Answered step by step

Verified Expert Solution

Question

1 Approved Answer

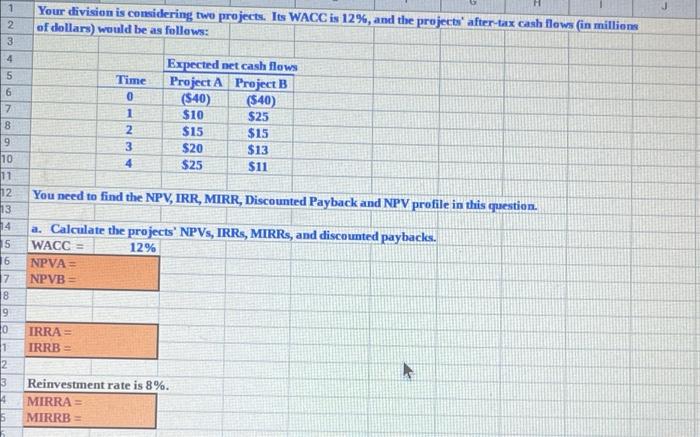

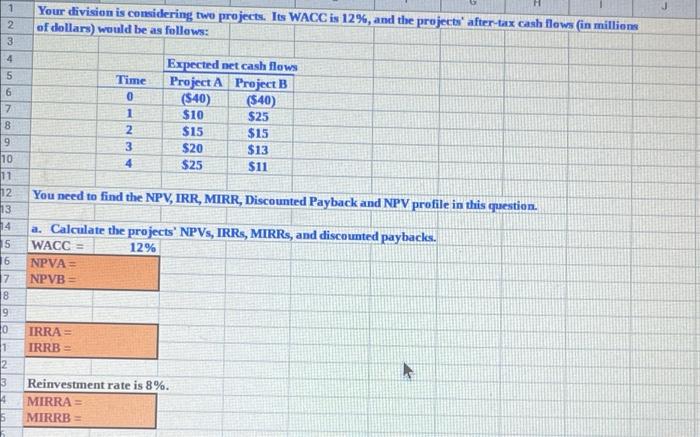

please help! 1 2 3 Your division is considering two projects. Its WACC is 12%, and the projects' after-tax cash flows (in millions of dollars)

please help!

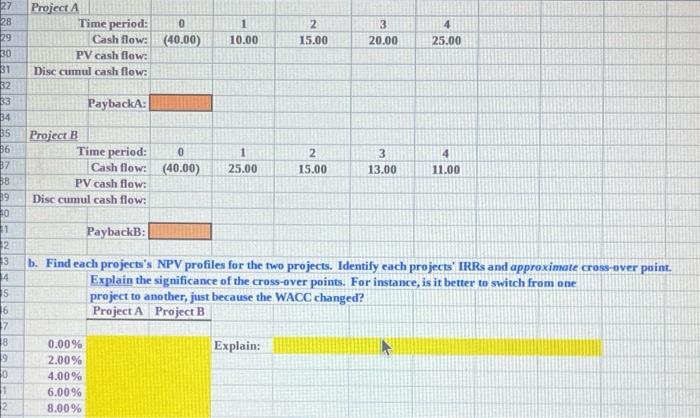

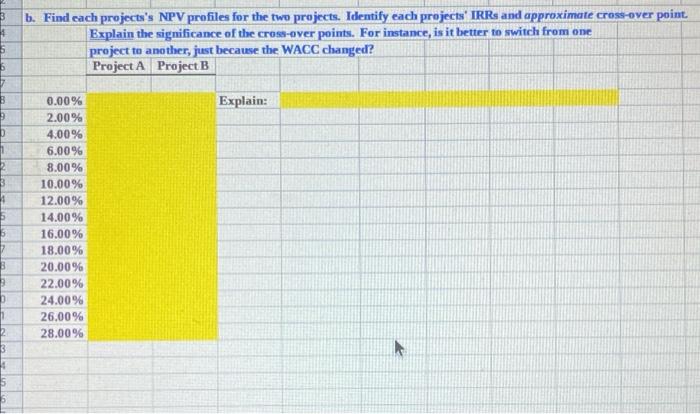

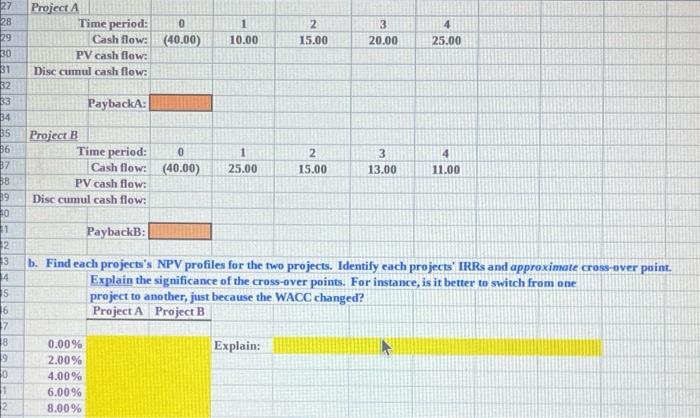

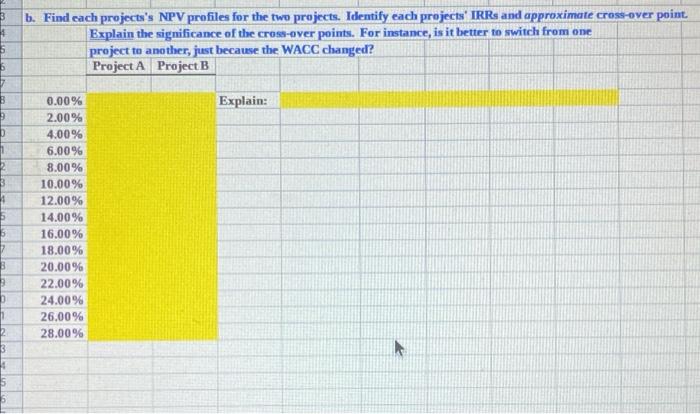

1 2 3 Your division is considering two projects. Its WACC is 12%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: CON 4 5 6 7 8 Time 0 1 2 3 4 Expected net cash flows Project A Project B (540) (540) $10 $25 $15 $15 $20 $13 $25 $11 9 10 11 12 You need to find the NPV, IRR, MIRR, Discounted Payback and NPV profile in this question. 13 14 a. Calculate the projects' NPVs, IRRS, MIRRs, and discounted paybacks. WACC = 12% NPVA NPVB = 15 16 17 18 9 10 1 IRRA IRRB = 2 3 5 Reinvestment rate is 8%. MIRRA= MIRRB = Project A Time period: Cash flow: PV cash flow: Disc cumul cash flow: 0 (40.00) 1 10.00 2 15.00 3 20.00 4 25.00 27 28 29 30 31 32 33 34 35 36 37 BB 19 10 PaybackA: 4 Project B Time period: 0 Cash flow: (40,00) PV cash flow: Disc cumul cash flow: 1 25.00 2 15.00 3 13.00 11.00 PaybackB: b. Find each projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross-over point. Explain the significance of the cross-over points. For instance, is it better to switch from one project to another, just because the WACC changed? Project A Project B 2 3 4 5 16 7 18 19 0 1 2 Explain: 0.00% 2.00% 4.00% 6.0096 8.00% 3 1 5 6 b. Find cach projects's NPV profiles for the two projects. Identify each projects' IRRs and approximate cross-over point Explain the significance of the cross-over points. For instance, is it better to switch from one project to another, just because the WACC changed? Project A Project. B 3 Explain: 1 3 3 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00% 24.00% 26.00% 28.00% 5 12 3 1 2 3 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started