please help

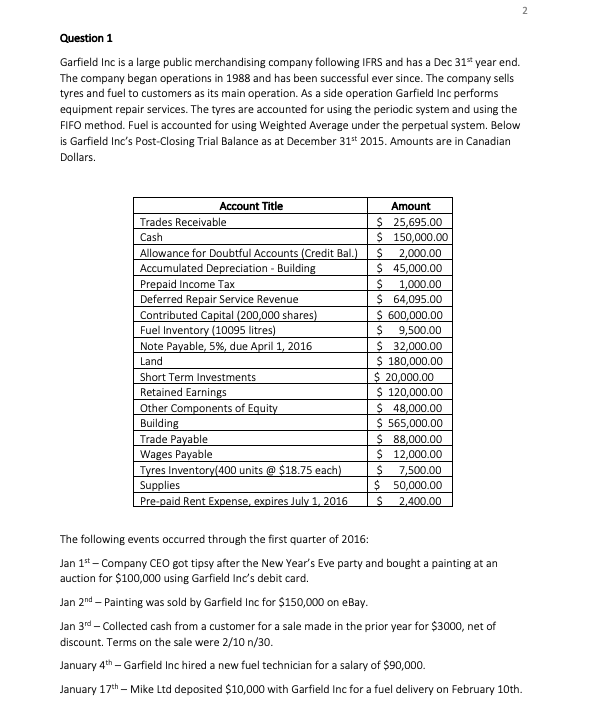

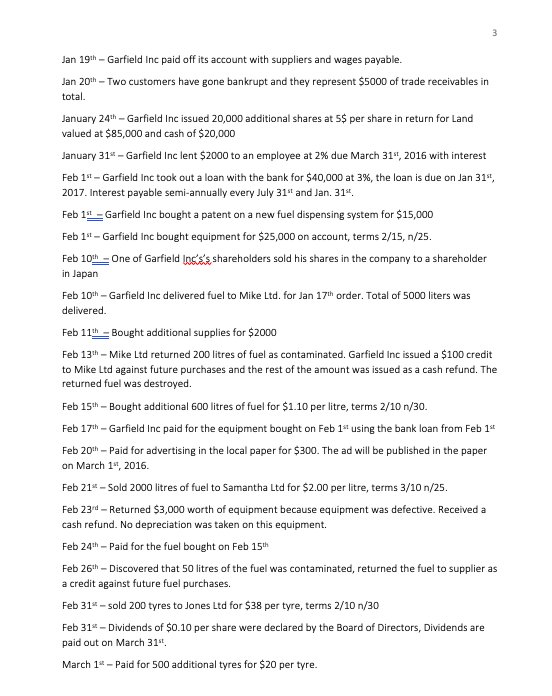

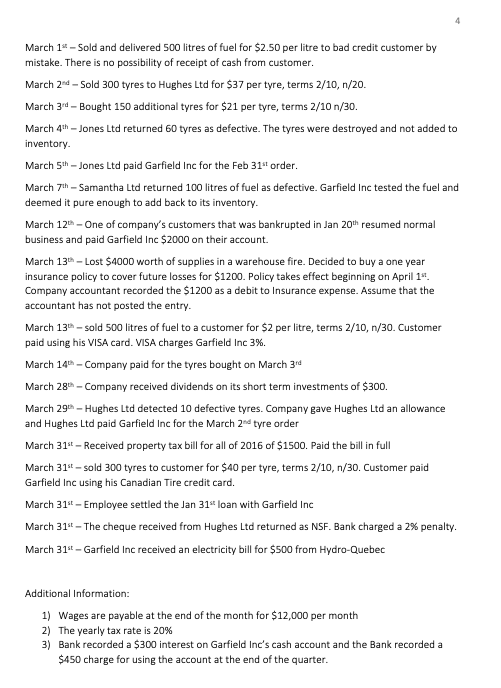

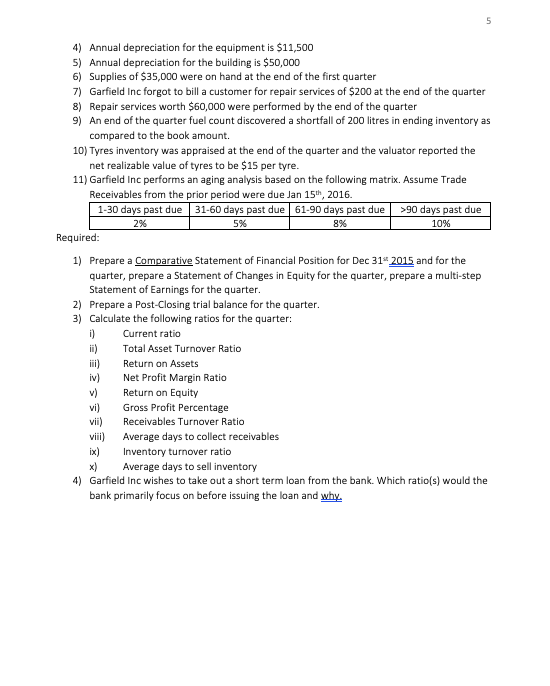

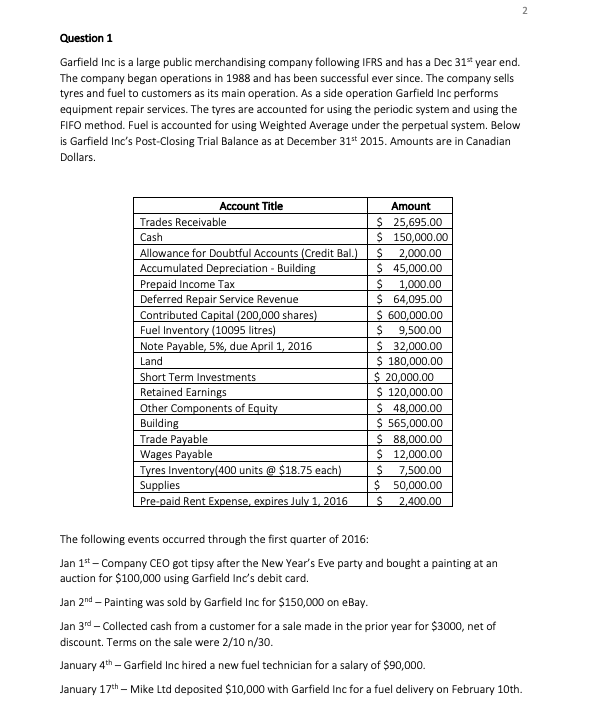

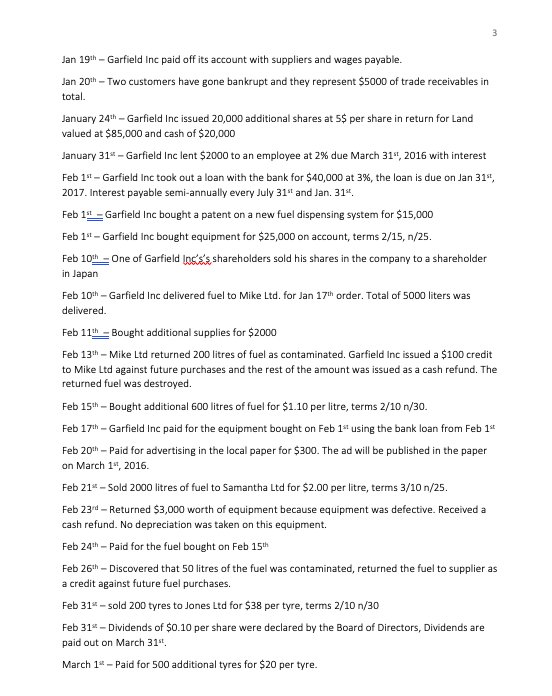

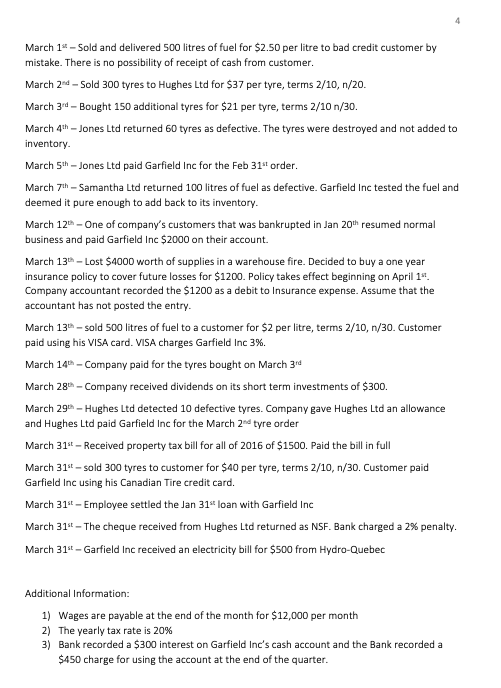

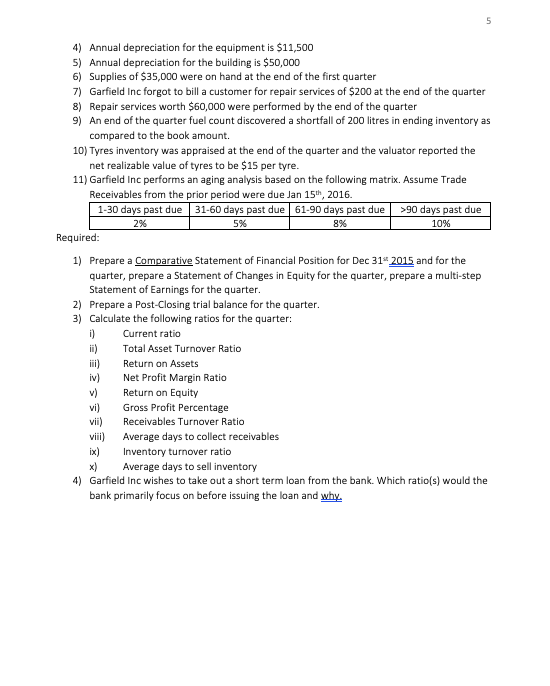

2 Question 1 Garfield Inc is a large public merchandising company following IFRS and has a Dec 31st year end. The company began operations in 1988 and has been successful ever since. The company sells tyres and fuel to customers as its main operation. As a side operation Garfield Inc performs equipment repair services. The tyres are accounted for using the periodic system and using the FIFO method. Fuel is accounted for using Weighted Average under the perpetual system. Below is Garfield Inc's Post-Closing Trial Balance as at December 31st 2015. Amounts are in Canadian Dollars. Account Title Trades Receivable Cash Allowance for Doubtful Accounts (Credit Bal.) Accumulated Depreciation - Building Prepaid Income Tax Deferred Repair Service Revenue Contributed Capital (200,000 shares) Fuel Inventory (10095 litres) Note Payable, 5%, due April 1, 2016 Land Short Term Investments Retained Earnings Other Components of Equity Building Trade Payable Wages Payable Tyres Inventory(400 units @ $18.75 each) Supplies Pre-paid Rent Expense, expires July 1, 2016 Amount $ 25,695.00 $ 150,000.00 S 2,000.00 $ 45,000.00 S 1,000.00 $ 64,095.00 $ 600,000.00 $ 9,500.00 $ 32,000.00 $ 180,000.00 $ 20,000.00 $ 120,000.00 $ 48,000.00 $ 565,000.00 $ 88,000.00 $ 12,000.00 $ 7,500.00 $ 50,000.00 S 2,400.00 The following events occurred through the first quarter of 2016: Jan 1st - Company CEO got tipsy after the New Year's Eve party and bought a painting at an auction for $100,000 using Garfield Inc's debit card. Jan 2nd Painting was sold by Garfield Inc for $150,000 on eBay. Jan 3rd Collected cash from a customer for a sale made in the prior year for $3000, net of discount. Terms on the sale were 2/10 n/30. January 4th Garfield Inc hired a new fuel technician for a salary of $90,000. January 17th Mike Ltd deposited $10,000 with Garfield Inc for a fuel delivery on February 10th. Jan 19th - Garfield Inc paid off its account with suppliers and wages payable. Jan 20th - Two customers have gone bankrupt and they represent $5000 of trade receivables in total. January 24th - Garfield Inc issued 20,000 additional shares at 5$ per share in return for Land valued at $85,000 and cash of $20,000 January 31* - Garfield Inc lent $2000 to an employee at 2% due March 31", 2016 with interest Feb 1st - Garfield Inc took out a loan with the bank for $40,000 at 3%, the loan is due on Jan 314, 2017. Interest payable semi-annually every July 31" and Jan. 314 Feb 11_-Garfield Inc bought a patent on a new fuel dispensing system for $15,000 Feb 1st - Garfield Inc bought equipment for $25,000 on account, terms 2/15, n/25. Feb 10th - One of Garfield Ins's's shareholders sold his shares in the company to a shareholder in Japan Feb 10th - Garfield Inc delivered fuel to Mike Ltd. for Jan 17th order. Total of 5000 liters was delivered Feb 11th - Bought additional supplies for $2000 Feb 13th - Mike Ltd returned 200 litres of fuel as contaminated. Garfield Inc issued a $100 credit to Mike Ltd against future purchases and the rest of the amount was issued as a cash refund. The returned fuel was destroyed. Feb 15th - Bought additional 600 litres of fuel for $1.10 per litre, terms 2/10 n/30. Feb 17th - Garfield Inc paid for the equipment bought on Feb 1" using the bank loan from Feb 14 Feb 201h Paid for advertising in the local paper for $300. The ad will be published in the paper on March 1", 2016 Feb 21 - Sold 2000 litres of fuel to Samantha Ltd for $2.00 per litre, terms 3/10 n/25. Feb 234 - Returned $3,000 worth of equipment because equipment was defective. Received a cash refund. No depreciation was taken on this equipment. Feb 24th - Paid for the fuel bought on Feb 15th Feb 26th - Discovered that 50 litres of the fuel was contaminated, returned the fuel to supplier as a credit against future fuel purchases. Feb 31* - sold 200 tyres to Jones Ltd for $38 per tyre, terms 2/10 n/30 Feb 31* - Dividends of $0.10 per share were declared by the Board of Directors, Dividends are paid out on March 31 March 18 - Paid for 500 additional tyres for $20 per tyre. March 1* - Sold and delivered 500 litres of fuel for $2.50 per litre to bad credit customer by mistake. There is no possibility of receipt of cash from customer. March 2ed Sold 300 tyres to Hughes Ltd for $37 per tyre, terms 2/10,n/20. March 3d - Bought 150 additional tyres for $21 per tyre, terms 2/10 n/30. March 4th --Jones Ltd returned 60 tyres as defective. The tyres were destroyed and not added to inventory March 5th Jones Ltd paid Garfield Inc for the Feb 31st order. March 7th - Samantha Ltd returned 100 litres of fuel as defective. Garfield Inc tested the fuel and deemed it pure enough to add back to its inventory. March 12th - One of company's customers that was bankrupted in Jan 20th resumed normal business and paid Garfield Inc $2000 on their account. March 13th - Lost $4000 worth of supplies in a warehouse fire. Decided to buy a one year insurance policy to cover future losses for $1200. Policy takes effect beginning on April 18 Company accountant recorded the $1200 as a debit to Insurance expense. Assume that the accountant has not posted the entry. March 13h - sold 500 litres of fuel to a customer for $2 per litre, terms 2/10, 1/30. Customer paid using his VISA card. VISA charges Garfield Inc 3%. March 14th - Company paid for the tyres bought on March 3rd March 28th - Company received dividends on its short term investments of $300. March 29th -Hughes Ltd detected 10 defective tyres. Company gave Hughes Ltd an allowance and Hughes Ltd paid Garfield Inc for the March 2nd tyre order March 31st - Received property tax bill for all of 2016 of $1500. Paid the bill in full March 31st - sold 300 tyres to customer for $40 per tyre, terms 2/10, 1/30. Customer paid Garfield Inc using his Canadian Tire credit card. March 314 - Employee settled the Jan 31" Ioan with Garfield Inc March 31st - The cheque received from Hughes Ltd returned as NSF. Bank charged a 2% penalty. March 31- Garfield Inc received an electricity bill for $500 from Hydro-Quebec Additional Information: 1) Wages are payable at the end of the month for $12,000 per month 2) The yearly tax rate is 20% 3) Bank recorded a $300 interest on Garfield Inc's cash account and the Bank recorded a $450 charge for using the account at the end of the quarter. 5 4) Annual depreciation for the equipment is $11,500 5) Annual depreciation for the building is $50,000 6) Supplies of $35,000 were on hand at the end of the first quarter 7) Garfield Inc forgot to bill a customer for repair services of $200 at the end of the quarter 8) Repair services worth $60,000 were performed by the end of the quarter 9) An end of the quarter fuel count discovered a shortfall of 200 litres in ending inventory as compared to the book amount. 10) Tyres inventory was appraised at the end of the quarter and the valuator reported the net realizable value of tyres to be $15 per tyre. 11) Garfield Inc performs an aging analysis based on the following matrix. Assume Trade Receivables from the prior period were due Jan 15th, 2016. 1-30 days past due 31-60 days past due 61-90 days past due >90 days past due 2% 5% 8% 10% Required: 1) Prepare a Comparative Statement of Financial Position for Dec 314 2015 and for the quarter, prepare a statement of Changes in Equity for the quarter, prepare a multi-step Statement of Earnings for the quarter. 2) Prepare a Post-Closing trial balance for the quarter. 3) Calculate the following ratios for the quarter: ) Current ratio ii) Total Asset Turnover Ratio iii) Return on Assets iv) Net Profit Margin Ratio Return on Equity vi) Gross Profit Percentage vii) Receivables Turnover Ratio viii) Average days to collect receivables ix) Inventory turnover ratio x) Average days to sell inventory 4) Garfield Inc wishes to take out a short term loan from the bank. Which ratio(s) would the bank primarily focus on before issuing the loan and why. 2 Question 1 Garfield Inc is a large public merchandising company following IFRS and has a Dec 31st year end. The company began operations in 1988 and has been successful ever since. The company sells tyres and fuel to customers as its main operation. As a side operation Garfield Inc performs equipment repair services. The tyres are accounted for using the periodic system and using the FIFO method. Fuel is accounted for using Weighted Average under the perpetual system. Below is Garfield Inc's Post-Closing Trial Balance as at December 31st 2015. Amounts are in Canadian Dollars. Account Title Trades Receivable Cash Allowance for Doubtful Accounts (Credit Bal.) Accumulated Depreciation - Building Prepaid Income Tax Deferred Repair Service Revenue Contributed Capital (200,000 shares) Fuel Inventory (10095 litres) Note Payable, 5%, due April 1, 2016 Land Short Term Investments Retained Earnings Other Components of Equity Building Trade Payable Wages Payable Tyres Inventory(400 units @ $18.75 each) Supplies Pre-paid Rent Expense, expires July 1, 2016 Amount $ 25,695.00 $ 150,000.00 S 2,000.00 $ 45,000.00 S 1,000.00 $ 64,095.00 $ 600,000.00 $ 9,500.00 $ 32,000.00 $ 180,000.00 $ 20,000.00 $ 120,000.00 $ 48,000.00 $ 565,000.00 $ 88,000.00 $ 12,000.00 $ 7,500.00 $ 50,000.00 S 2,400.00 The following events occurred through the first quarter of 2016: Jan 1st - Company CEO got tipsy after the New Year's Eve party and bought a painting at an auction for $100,000 using Garfield Inc's debit card. Jan 2nd Painting was sold by Garfield Inc for $150,000 on eBay. Jan 3rd Collected cash from a customer for a sale made in the prior year for $3000, net of discount. Terms on the sale were 2/10 n/30. January 4th Garfield Inc hired a new fuel technician for a salary of $90,000. January 17th Mike Ltd deposited $10,000 with Garfield Inc for a fuel delivery on February 10th. Jan 19th - Garfield Inc paid off its account with suppliers and wages payable. Jan 20th - Two customers have gone bankrupt and they represent $5000 of trade receivables in total. January 24th - Garfield Inc issued 20,000 additional shares at 5$ per share in return for Land valued at $85,000 and cash of $20,000 January 31* - Garfield Inc lent $2000 to an employee at 2% due March 31", 2016 with interest Feb 1st - Garfield Inc took out a loan with the bank for $40,000 at 3%, the loan is due on Jan 314, 2017. Interest payable semi-annually every July 31" and Jan. 314 Feb 11_-Garfield Inc bought a patent on a new fuel dispensing system for $15,000 Feb 1st - Garfield Inc bought equipment for $25,000 on account, terms 2/15, n/25. Feb 10th - One of Garfield Ins's's shareholders sold his shares in the company to a shareholder in Japan Feb 10th - Garfield Inc delivered fuel to Mike Ltd. for Jan 17th order. Total of 5000 liters was delivered Feb 11th - Bought additional supplies for $2000 Feb 13th - Mike Ltd returned 200 litres of fuel as contaminated. Garfield Inc issued a $100 credit to Mike Ltd against future purchases and the rest of the amount was issued as a cash refund. The returned fuel was destroyed. Feb 15th - Bought additional 600 litres of fuel for $1.10 per litre, terms 2/10 n/30. Feb 17th - Garfield Inc paid for the equipment bought on Feb 1" using the bank loan from Feb 14 Feb 201h Paid for advertising in the local paper for $300. The ad will be published in the paper on March 1", 2016 Feb 21 - Sold 2000 litres of fuel to Samantha Ltd for $2.00 per litre, terms 3/10 n/25. Feb 234 - Returned $3,000 worth of equipment because equipment was defective. Received a cash refund. No depreciation was taken on this equipment. Feb 24th - Paid for the fuel bought on Feb 15th Feb 26th - Discovered that 50 litres of the fuel was contaminated, returned the fuel to supplier as a credit against future fuel purchases. Feb 31* - sold 200 tyres to Jones Ltd for $38 per tyre, terms 2/10 n/30 Feb 31* - Dividends of $0.10 per share were declared by the Board of Directors, Dividends are paid out on March 31 March 18 - Paid for 500 additional tyres for $20 per tyre. March 1* - Sold and delivered 500 litres of fuel for $2.50 per litre to bad credit customer by mistake. There is no possibility of receipt of cash from customer. March 2ed Sold 300 tyres to Hughes Ltd for $37 per tyre, terms 2/10,n/20. March 3d - Bought 150 additional tyres for $21 per tyre, terms 2/10 n/30. March 4th --Jones Ltd returned 60 tyres as defective. The tyres were destroyed and not added to inventory March 5th Jones Ltd paid Garfield Inc for the Feb 31st order. March 7th - Samantha Ltd returned 100 litres of fuel as defective. Garfield Inc tested the fuel and deemed it pure enough to add back to its inventory. March 12th - One of company's customers that was bankrupted in Jan 20th resumed normal business and paid Garfield Inc $2000 on their account. March 13th - Lost $4000 worth of supplies in a warehouse fire. Decided to buy a one year insurance policy to cover future losses for $1200. Policy takes effect beginning on April 18 Company accountant recorded the $1200 as a debit to Insurance expense. Assume that the accountant has not posted the entry. March 13h - sold 500 litres of fuel to a customer for $2 per litre, terms 2/10, 1/30. Customer paid using his VISA card. VISA charges Garfield Inc 3%. March 14th - Company paid for the tyres bought on March 3rd March 28th - Company received dividends on its short term investments of $300. March 29th -Hughes Ltd detected 10 defective tyres. Company gave Hughes Ltd an allowance and Hughes Ltd paid Garfield Inc for the March 2nd tyre order March 31st - Received property tax bill for all of 2016 of $1500. Paid the bill in full March 31st - sold 300 tyres to customer for $40 per tyre, terms 2/10, 1/30. Customer paid Garfield Inc using his Canadian Tire credit card. March 314 - Employee settled the Jan 31" Ioan with Garfield Inc March 31st - The cheque received from Hughes Ltd returned as NSF. Bank charged a 2% penalty. March 31- Garfield Inc received an electricity bill for $500 from Hydro-Quebec Additional Information: 1) Wages are payable at the end of the month for $12,000 per month 2) The yearly tax rate is 20% 3) Bank recorded a $300 interest on Garfield Inc's cash account and the Bank recorded a $450 charge for using the account at the end of the quarter. 5 4) Annual depreciation for the equipment is $11,500 5) Annual depreciation for the building is $50,000 6) Supplies of $35,000 were on hand at the end of the first quarter 7) Garfield Inc forgot to bill a customer for repair services of $200 at the end of the quarter 8) Repair services worth $60,000 were performed by the end of the quarter 9) An end of the quarter fuel count discovered a shortfall of 200 litres in ending inventory as compared to the book amount. 10) Tyres inventory was appraised at the end of the quarter and the valuator reported the net realizable value of tyres to be $15 per tyre. 11) Garfield Inc performs an aging analysis based on the following matrix. Assume Trade Receivables from the prior period were due Jan 15th, 2016. 1-30 days past due 31-60 days past due 61-90 days past due >90 days past due 2% 5% 8% 10% Required: 1) Prepare a Comparative Statement of Financial Position for Dec 314 2015 and for the quarter, prepare a statement of Changes in Equity for the quarter, prepare a multi-step Statement of Earnings for the quarter. 2) Prepare a Post-Closing trial balance for the quarter. 3) Calculate the following ratios for the quarter: ) Current ratio ii) Total Asset Turnover Ratio iii) Return on Assets iv) Net Profit Margin Ratio Return on Equity vi) Gross Profit Percentage vii) Receivables Turnover Ratio viii) Average days to collect receivables ix) Inventory turnover ratio x) Average days to sell inventory 4) Garfield Inc wishes to take out a short term loan from the bank. Which ratio(s) would the bank primarily focus on before issuing the loan and why