Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP 16. 17. 18. 19. 20. 21. Mickley Company's plantwide predetermined overhead rate is $18.00 per direct labor-hour and its direct labor wage rate

PLEASE HELP

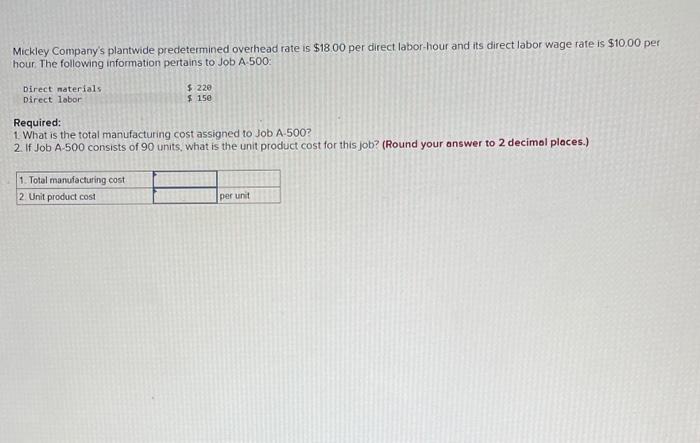

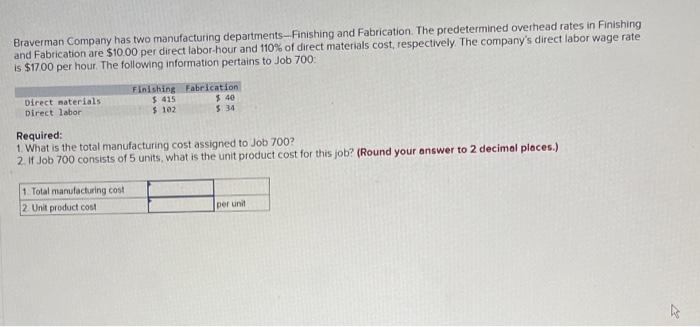

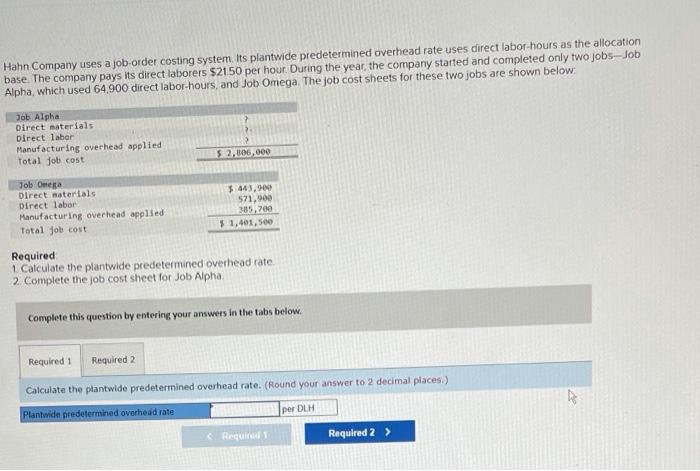

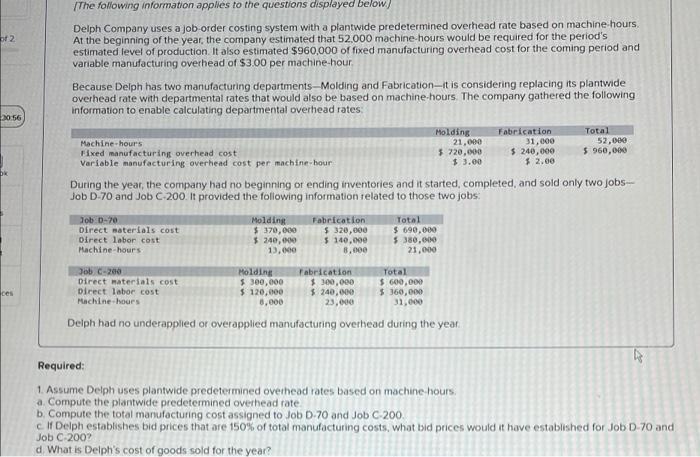

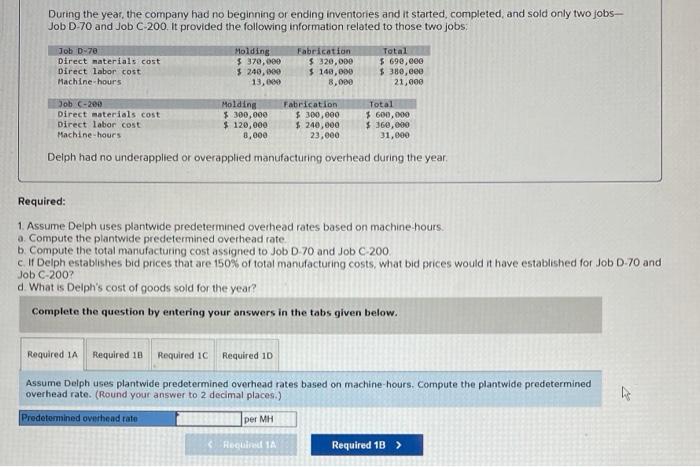

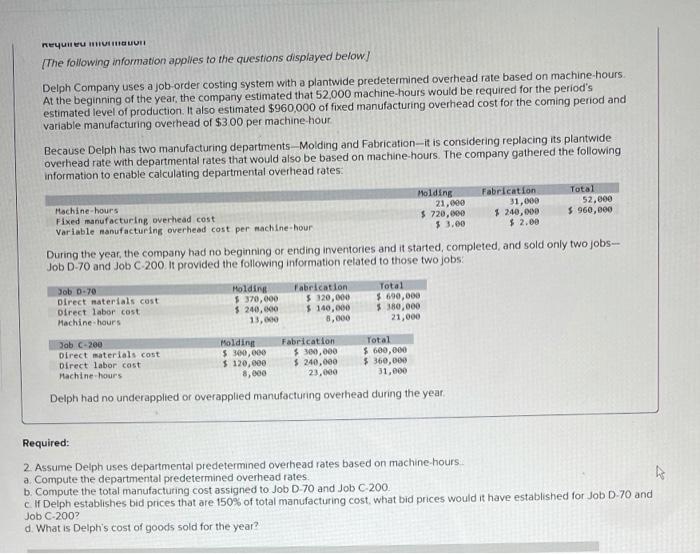

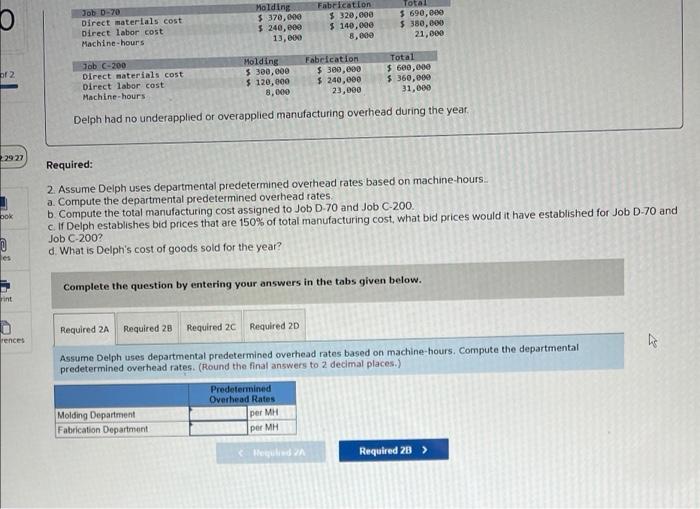

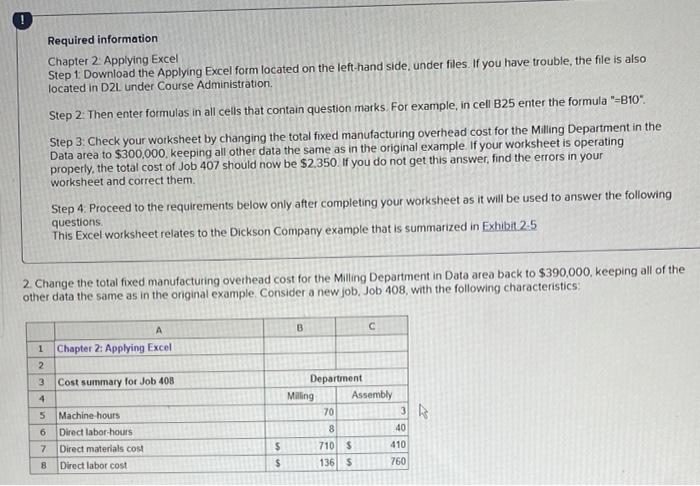

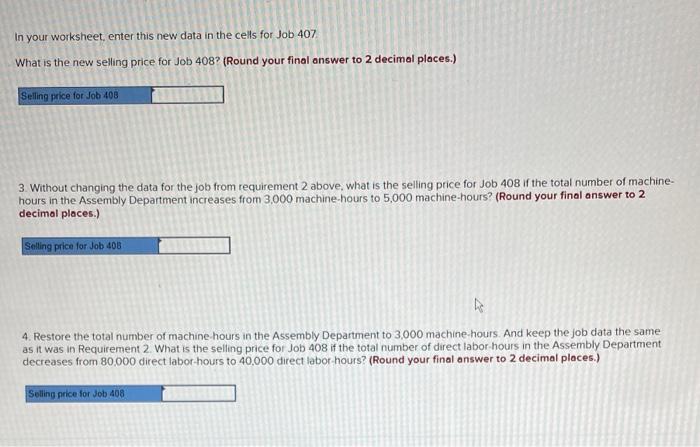

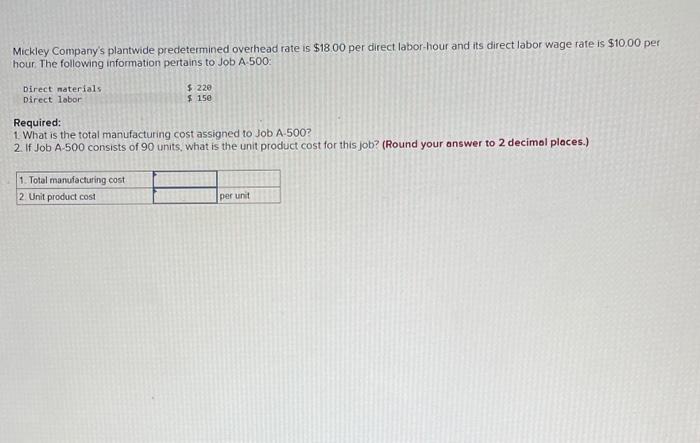

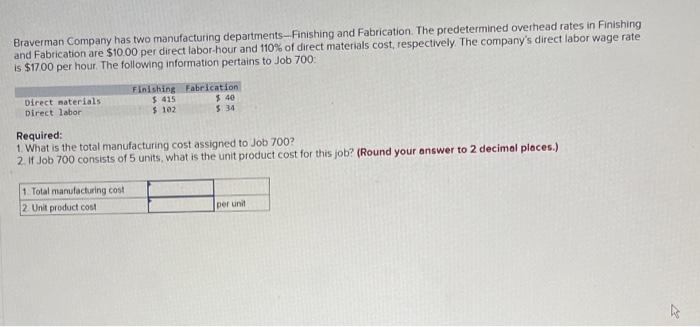

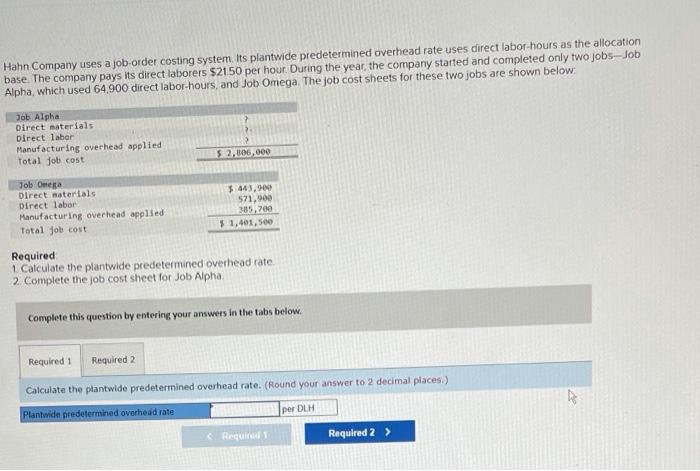

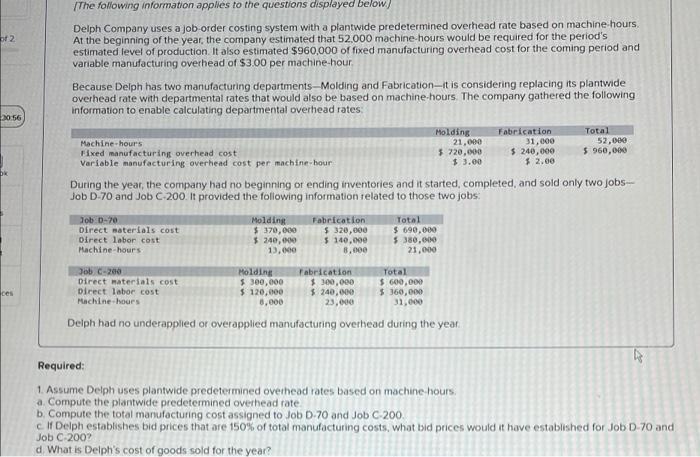

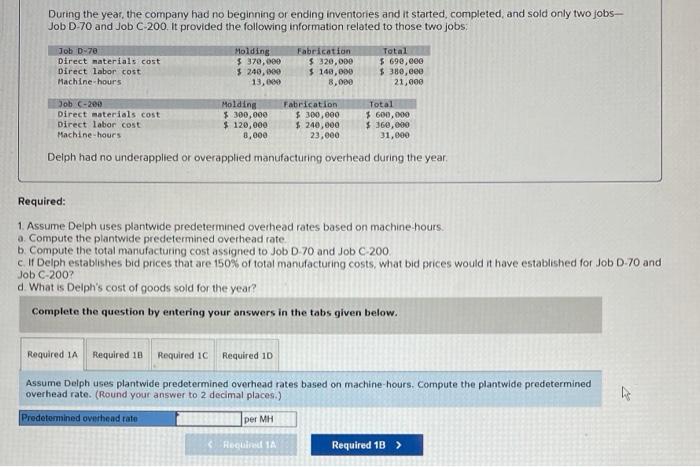

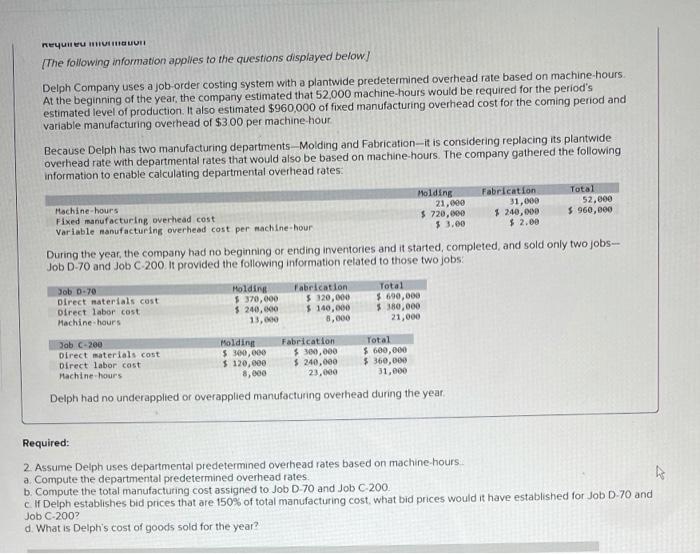

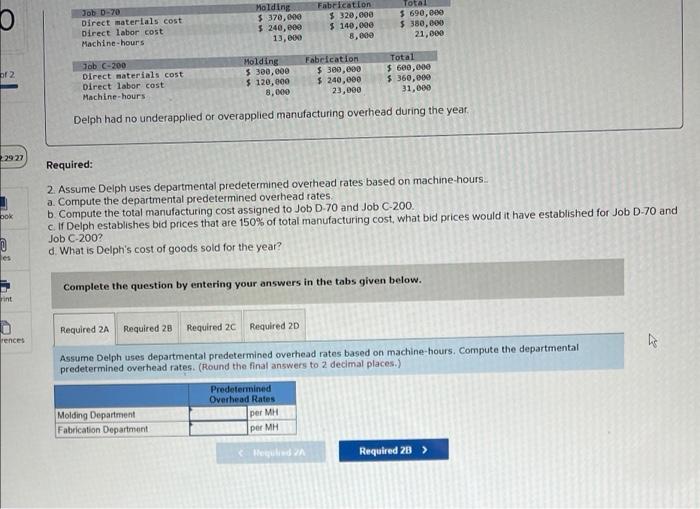

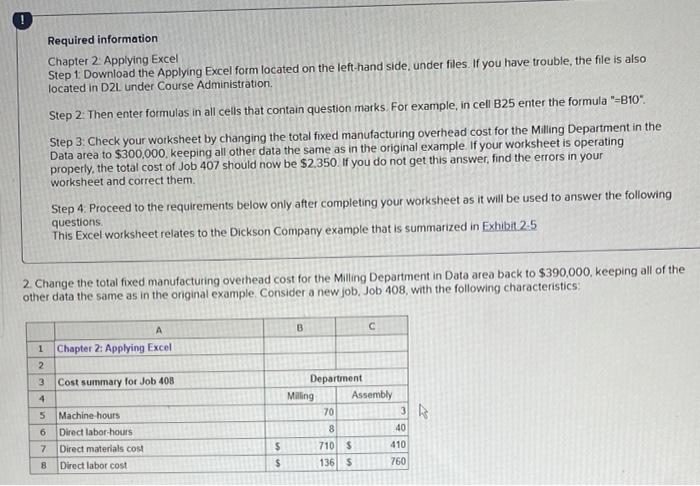

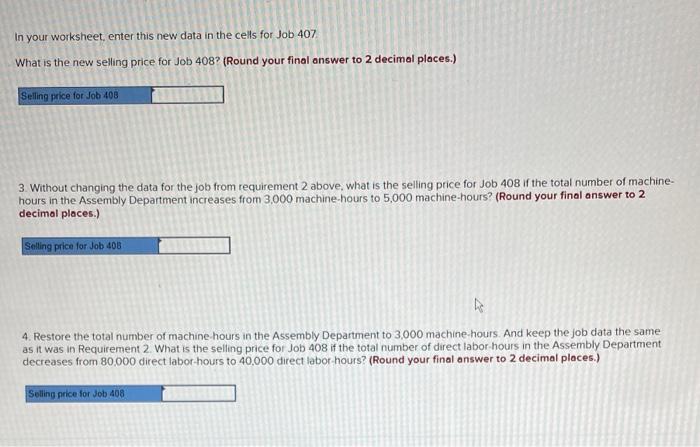

Mickley Company's plantwide predetermined overhead rate is $18.00 per direct labor-hour and its direct labor wage rate is $10,00 per hour. The following information pertains to Job A 500 Direct materials Direct labor $ 220 $ 150 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 90 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2 Unit product cost per unit Braverman Company has two manufacturing departments --Finishing and Fabrication. The predetermined overhead rates in Finishing and Fabrication are $10.00 per direct labor-hour and 110% of direct materials cost, respectively. The company's direct labor wage rate is $1700 per hour. The following information pertains to Job 700 Direct materials Direct labor Finishing Fabrication $415 40 $ 102 5 34 Required: 1 What is the total manufacturing cost assigned to Job 700? 2. Job 700 consists of 5 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1 Total manufacturing cost 2. Unit productos per unit Hahn Company uses a job order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $2150 per hour. During the year the company started and completed only two jobs--Job Alpha, which used 64.900 direct labor-hours, and Job Omega The job cost sheets for these two jobs are shown below Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost 52,806,000 Job Omega Direct materials Direct labor Manufacturing overhead applied Total Job cost $ 443,909 571,900 305,700 $ 1,461,500 Required 1. Calculate the plantwide predetermined overhead rate 2. Complete the job cost sheet for Job Alpha Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places) Plantwide predetermined overhead rate per DLM Regu Required 2 > of 2 20:56 The following information applies to the questions displayed below! Delph Company uses a job order costing system with a plantwide predetermined overhead rate based on machine hours. At the beginning of the year, the company estimated that 52.000 machine hours would be required for the period's estimated level of production. It also estimated $960,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per machine-hour Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates Molding Fabrication Total Machine-hours 21.000 31,000 52,000 Fixed manufacturing overhead cost 5.720,000 $ 240,000 $ 960.000 Variable manufacturing overhead cost per machine hour $ 3.00 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs Job D 70 and Job C 200. It provided the following information related to those two jobs: Job D-70 Molding Fabrication Total Direct materials cost $ 370,000 $ 320,000 $ 690,000 Direct labor cost $240,00 $ 140,000 $ 380,000 Machine-hours 13,000 8.000 21.000 Job C-200 Molding Fabrication Total Direct materials cost $300,000 $300,000 $ 600,000 Direct labor cost $ 120,000 $ 240,000 $360,000 Machine-hours 8,000 23,000 31,000 $ 2.00 ces Delph had no underapplied or overapplied manufacturing overhead during the year Required: 1. Assume Delph uses plantwide predetermined overhead rates based on machine hours a Compute the plantwide predetermined overhead rate b. Compute the total manufacturing cost assigned to Job D. 70 and Job C 200 I Delph establishes bid prices that are 150% of total manufacturing costs, what bid prices would it have established for Job D-70 and d. What is Delph's cost of goods sold for the year? Job 0 2002 During the year, the company had no beginning or ending inventories and it started, completed and sold only two jobs- Job D-70 and Job C-200. It provided the following information related to those two jobs Job D-70 Direct materials cost Direct labor cost Machine-hours Molding $ 370,000 $ 240,000 13,00 Fabrication $ 320,000 $ 140,000 8,000 Total $ 690,000 $ 380,000 21,600 Job C-200 Direct materials cost Direct labor cost Machine-hours Molding $ 300,000 $120,000 8,000 Fabrication $ 300,000 $ 240,000 23.ee Total $600,000 $360,000 31,800 Delph had no underapplied or overapplied manufacturing overhead during the year Required: 1. Assume Delph uses plantwide predetermined overhead rates based on machine hours. 0. Compute the plantwide predetermined overhead rate b Compute the total manufacturing cost assigned to Job D-70 and Job C 200 c It Delph establishes bid prices that are 150% of total manufacturing costs, what bid prices would it have established for Job D-70 and Job C-2002 d. What is Delph's cost of goods sold for the year? Complete the question by entering your answers in the tabs given below. Required 1A Required 18 Required IC Required 10 Assume Delph uses plantwide predetermined overhead rates based on machine-hours, compute the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Predetermined overhead rate per MH R RIA Required 1B > Requireu HIRGLUTI The following information applies to the questions displayed below! Delph Company uses a job-order costing system with a plantwide predetermined overhead rate based on machine hours. At the beginning of the year, the company estimated that 52,000 machine hours would be required for the period's estimated level of production. It also estimated $960,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $300 per machine hour Because Delph has two manufacturing departments-Molding and Fabricationit is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine hours. The company gathered the following information to enable calculating departmental overhead rates: Total Molding 21,00 $ 720.000 53.00 Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Fabrication 31,000 240,000 $ 2.00 52.000 $ 960,000 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs Job D-70 and Job C 200. It provided the following information related to those two jobs Job 0.70 Direct materials cost Direct labor cost Hachine-hours Holding $ 370,000 $ 240,000 13,00 Fabrication $ 120,000 $ 140,000 8,000 Total $ 690,000 $380,000 21,000 Job C-200 Direct materials cost Direct labor cost Machine hours Molding 5 300,000 $ 120,000 8,000 Fabrication $ 30,000 $ 240,000 23.000 Total $ 600,000 $360,000 31,000 Delph had no underapplied or overapplied manufacturing overhead during the year Required: 2. Assume Delph uses departmental predetermined overhead rates based on machine hours a. Compute the departmental predetermined overhead rates b. Compute the total manufacturing cost assigned to Job D-70 and Job C 200 CI Delph establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job D 70 and Job C-2002 d. What is Delph's cost of goods sold for the year? Job D-70 Direct materials cost Direct labor cost Machine-hours Molding $ 370,00 $ 240,000 13,000 Fabrication $ 320,000 $ 140,000 8,800 Total $ 690,000 $ 380,000 21,000 of 2 Job C-200 Direct materials cost Direct labor cost Machine-hour's Molding $ 300,000 $ 120,000 8,000 Fabrication $ 300,000 $ 240,000 23,000 Total $ 600,000 $360,000 31,000 Delph had no underapplied or overapplied manufacturing overhead during the year 2927 Required: pok 2. Assume Delph uses departmental predetermined overhead rates based on machine-hours a. Compute the departmental predetermined overhead rates. b. Compute the total manufacturing cost assigned to Job D 70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing cost, what bid prices would it have established for Job D-70 and Job C-2002 d. What is Delph's cost of goods sold for the year? es Complete the question by entering your answers in the tabs given below. int Required 2A Required 28 Required 2C Required 2D rences Assume Delph uses departmental predetermined overhead rates based on machine-hours. Compute the departmental predetermined overhead rates. (Round the final answers to 2 decimal places.) Molding Department Fabrication Department Predetermined Overhead Rates per MH per MH WA Required 28 > Required information Chapter 2 Applying Excel Step 1 Download the Applying Excel form located on the left-hand side, under files. If you have trouble, the file is also located in D2L under Course Administration Step 2. Then enter formulas in all cells that contain question marks. For example, in cell B25 enter the formula "=B10". Step 3. Check your worksheet by changing the total fixed manufacturing overhead cost for the Milling Department in the Data area to $300,000, keeping all other data the same as in the original example. If your worksheet is operating properly, the total cost of Job 407 should now be $2,350. If you do not get this answer, find the errors in your worksheet and correct them Step 4. Proceed to the requirements below only after completing your worksheet as it will be used to answer the following questions This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit25 2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example Consider a new job, Job 408, with the following characteristics B 1 Chapter 2: Applying Excel 2 3 Cost summary for Job 408 4 5 Machine-hours 6 Direct labor hours 7 Direct materials cost 8 Direct labor cost Department Milling Assembly 70 3 R 8 40 710 $ 410 1365 760 $ $ In your worksheet, enter this new data in the cells for Job 407 What is the new selling price for Job 408? (Round your final answer to 2 decimal places.) Selling price for Job 408 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 If the total number of machine- hours in the Assembly Department increases from 3,000 machine-hours to 5,000 machine-hours? (Round your final answer to 2 decimal places.) Selling price for Job 408 4 Restore the total number of machine hours in the Assembly Department to 3,000 machine hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor hours in the Assembly Department decreases from 80,000 direct labor hours to 40,000 direct labor hours? (Round your final answer to 2 decimal places.) Selling price for Job 408 16.

17.

18.

19.

20.

21.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started