Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! 2 The management of Ballard MicroBrew is considering the purchase of an automated botting machine for $47,000. The machine would replace an old

please help! 2

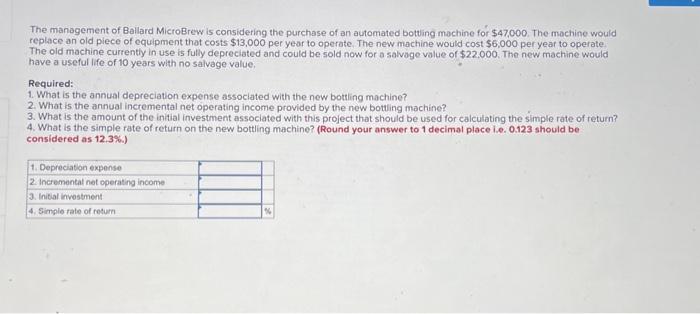

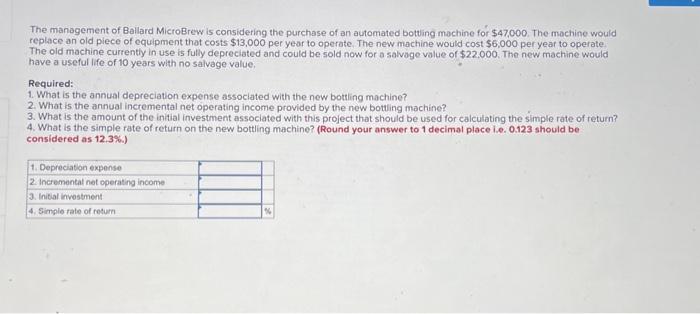

The management of Ballard MicroBrew is considering the purchase of an automated botting machine for $47,000. The machine would replace an old piece of equipment that costs $13,000 per year to operate. The new machine would cost $6,000 per year to operate. The old machine currently in use is futly depreclated and could be sold now for a salvage value of $22.000, The new machine would have a uscful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense assoclated with the new bottling machine? 2. What is the annual inctemental net operating income provided by the new botting machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3% )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started