Please help

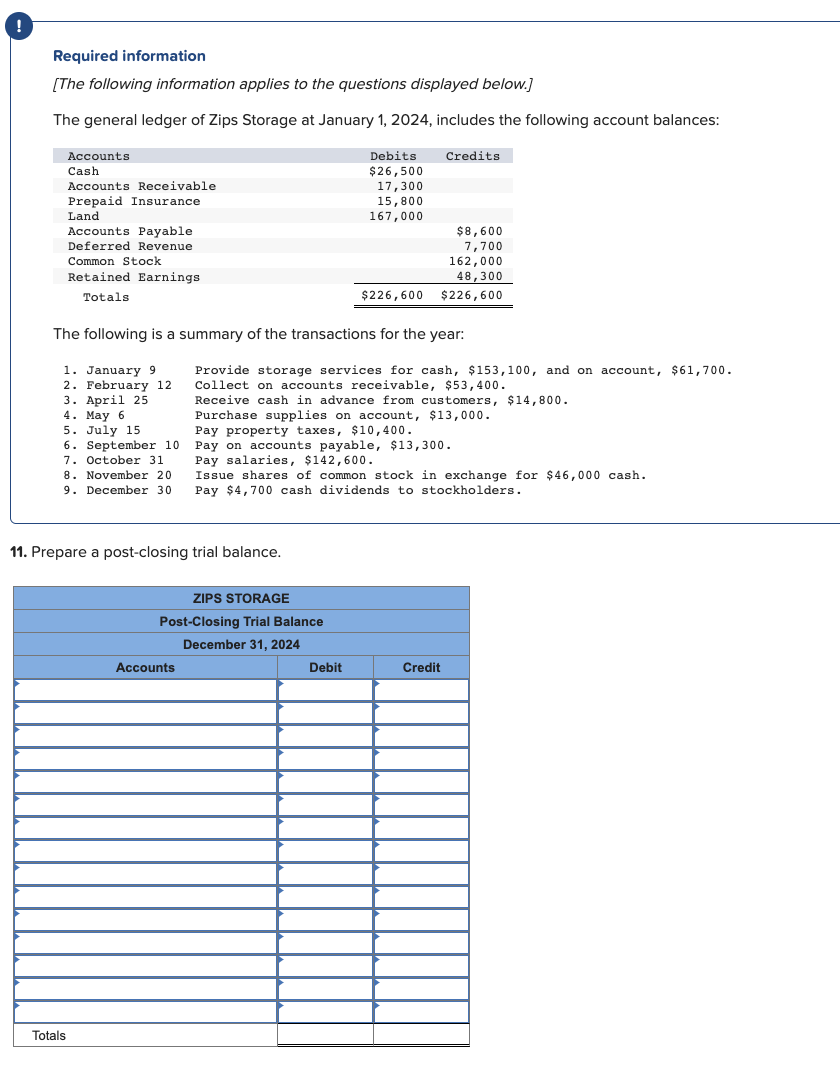

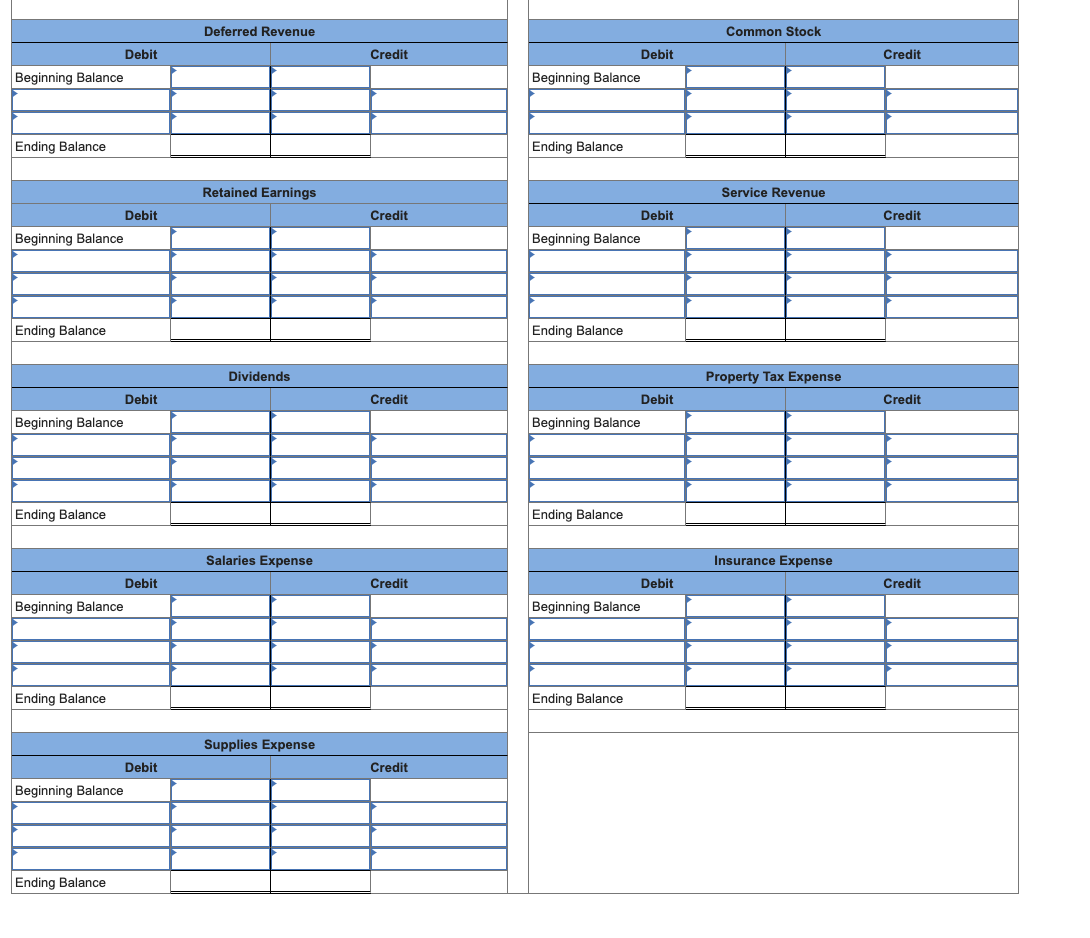

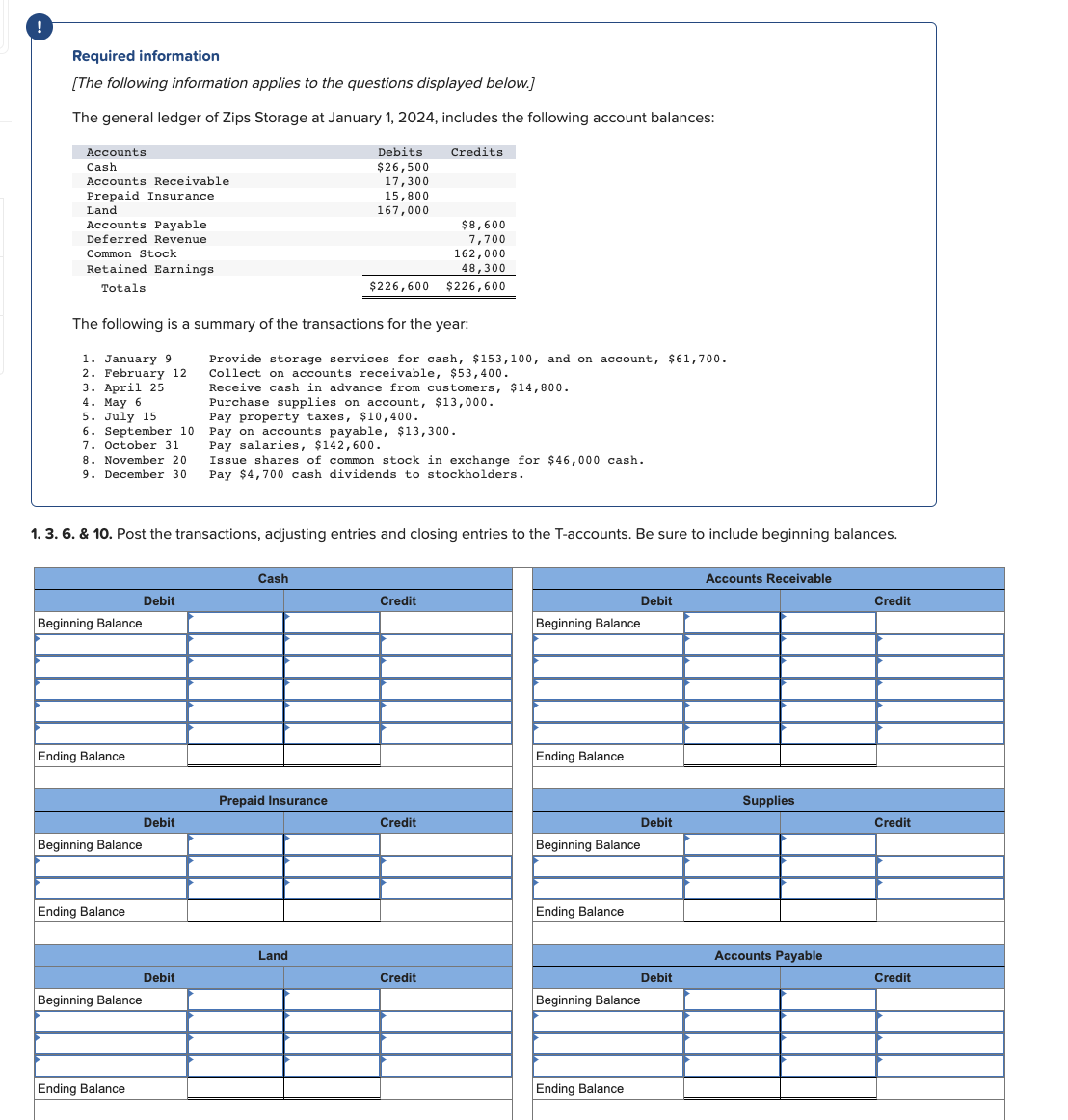

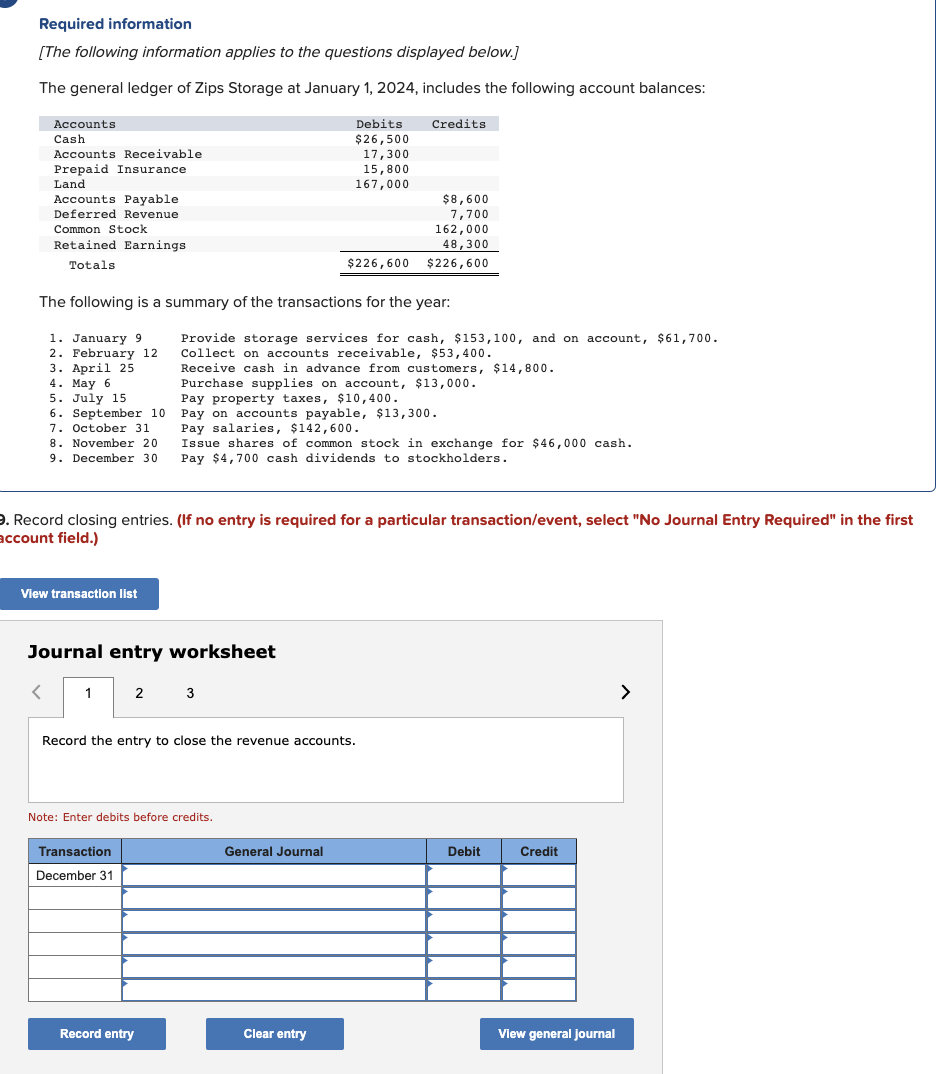

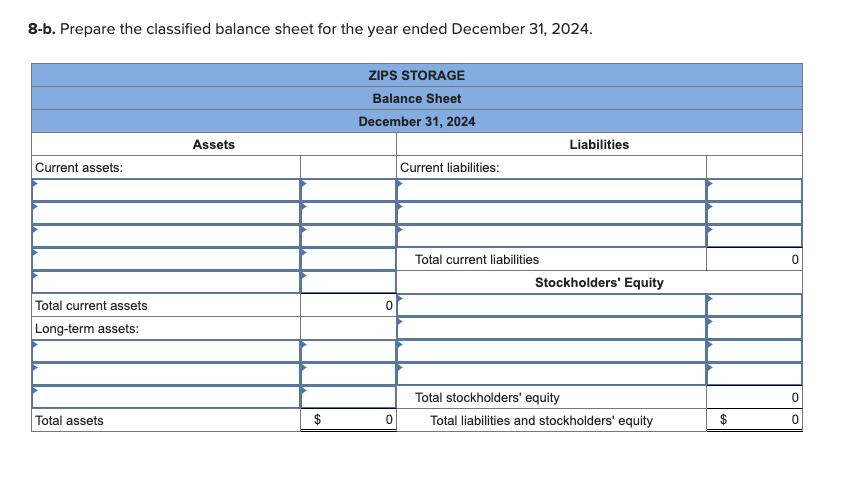

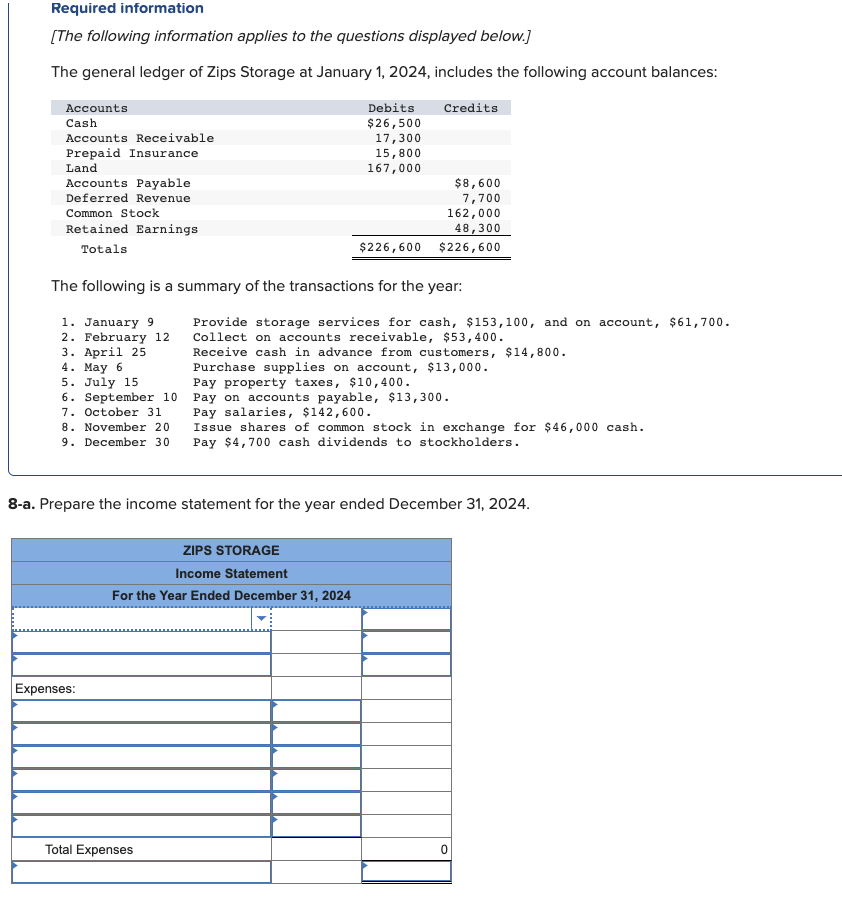

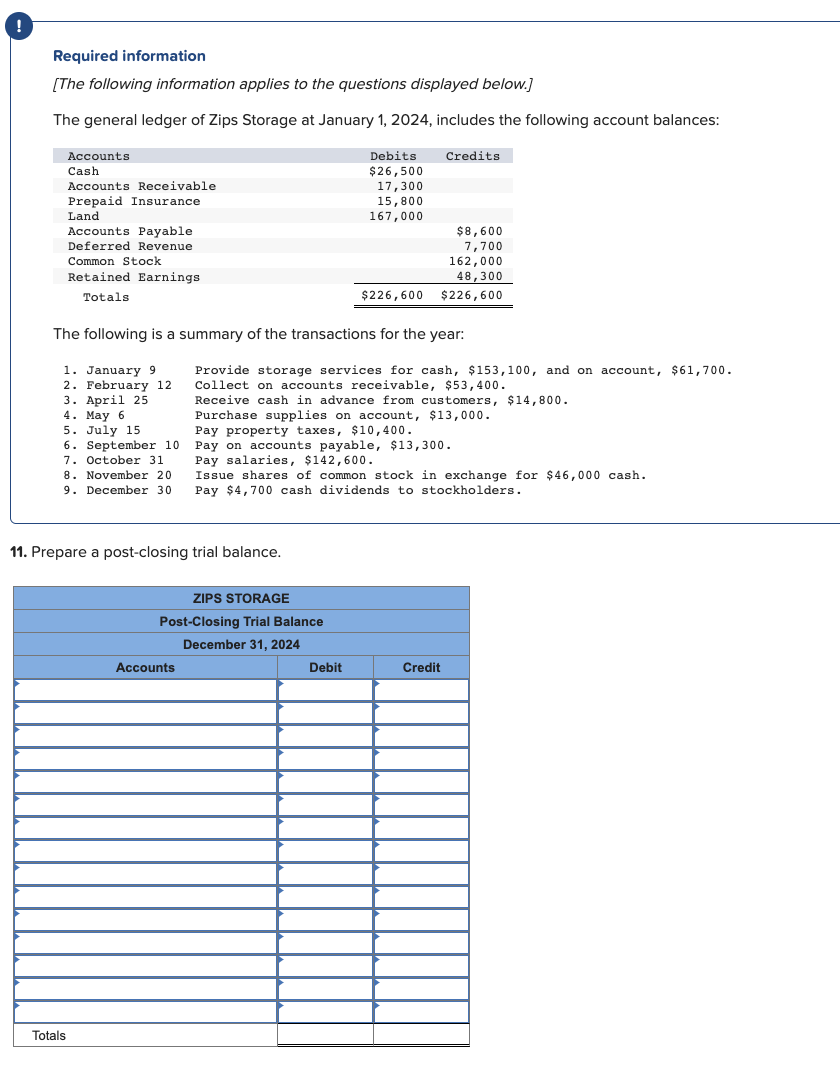

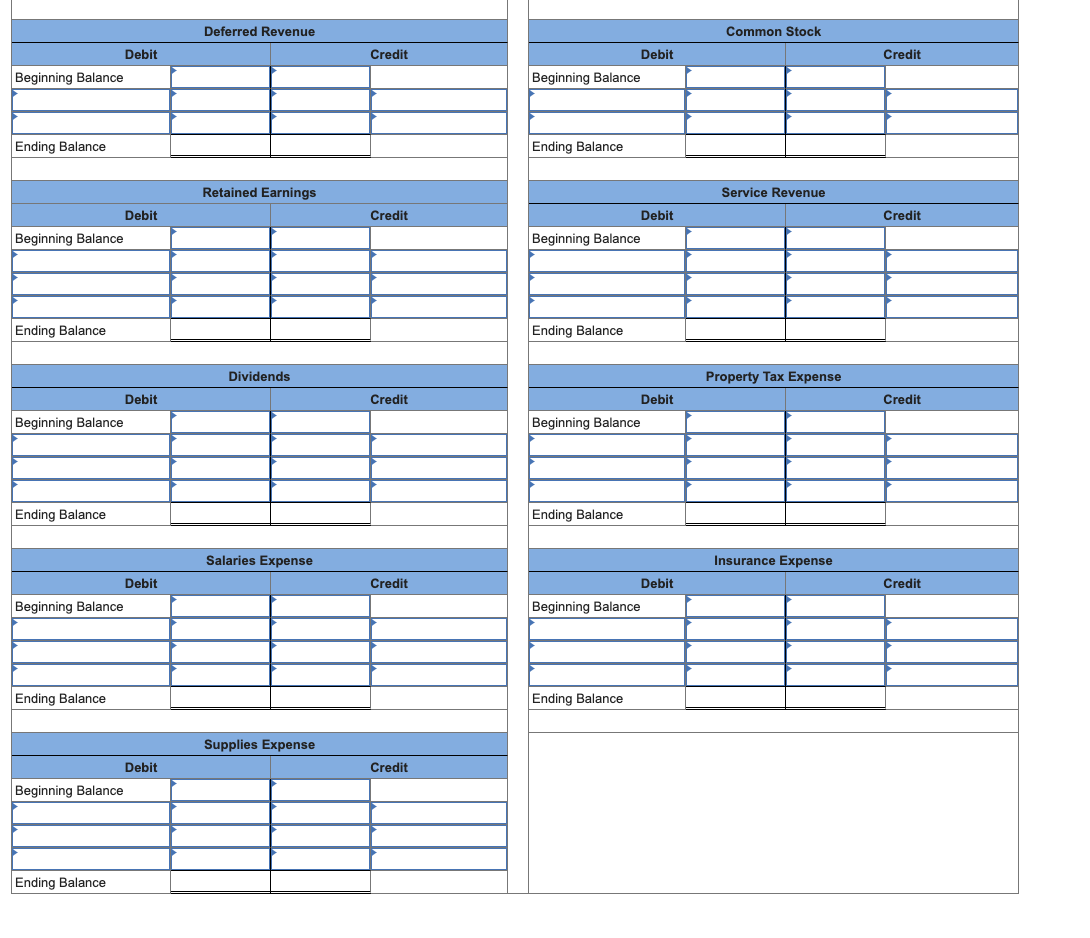

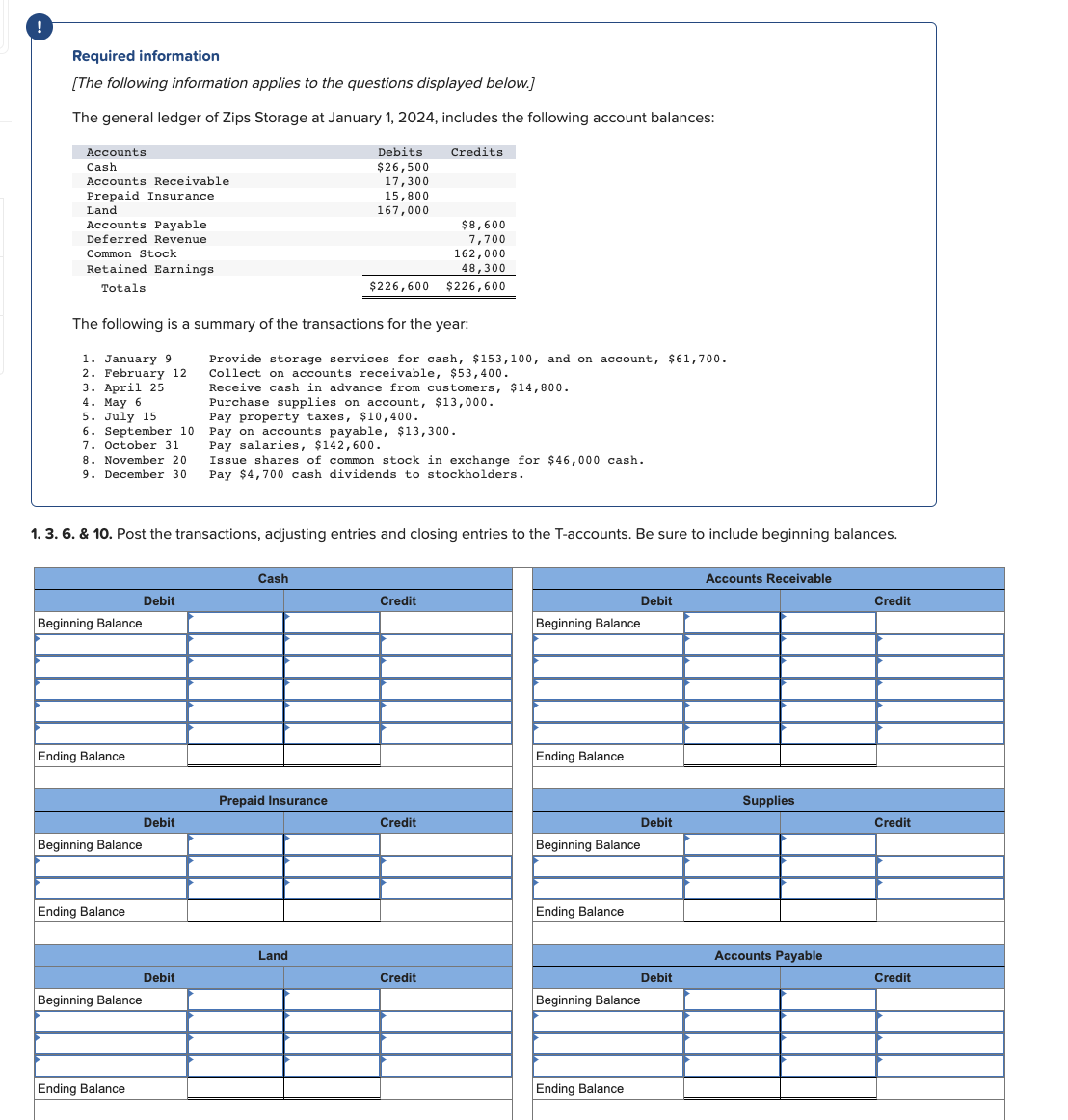

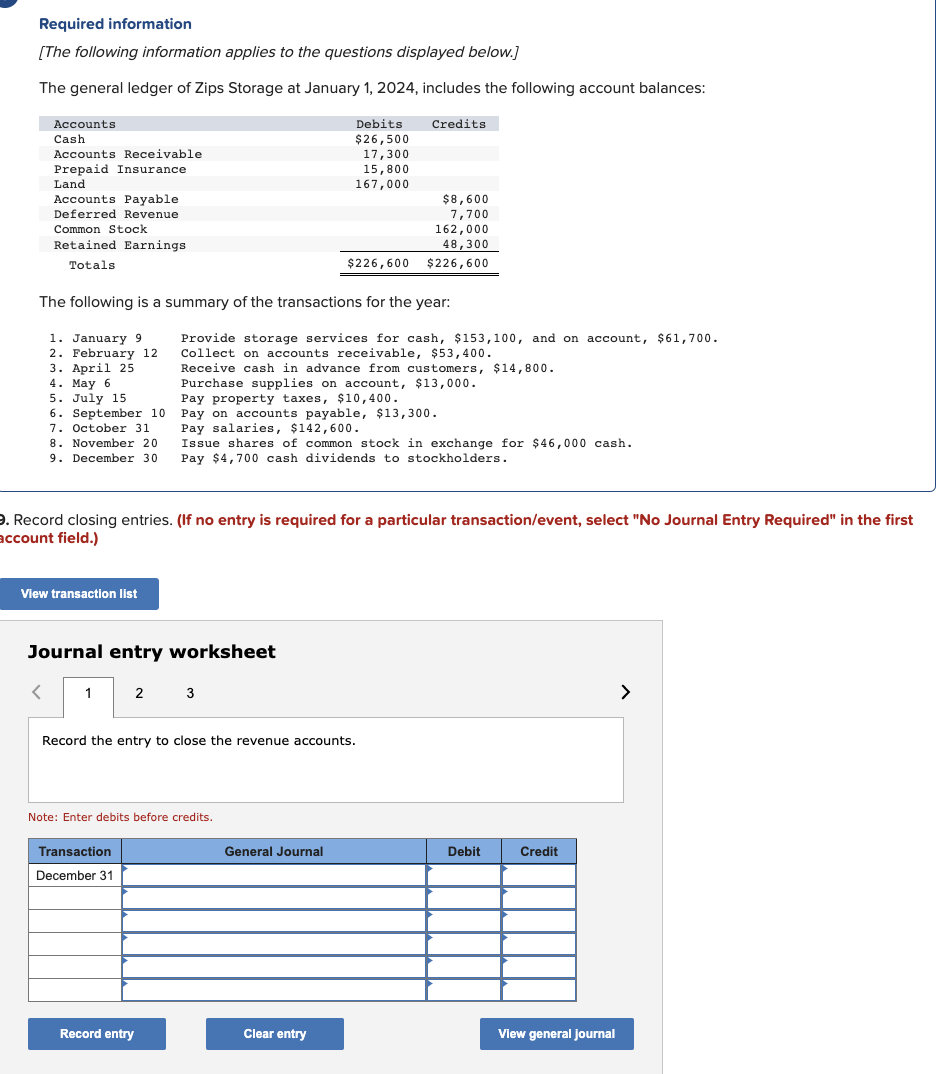

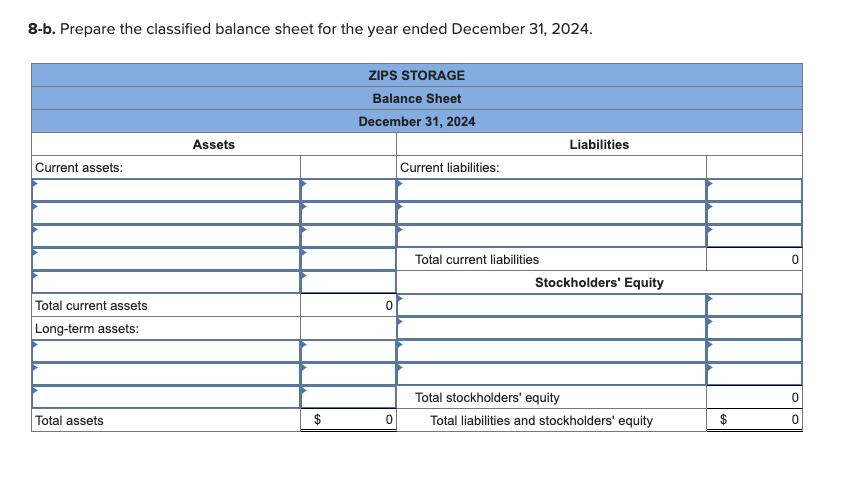

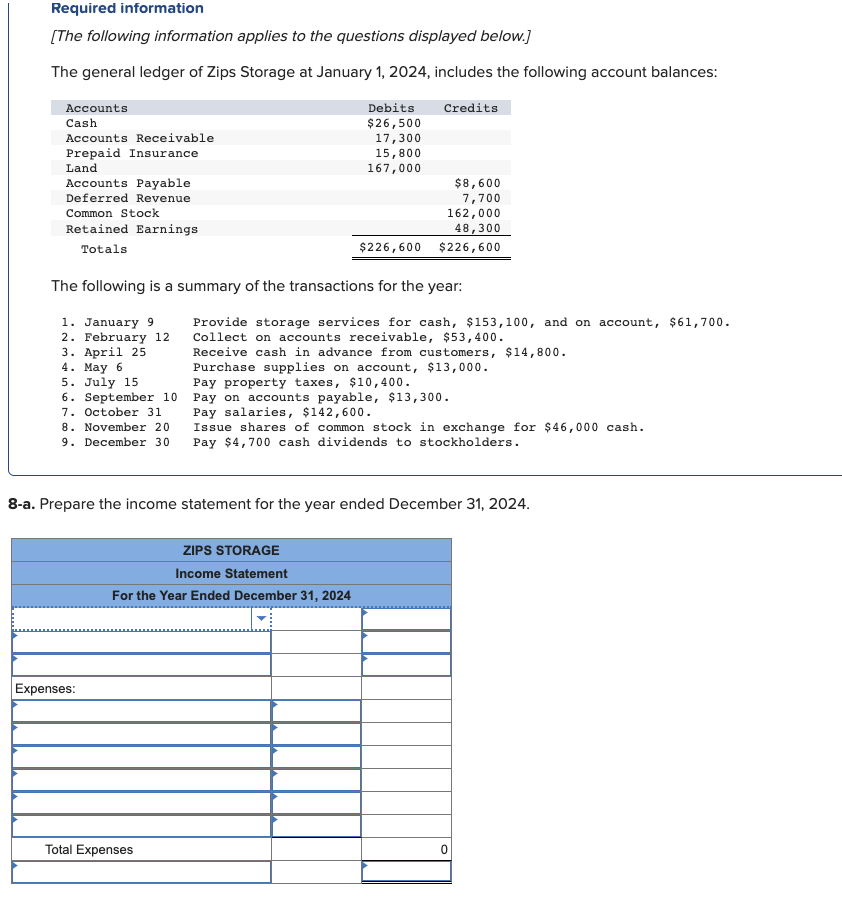

8-b. Prepare the classified balance sheet for the year ended December 31, 2024. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $153,100, and on account, $61,700. 2. February 12 Collect on accounts receivable, $53,400. 3. April 25 Receive cash in advance from customers, $14,800. 4. May 6 Purchase supplies on account, $13,000. 5. July 15 Pay property taxes, $10,400. 6. September 10 Pay on accounts payable, $13,300. 7. October 31 Pay salaries, $142,600. 8. November 20 Issue shares of common stock in exchange for $46,000cash. 9. December 30 Pay $4,700 cash dividends to stockholders. 11. Prepare a post-closing trial balance. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $153,100, and on account, $61,700. Collect on accounts receivable, $53,400. Receive cash in advance from customers, $14,800. Purchase supplies on account, $13,000. Pay property taxes, $10,400. Pay on accounts payable, $13,300. Pay salaries, $142,600. Issue shares of common stock in exchange for $46,000cash. Pay $4,700 cash dividends to stockholders. 8-a. Prepare the income statement for the year ended December 31, 2024. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $153,100, and on account, $61,700. Collect on accounts receivable, $53,400. Receive cash in advance from customers, $14,800. Purchase supplies on account, $13,000. Pay property taxes, $10,400. Pay on accounts payable, $13,300. Pay salaries, $142,600. Issue shares of common stock in exchange for $46,000 cash. Pay $4,700 cash dividends to stockholders. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $153,100, and on account, $61,700. 2. February 12 Collect on accounts receivable, $53,400. 3. April 25 Receive cash in advance from customers, $14,800. 4. May 6 Purchase supplies on account, $13,000. 5. July 15 Pay property taxes, $10,400. 6. September 10 Pay on accounts payable, $13,300. 7. October 31 Pay salaries, $142,600. 8. November 20 Issue shares of common stock in exchange for $46,000cash. 9. December 30 Pay $4,700 cash dividends to stockholders. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first ccount field.) Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. 8-b. Prepare the classified balance sheet for the year ended December 31, 2024. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $153,100, and on account, $61,700. 2. February 12 Collect on accounts receivable, $53,400. 3. April 25 Receive cash in advance from customers, $14,800. 4. May 6 Purchase supplies on account, $13,000. 5. July 15 Pay property taxes, $10,400. 6. September 10 Pay on accounts payable, $13,300. 7. October 31 Pay salaries, $142,600. 8. November 20 Issue shares of common stock in exchange for $46,000cash. 9. December 30 Pay $4,700 cash dividends to stockholders. 11. Prepare a post-closing trial balance. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $153,100, and on account, $61,700. Collect on accounts receivable, $53,400. Receive cash in advance from customers, $14,800. Purchase supplies on account, $13,000. Pay property taxes, $10,400. Pay on accounts payable, $13,300. Pay salaries, $142,600. Issue shares of common stock in exchange for $46,000cash. Pay $4,700 cash dividends to stockholders. 8-a. Prepare the income statement for the year ended December 31, 2024. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $153,100, and on account, $61,700. Collect on accounts receivable, $53,400. Receive cash in advance from customers, $14,800. Purchase supplies on account, $13,000. Pay property taxes, $10,400. Pay on accounts payable, $13,300. Pay salaries, $142,600. Issue shares of common stock in exchange for $46,000 cash. Pay $4,700 cash dividends to stockholders. Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $153,100, and on account, $61,700. 2. February 12 Collect on accounts receivable, $53,400. 3. April 25 Receive cash in advance from customers, $14,800. 4. May 6 Purchase supplies on account, $13,000. 5. July 15 Pay property taxes, $10,400. 6. September 10 Pay on accounts payable, $13,300. 7. October 31 Pay salaries, $142,600. 8. November 20 Issue shares of common stock in exchange for $46,000cash. 9. December 30 Pay $4,700 cash dividends to stockholders. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first ccount field.) Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits