Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help 15.) Lori is a qualifying widow in 2022 and reports the following income: $120,000 of W-2 salary, $5,000 Interest (incl. $3,000 interest from

Please help

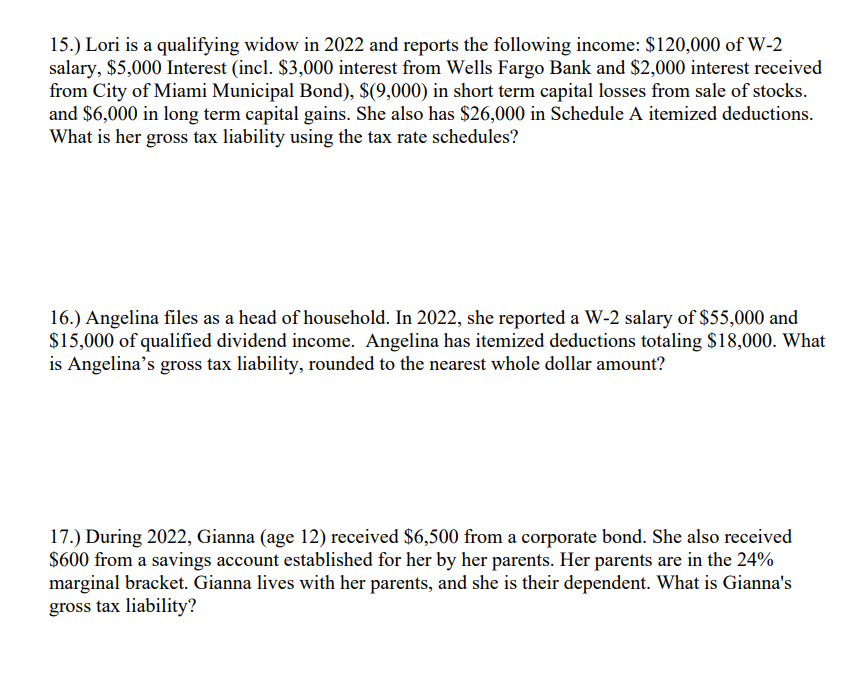

15.) Lori is a qualifying widow in 2022 and reports the following income: $120,000 of W-2 salary, \$5,000 Interest (incl. \$3,000 interest from Wells Fargo Bank and \$2,000 interest received from City of Miami Municipal Bond), $(9,000) in short term capital losses from sale of stocks. and $6,000 in long term capital gains. She also has $26,000 in Schedule A itemized deductions. What is her gross tax liability using the tax rate schedules? 16.) Angelina files as a head of household. In 2022 , she reported a W-2 salary of $55,000 and $15,000 of qualified dividend income. Angelina has itemized deductions totaling $18,000. What is Angelina's gross tax liability, rounded to the nearest whole dollar amount? 17.) During 2022, Gianna (age 12) received $6,500 from a corporate bond. She also received $600 from a savings account established for her by her parents. Her parents are in the 24% marginal bracket. Gianna lives with her parents, and she is their dependent. What is Gianna's gross tax liability

15.) Lori is a qualifying widow in 2022 and reports the following income: $120,000 of W-2 salary, \$5,000 Interest (incl. \$3,000 interest from Wells Fargo Bank and \$2,000 interest received from City of Miami Municipal Bond), $(9,000) in short term capital losses from sale of stocks. and $6,000 in long term capital gains. She also has $26,000 in Schedule A itemized deductions. What is her gross tax liability using the tax rate schedules? 16.) Angelina files as a head of household. In 2022 , she reported a W-2 salary of $55,000 and $15,000 of qualified dividend income. Angelina has itemized deductions totaling $18,000. What is Angelina's gross tax liability, rounded to the nearest whole dollar amount? 17.) During 2022, Gianna (age 12) received $6,500 from a corporate bond. She also received $600 from a savings account established for her by her parents. Her parents are in the 24% marginal bracket. Gianna lives with her parents, and she is their dependent. What is Gianna's gross tax liability Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started