Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! (11) When it purchased Sutton, Inc. on January 1, 20X1, Pavin Corporation issued 500,000 shares of its par voting common stock. On that

please help!

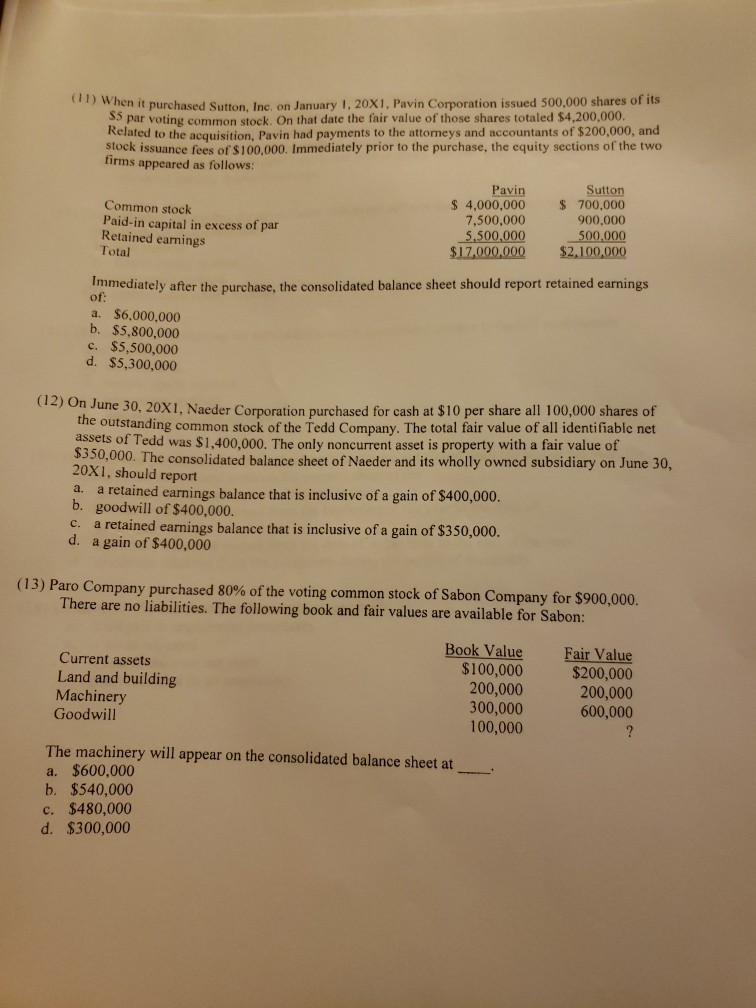

(11) When it purchased Sutton, Inc. on January 1, 20X1, Pavin Corporation issued 500,000 shares of its par voting common stock. On that date the fair value of those shares totaled $4,200,000 Related to the acquisition, Pavin had payments to the attormeys and accountants of $200,000, and stock issuance fees of $100,000. Immediately prior to the purchase, the equity sections of the two firms appeared as follows: Pavin 4,000,000 7,500,000 Sutton 700,000 900,000 500,000 $2,100,000 Common stock Paid-in capital in excess of par Retained earnings Total 5.500,000 $17,000,000 mmediately after the purchase, the consolidated balance sheet should report retained earnings of: a. $6,000,000 b. $5,800,000 c. $5,500,000 d. $5,300,000 (12) On June 30, 20X1, Naeder Corporation purchased for cash at $10 per share all 100,000 shares of the outstanding common stock of the Tedd Company. The total fair value of all identifiable net assets of Tedd was $1,400,000. The only noncurrent asset is property with a fair value of $350,000. The consolidated balance sheet of Naeder and its wholly owned subsidiary on June 30, 20X1, should report a retained earnings balance that is inclusive of a gain of $400,000. b. goodwill of $400,000. C. a retained earnings balance that is inclusive of a gain of $3 50,000. d. a gain of $400,000 a. (13) Paro Company purchased 80% of the voting common stock of Sabon Company for $900,000. There are no liabilities. The following book and fair values are available for Sabon: Book Value Fair Value $200,000 200,000 600,000 Current assets $100,000 200,000 300,000 100,000 Land and building Machinery Goodwill ? The machinery will appear on the consolidated balance sheet at a. $600,000 b. $540,000 c. $480,000 d. $300,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started