Answered step by step

Verified Expert Solution

Question

1 Approved Answer

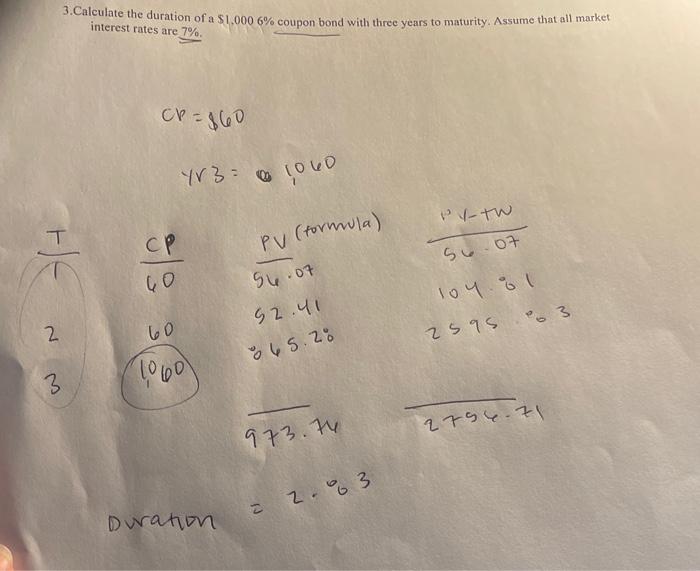

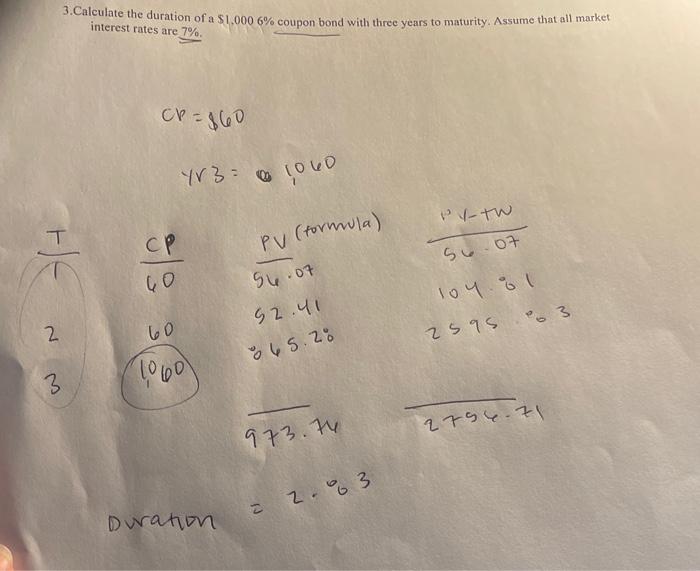

please help! 3.Calculate the duration of a $1.000 6% coupon bond with three years to maturity. Assume that all market interest rates are 7% CP=860

please help!

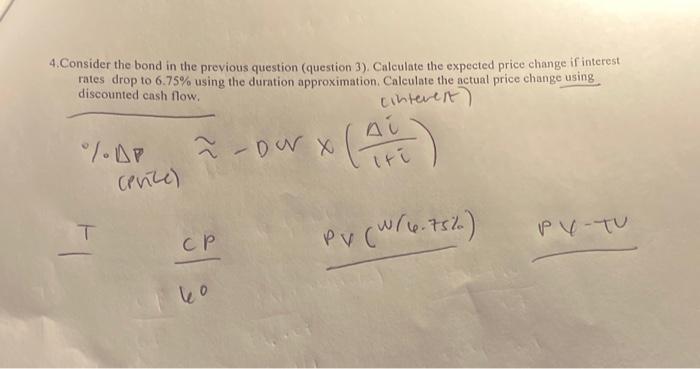

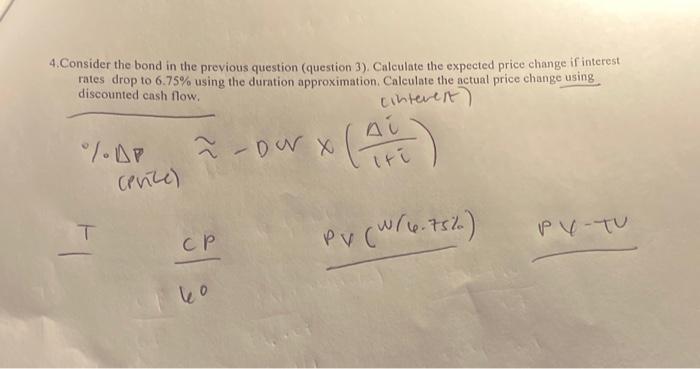

3.Calculate the duration of a $1.000 6% coupon bond with three years to maturity. Assume that all market interest rates are 7% CP=860 Yr3= 1060 Py-tw CP HE S6 07 GO PV (formula) S4.07 92.41 loy il 2 60 2595 8 65.20 3 1060 2754.71 973.74 = 2.93 Duration 4. Consider the bond in the previous question question 3). Calculate the expected price change if interest rates drop to 6.75% using the duration approximation Calculate the actual price change using discounted cash flow, Cinteren Ai LDP -Dwx (11) (price) T T PV (w/ 6.752) PY-TU ko

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started