Answered step by step

Verified Expert Solution

Question

1 Approved Answer

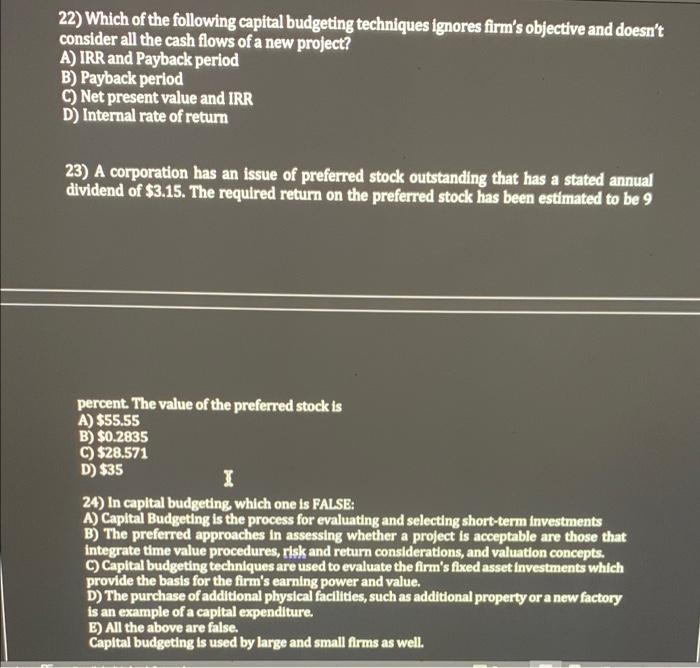

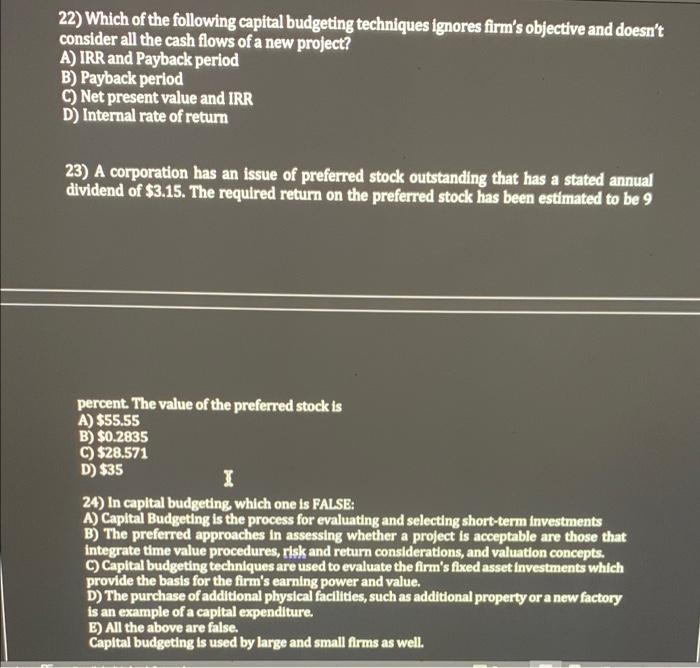

PLEASE HELP! 22) Which of the following capital budgeting techniques ignores firm's objective and doesn't consider all the cash flows of a new project? A)

PLEASE HELP!

22) Which of the following capital budgeting techniques ignores firm's objective and doesn't consider all the cash flows of a new project? A) IRR and Payback period B) Payback period C) Net present value and IRR D) Internal rate of return 23) A corporation has an issue of preferred stock outstanding that has a stated annual dividend of $3.15. The required return on the preferred stock has been estimated to be 9 percent. The value of the preferred stock is A) $55.55 B) $0.2835 C) $28.571 D) $35 I 24) In capital budgeting, which one is FALSE: A) Capital Budgeting is the process for evaluating and selecting short-term investments B) The preferred approaches in assessing whether a project is acceptable are those that integrate time value procedures, risk and return considerations, and valuation concepts. C) Capital budgeting techniques are used to evaluate the firm's fixed asset investments which provide the basis for the firm's earning power and value. D) The purchase of additional physical facilities, such as additional property or a new factory is an example of a capital expenditure. E) All the above are false. Capital budgeting is used by large and small firms as well

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started