Answered step by step

Verified Expert Solution

Question

1 Approved Answer

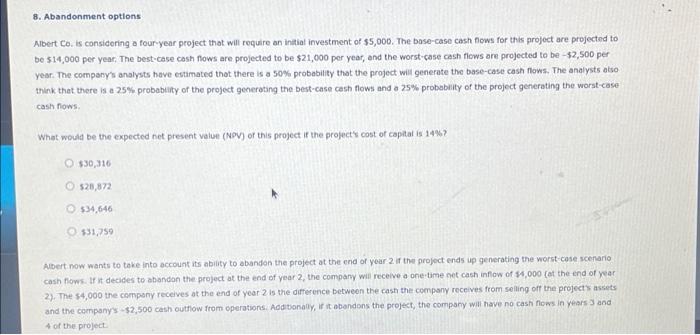

please help! 8. Abandonment options Albert Co. is considering a four year project that will require an initial investment of $5,000. The base-case cash flows

please help!

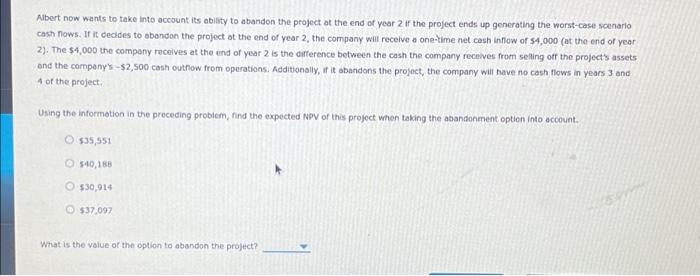

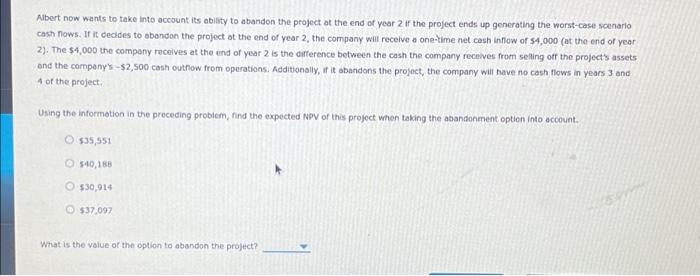

8. Abandonment options Albert Co. is considering a four year project that will require an initial investment of $5,000. The base-case cash flows for this project are projected to be 514,000 per year. The best-case cash nows are projected to be $21,000 per year, and the worst case cash flows are projected to be - $2,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flow and a 25% probability of the project generating the worst-case cash rows What would be the expected net present valur (NPV) of this project if the project's cost of capital is 14%? $30,310 528,872 $34.646 531,759 Albert now wants to take into account its ability to abandon the project at the end of year 2 ir the project ends up generating the worst case scenario cash flows. If it decides to abandon the project at the end of year 2, the company will receive a one-time net cash inflow of $4.000 (at the end of year 2). The $4,000 the company receives at the end of year 2 is the difference between the cash the company receives from selling off the projects assets and the company's $2,500 cash outflow from operations. Additionally, it abandons the project, the company will have no cash flows in years and of the project Albert now wants to take into account its ability to abandon the project at the end of year 2 or the project ends up generating the worst-case scenario cash nows. Ir it decides to abandon the project at the end of year 2, the company will receive a one-time net cash innow of 54,000 (at the end of year 2). The $4,000 the company receives at the end of year 2 is the difference between the cash the company receives from selling off the project's assets and the company's -$2,500 cash outlow from operations. Additionally, if it abandons the project, the company will have no cash Nows in years 3 and 1 of the project Using the information in the preceding problem, nind the expected NPV of this project when taking the abandonment option into account. $35,551 540,188 530,914 537,097 What is the value of the option to abandon the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started