please help!!

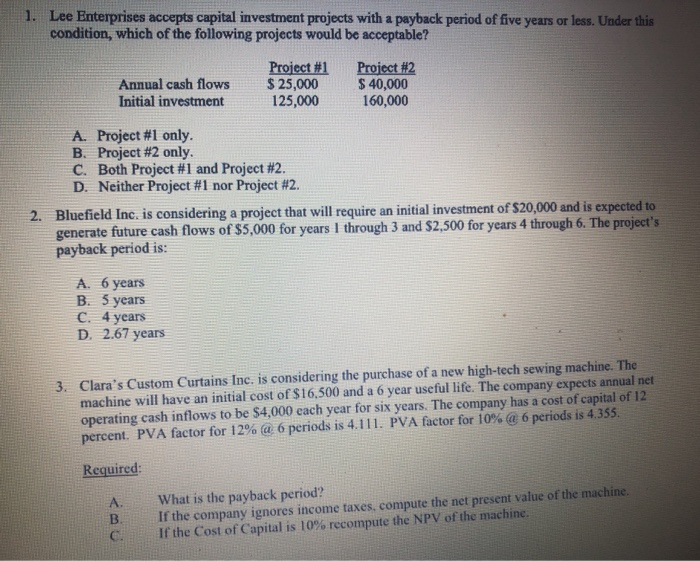

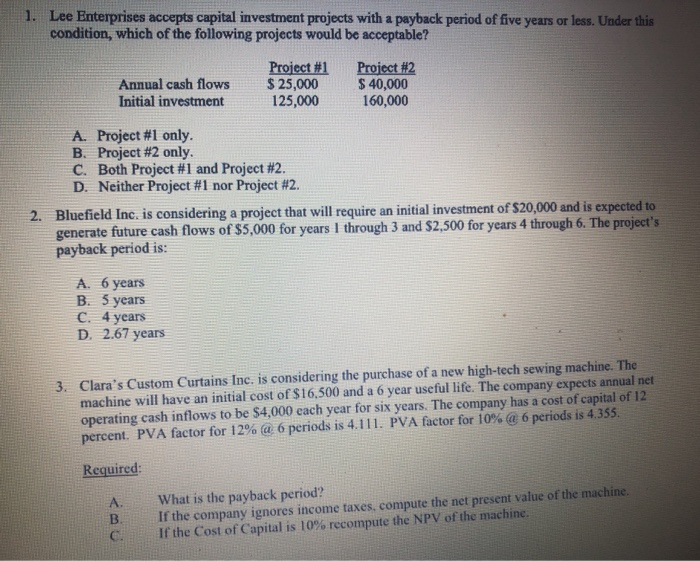

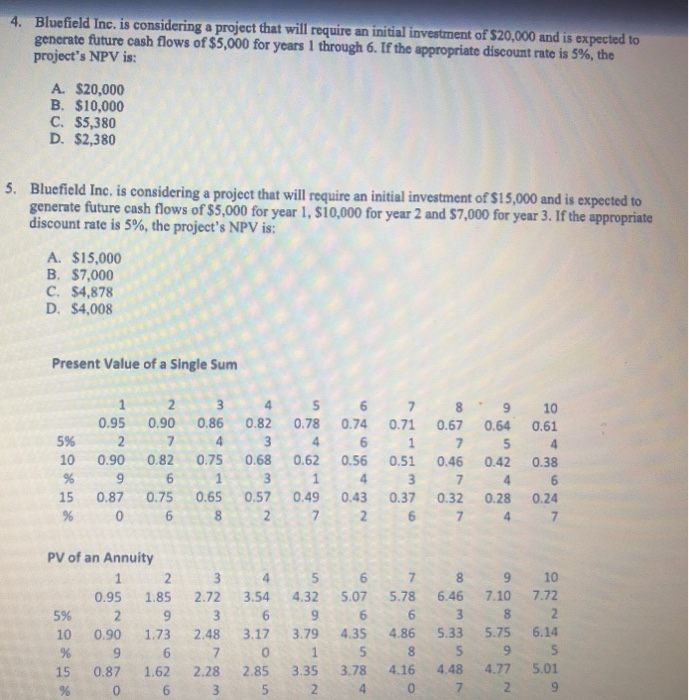

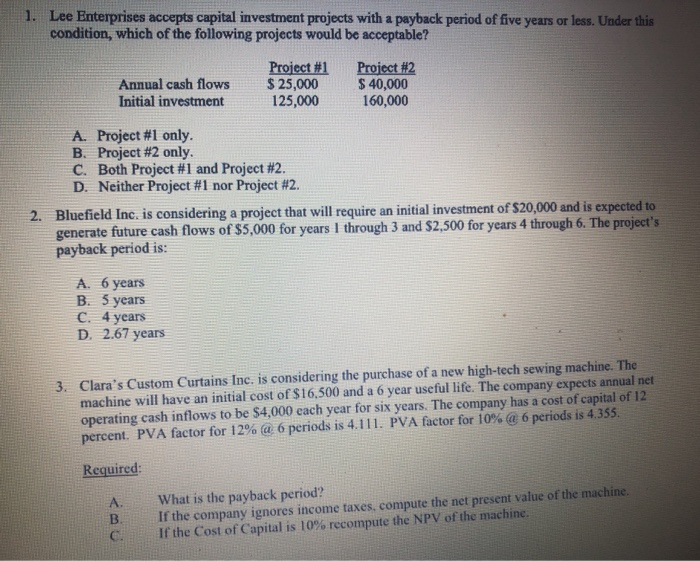

1. Lee Enterprises accepts capital investment projects with a payback period of five years or less. Under this condition, which of the following projects would be acceptable? Annual cash flows Initial investment Project #1 $ 25,000 125,000 Project #2 $ 40,000 160,000 A. Project #1 only. B. Project #2 only. C. Both Project #1 and Project #2. D. Neither Project #1 nor Project #2. Bluefield Inc. is considering a project that will require an initial investment of $20,000 and is expected to generate future cash flows of $5,000 for years 1 through 3 and $2,500 for years 4 through 6. The project's payback period is: A. 6 years B. 5 years C. 4 years D. 2.67 years 3. Clara's Custom Curtains Inc. is considering the purchase of a new high-tech sewing machine. The machine will have an initial cost of $16,500 and a 6 year useful life. The company expects annual net operating cash inflows to be $4,000 each year for six years. The company has a cost of capital of 12 percent. PVA factor for 12% @ 6 periods is 4.111. PVA factor for 10% @ 6 periods is 4.355. Required: What is the payback period? If the company ignores income taxes, compute the net present value of the machine If the Cost of Capital is 10% recompute the NPV of the machine. 4. Bluefield Inc. is considering a project that will require an initial investment of $20,000 and is expected to generate future cash flows of $5,000 for years 1 through 6. If the appropriate discount rate is 5%, the project's NPV is: A. $20,000 B. $10,000 C. $5,380 D. $2,380 Bluefield Inc. is considering a project that will require an initial investment of $15,000 and is expected to generate future cash flows of $5,000 for year 1, $10,000 for year 2 and $7,000 for year 3. If the appropriate discount rate is 5%, the project's NPV is: A. $15,000 B. $7,000 C. $4,878 D. $4,008 Present Value of a Single Sum 5% 10 % 15 % 0.95 2 0.90 9 0.87 0 0.90 7 0.82 6 0.75 6 0.86 4 0.75 1 0.65 8 0.82 3 0.68 3 0.57 2 0.78 4 0.62 1 0.49 7 6 0.74 6 0.56 4 0.43 2 7 0.71 1 0.51 3 0.37 6 8 0.67 7 0.46 7 0.32 7 9 0.64 5 0.42 4 0.28 4 10 0.61 4 0.38 6 0.24 7 PV of an Annuity 6 7 8 9 10 0.95 1.85 2.72 3.54 4.32 5.07 5.78 6.46 7.10 7.72 5% 2 9 3 6 9 6 6 3 8 2 10 0.90 1.73 2.48 3.17 3.79 4.35 4.86 5.33 5.75 6.14 % 9 6 7 o 15 85 95 15 0.87 1.62 2.28 2.85 3.35 3.78 4.16 4.48 4.77 5.01 % 6 3 5 2 4 0 7 2 9