Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help 2 points QUESTION 1 Kentucky Technology has a weighted average cost of capital of 8.06 percent and is evaluating two projects: A and

please help

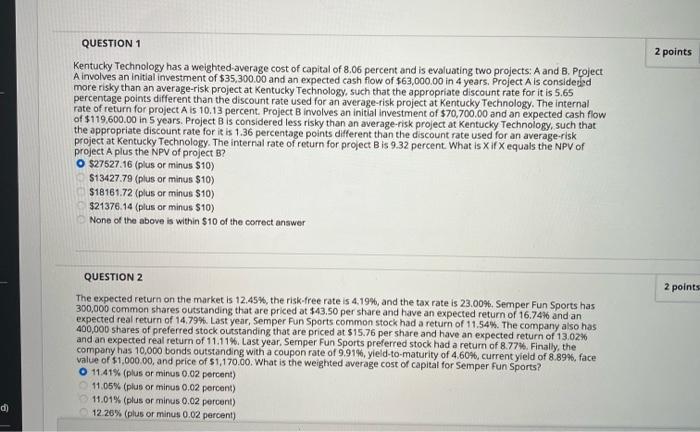

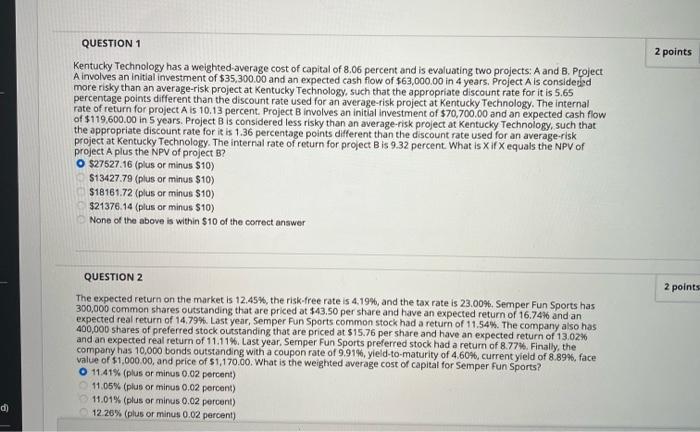

2 points QUESTION 1 Kentucky Technology has a weighted average cost of capital of 8.06 percent and is evaluating two projects: A and B. Project A involves an initial investment of $35,300.00 and an expected cash flow of 563,000.00 in 4 years, Project Ais consideded more risky than an average-risk project at Kentucky Technology, such that the appropriate discount rate for it is 5.65 percentage points different than the discount rate used for an average-risk project at Kentucky Technology. The internal rate of return for project A is 10.13 percent. Project B involves an initial investment of $70,700.00 and an expected cash flow of $119,600.00 in 5 years. Project B is considered less risky than an average-risk project at Kentucky Technology, such that the appropriate discount rate for it is 1.36 percentage points different than the discount rate used for an average risk project at Kentucky Technology. The internal rate of return for project Bis 9.32 percent. What is xif X equals the NPV of project A plus the NPV of project B? O $27527.16 (plus or minus $10) 513427.79 (plus or minus $10) $18161.72 (plus or minus $10) $21376.14 (plus or minus $10) None of the above is within $10 of the correct answer 2 points QUESTION 2 The expected return on the market is 12.45%, the risk-free rate is 4.19%, and the tax rate is 23.00%. Semper Fun Sports has 300,000 common shares outstanding that are priced at $43.50 per share and have an expected return of 16.74% and an expected real return of 14.79%. Last year, Semper Fun Sports common stock had a return of 11.54%. The company also has 400,000 shares of preferred stock outstanding that are priced at $15.76 per share and have an expected return of 13.02% and an expected real return of 11.11%. Last year. Semper Fun Sports preferred stock had a return of 8.77%. Finally, the company has 10,000 bonds outstanding with a coupon rate of 9.91%, yield-to-maturity of 4,60%, current yield of 8.89%, face value of $1,000.00, and price of $1,170.00. What is the weighted average cost of capital for Semper Fun Sports? O 11.41% (plus or minus 0.02 percent) 11.05% (plus or minus 0.02 porcent) 11.01% (plus or minus 0.02 porcent) 12.28% (plus or minus 0.02 percent) d)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started