Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help 19:29 54% D10. XYC Trucking_al of Fixed Assets - Read-only Sign in to edit and save changes to this file. ii) Trucks Disposal

please help

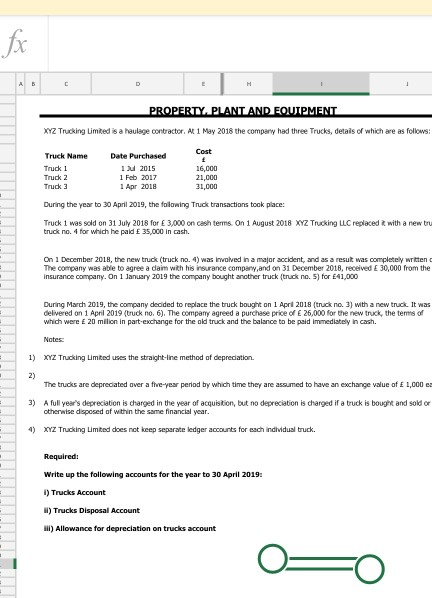

19:29 54% D10. XYC Trucking_al of Fixed Assets - Read-only Sign in to edit and save changes to this file. ii) Trucks Disposal Account COM IM Team 20 . The newly 2035 2.000 och borre. On lagunto XXL TrackingCod with truck or which he paid 35,000 h De beboud in a major citanda cari econds to de monotopom. On my the company bought the buckere Sir 11 During 2013, the company decided to place the trud boughton rrukohane trudim S 1. The pred a pictwo head, wine of 30 H Www Serwery medio A torbedintre coton, but more charged alok bought and dat Trucs et Testy Account Task III 0 09:04 al 12% D10. XYC Trucking_al of Fixed Assets - Read-only Sign in to edit and save changes to this file. PROPERT. BLANT AND ENEMENT III 0 fx C H PROPERTY. PLANT AND EQUIPMENT XYZ Trucking Limited is a haulage contractor. At 1 May 2018 the company had three Trucks, details of which are as follows: Truck Name Date Purchased Cost Truck 1 12 2015 16,000 Truck 2 1 Feb 2017 21,000 Truck 3 1 Apr 2018 31,000 During the year to 30 April 2019, the following Truck transactions took place: Truck 1 was sold on 31 July 2018 for 3,000 on cash terms on 1 August 2018 XYZ Trucking LLC replaced it with a new tru truck no. 4 for which he paid 35,000 in cash. On 1 December 2018, the new truck (truck no. 4) was involved in a major accident, and as a result was completely written The company was able to agree a daim with his insurance company, and on 31 December 2018, received E 30,000 from the Insurance company. On 1 January 2019 the company bought another truck (truck no. 5) for 41,000 . . During March 2019, the company decided to replace the truck bought on 1 April 2018 truck no. 3) with a new truck. It was delivered on 1 April 2019 truck no. 6). The company agreed a purchase price of E 25,000 for the new truck, the terms of which were 20 milion in part-exchange for the old truck and the balance to be paid immediately in cash. Notes: 1) XYZ Trucking Limited uses the straight-line method of depreciation. 2) The trucks are depreciated over a five-year period by which time they are assumed to have an exchange value of 1,000 e 3) A full year's depreciation is charged in the year of acquisition, but no depreciation is charged if a truck is bought and sold or otherwise disposed of within the same financial year. 4) XYZ Trucking Limited does not keep separate ledger accounts for each individual truck. Required: Write up the following accounts for the year to 30 April 2019 1) Trucks Account 1) Trucks Disposal Account I) Allowance for depreciation on trucks account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started