Answered step by step

Verified Expert Solution

Question

1 Approved Answer

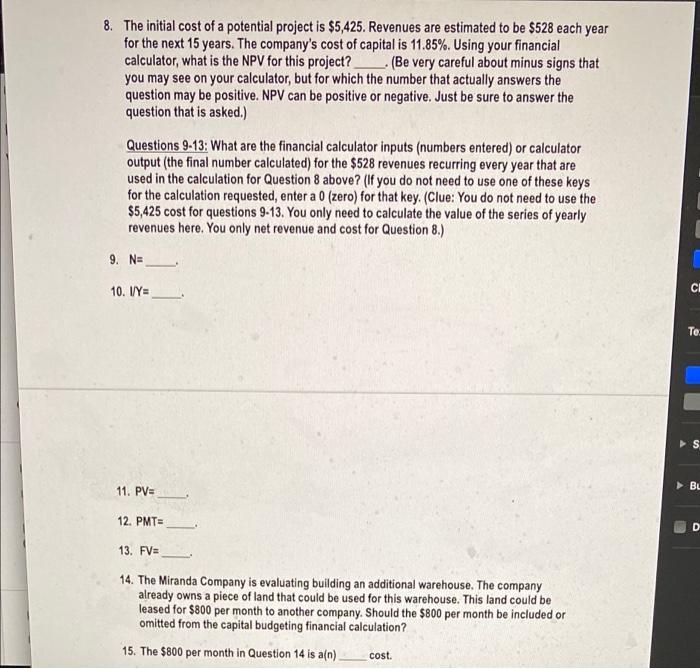

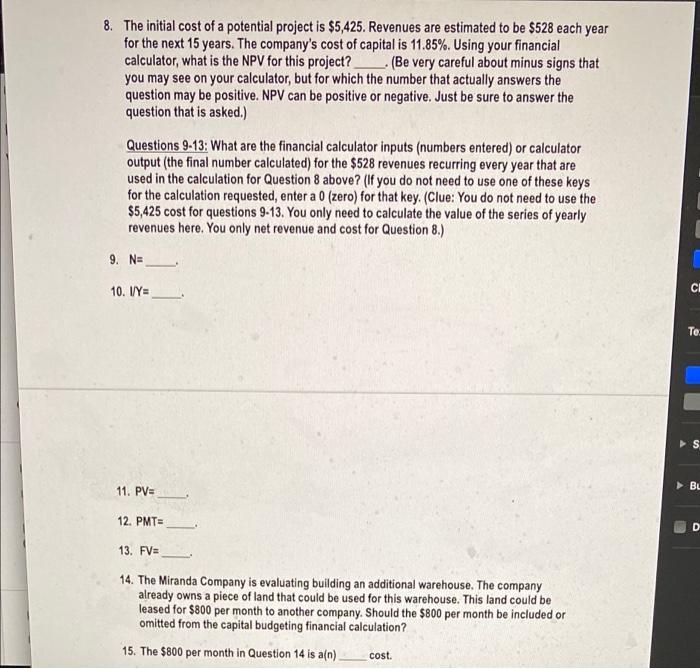

please help 8. The initial cost of a potential project is $5,425. Revenues are estimated to be $528 each year for the next 15 years.

please help

8. The initial cost of a potential project is $5,425. Revenues are estimated to be $528 each year for the next 15 years. The company's cost of capital is 11.85%. Using your financial calculator, what is the NPV for this project? (Be very careful about minus signs that you may see on your calculator, but for which the number that actually answers the question may be positive. NPV can be positive or negative. Just be sure to answer the question that is asked.) Questions 9-13: What are the financial calculator inputs (numbers entered) or calculator output (the final number calculated) for the $528 revenues recurring every year that are used in the calculation for Question 8 above? (If you do not need to use one of these keys for the calculation requested, enter a 0 (zero) for that key. (Clue: You do not need to use the $5,425 cost for questions 9-13. You only need to calculate the value of the series of yearly revenues here. You only net revenue and cost for Question 8.) 9. N= 10. I/Y= CI Te 11. PV= BL 12. PMT= D 13. FV= 14. The Miranda Company is evaluating building an additional warehouse. The company already owns a piece of land that could be used for this warehouse. This land could be leased for $800 per month to another company. Should the $800 per month be included or omitted from the capital budgeting financial calculation? 15. The $800 per month in Question 14 is a(n) cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started