash 4,000 O d. DEBIT Retained Earnings 2,083 / CREDIT Interest Expense 2,083

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started