please help

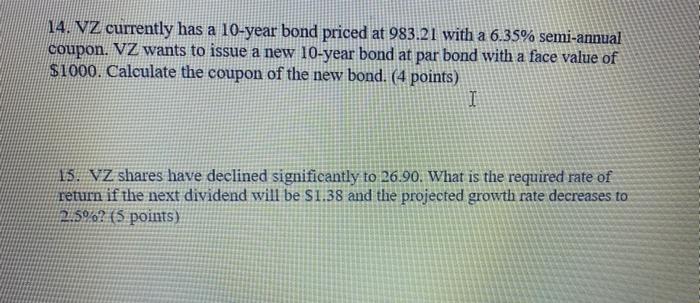

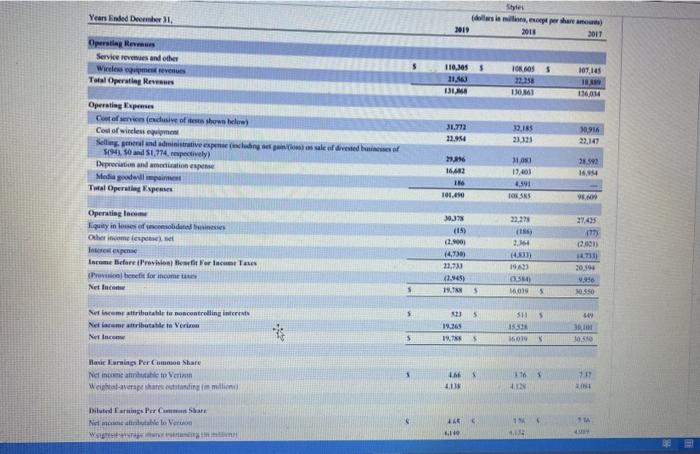

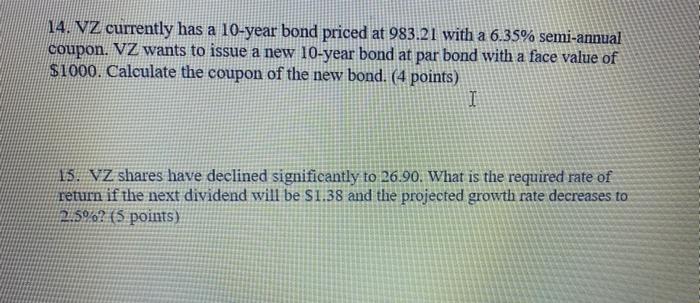

14. VZ currently has a 10-year bond priced at 983.21 with a 6.35% semi-annual coupon. VZ wants to issue a new 10-year bond at par bond with a face value of $1000. Calculate the coupon of the new bond. (4 points) 1 15. VZ shares have declined significantly to 26.90. What is the required rate of return if the next dividend will be $1.38 and the projected growth rate decreases to 2.590? (5 points) Styles Years Kinded Deer I 2019 2018 2017 Operating Revers Services and other Wiesentere Total Operating Revues 110.30 10.SOS S 107,145 IS 174094 130.06) 31.772 12.954 13,185 33333 10916 Operating Expense Cost of conduse of shows) Cost of wicement Sellingen und mitutive experiencing af diverted of 5094 50 and 51,774, respectively) Depreciation and mentionespense Media will me Total Operating per 3100 17,00) 25.592 16.654 16,412 186 101.00 4.591 TOX35 . Operating In qy in loofde the income lep 0.37 (15) 22.278 (188 2014 d. 0.001) 17 20,39 ISA Income Before rosii Brian benefit for income Net Inc (4130) 20,30 2.94 19. $ MON 5 MOSSO 5 5 Metincem attributable to controlling interest Nellarme attributable to Verin Ner Inc 3 19.30 19.75 5115 153 1019 3 1 5 Hasiekarning Per Common Share Net income and to en Whave hangi milioni 711 1165 LIN Diluted sings Per Care Nectable love W 26 11 convalidated States opel vecerizonicam Inc. and Solsidiaries (dollars in millions 2018 2017 Years Ended December 31. 2019 19,788 5 16,019 $ 30350 345 Net Income Other Comprehensive Loss, Net of Tus (Expense) Benefit Foreign currency translation adjustments, net of tax of 121). (11) and 530 Unrealized gain (los) on cash flow hedges, nct of tax of 5265, S(19) and 520 Unrealized gain (los) ce marketable securities, net of tax of 250 and 10 Defined benefit pension and postretirement plams, net of tax of 5219, 5384 and 5144 Other comprehensive loss attributable to Verizon Total Comprehensive Income 16 (736) 7 (659) (117) 55 1 (8389 19199 15.120 $ (31) (149 214) (14) 30.336 (1372) 18.416 5 5 5 523 17,193 SLI 14.60 449 30.01 Comprehensive income attributable to controlling interest Comprehensive income attributable to Veron Total Comprehensive Income 18.416 5 15.120 5 30 536