Answered step by step

Verified Expert Solution

Question

1 Approved Answer

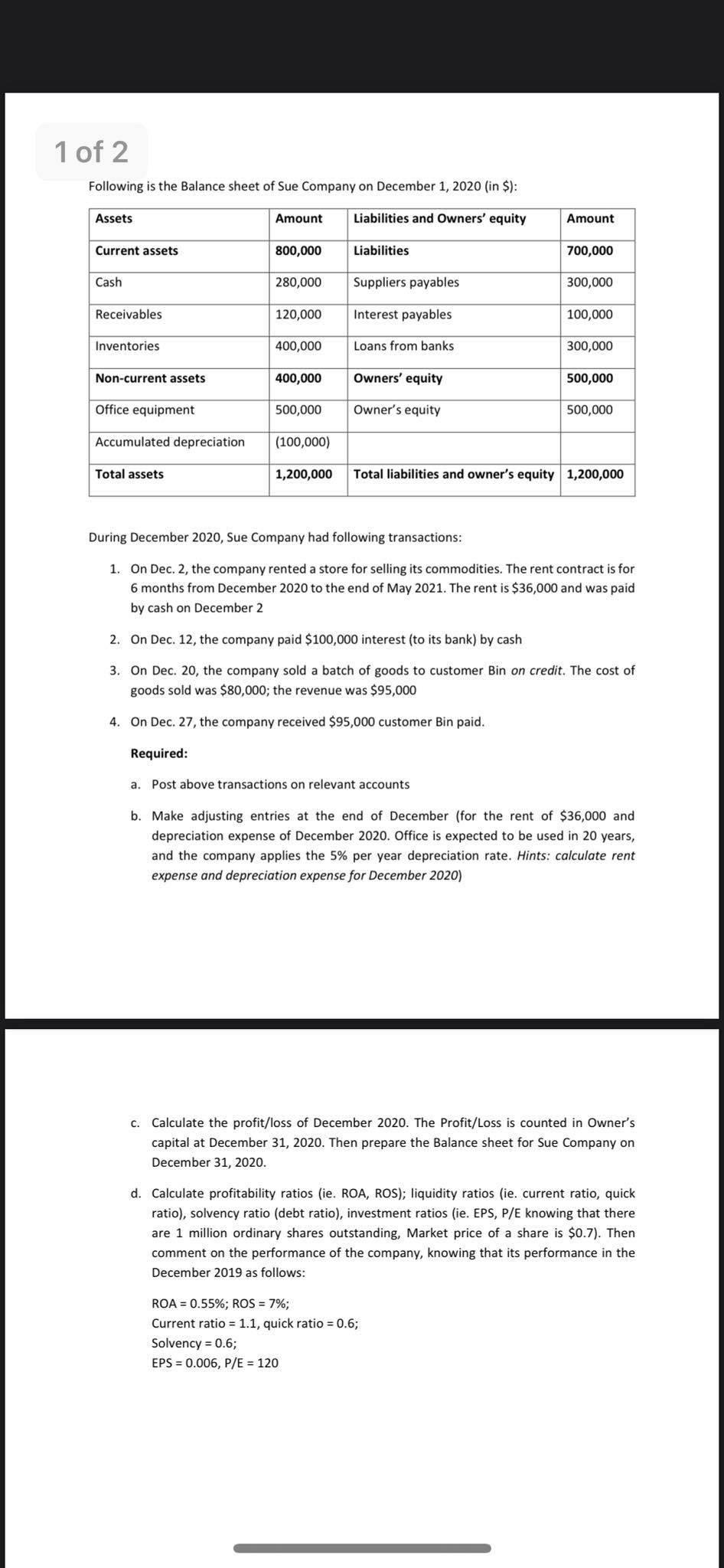

PLEASE HELP!!! 1 of 2 Following is the Balance sheet of Sue Company on December 1, 2020 (in $): Assets Amount Liabilities and Owners' equity

PLEASE HELP!!!

1 of 2 Following is the Balance sheet of Sue Company on December 1, 2020 (in $): Assets Amount Liabilities and Owners' equity Amount Current assets 800,000 Liabilities 700,000 Cash 280,000 Suppliers payables 300,000 Receivables 120,000 Interest payables 100,000 Inventories 400,000 Loans from banks 300,000 Non-current assets 400,000 Owners' equity 500,000 Office equipment 500,000 Owner's equity 500,000 Accumulated depreciation (100,000) Total assets 1,200,000 Total liabilities and owner's equity 1,200,000 During December 2020, Sue Company had following transactions: 1. On Dec. 2, the company rented a store for selling its commodities. The rent contract is for 6 months from December 2020 to the end of May 2021. The rent is $36,000 and was paid by cash on December 2 2. On Dec. 12, the company paid $100,000 interest (to its bank) by cash 3. On Dec. 20, the company sold a batch of goods to customer Bin on credit. The cost of goods sold was $80,000; the revenue was $95,000 4. On Dec. 27, the company received $95,000 customer Bin paid. Required: a. Post above transactions on relevant accounts b. Make adjusting entries at the end of December (for the rent of $36,000 and depreciation expense of December 2020. Office is expected to be used in 20 years, and the company applies the 5% per year depreciation rate. Hints: calculate rent expense and depreciation expense for December 2020) C. Calculate the profit/loss of December 2020. The Profit/Loss is counted in Owner's capital at December 31, 2020. Then prepare the Balance sheet for Sue Company on December 31, 2020. d. Calculate profitability ratios (ie. ROA, ROS); liquidity ratios (ie. current ratio, quick ratio), solvency ratio (debt ratio), investment ratios (ie. EPS, P/E knowing that there are 1 million ordinary shares outstanding, Market price of a share is $0.7). Then comment on the performance of the company, knowing that its performance in the December 2019 as follows: ROA = 0.55%; ROS = 7%; Current ratio = 1.1, quick ratio = 0.6; Solvency = 0.6; EPS = 0.006, P/E = 120Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started