Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help (1) CAPM predicts that the risk premium increase in proportion to the beta of a security. Justify this statement using Figures 10.6 and

please help

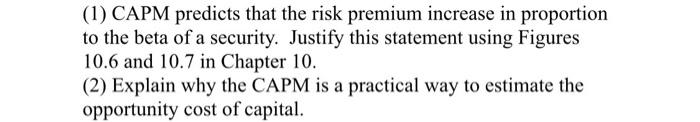

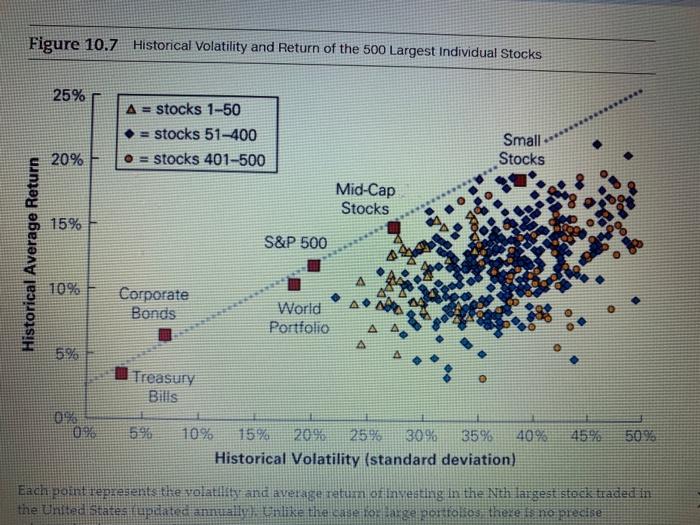

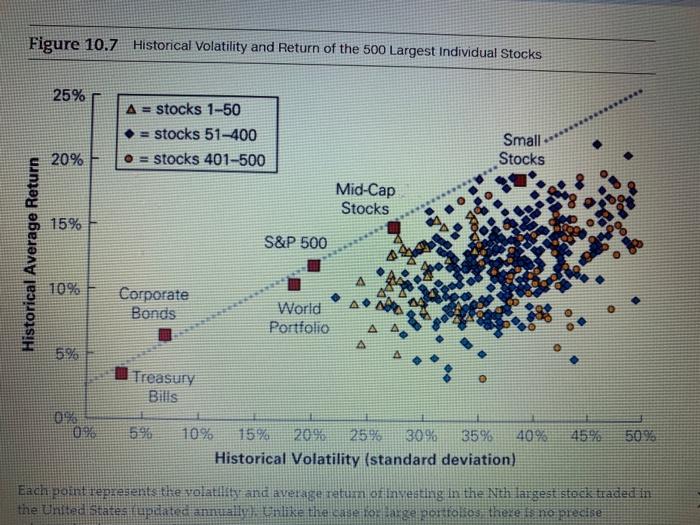

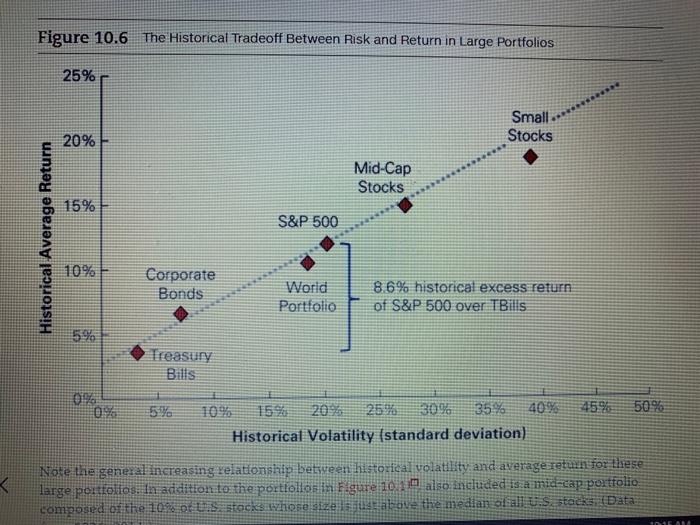

(1) CAPM predicts that the risk premium increase in proportion to the beta of a security. Justify this statement using Figures 10.6 and 10.7 in Chapter 10. (2) Explain why the CAPM is a practical way to estimate the opportunity cost of capital. Figure 10.7 Historical Volatility and Return of the 500 Largest Individual Stocks 25% - stocks 1-50 = stocks 51-400 = stocks 401-500 Small Stocks 20% Mid-Cap Stocks 15% S&P 500 Historical Average Return Corporate Bonds World Portfolio A 5% Treasury Bills 0% 590 10% 15% 20% 25% 30% 35% 40% 45% 5093 Historical Volatility (standard deviation) Each point represents the volatility and average retum iinvesting in the Nth largest stock traded in the United States updates annually). Unlike the case o arge portfolios there is no precise Figure 10.6 The Historical Tradeoff Between Risk and Return in Large Portfolios 25% en Small Stocks 20% . Mid-Cap Stocks 15% S&P 500 Historical Average Return 10% Corporate Bonds World Portfolio 8.6% historical excess return of S&P 500 over TBills Treasury Bills 09 45% 50% 10% 15% 200 25% 3098 35%. 40 Historical Volatility (standard deviation)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started